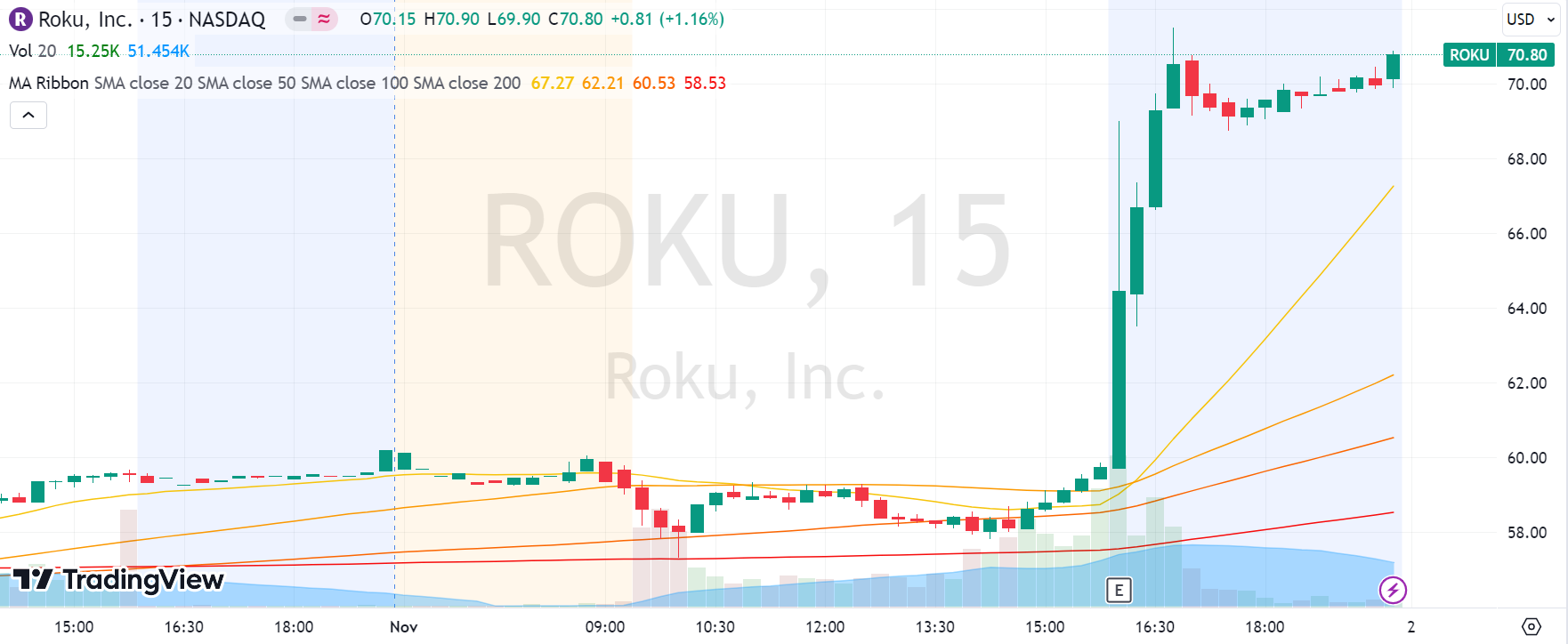

$Roku Inc(ROKU)$ surged nearly 19%, which exceeded expectations by quite a bit. The market is not fully pricing in its strong performance.

Q3 Earnings Review

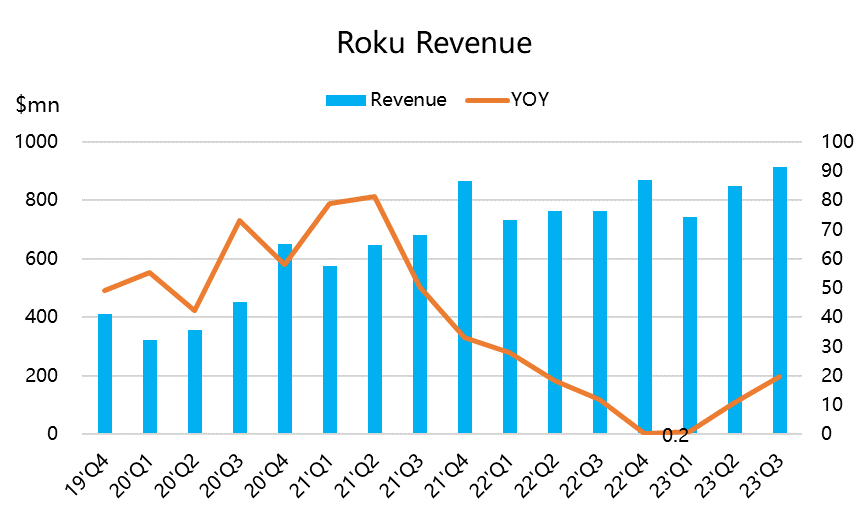

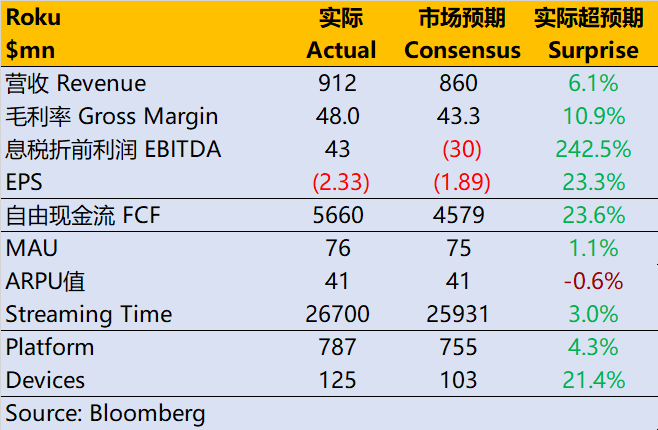

Revenue reached $912 million, a year-on-year increase of 20%, significantly exceeding the market expectation of $856 million. Hardware revenue was $125 million, higher than the market expectation of $103 million; platform revenue was $787 million, higher than the market expectation of $755 million.

Gross margin reached 48%, higher than the market expectation of 43.3%.

EBITDA was $43 million, turning a loss into a profit, while the market expectation was a loss of $30 million. However, the earnings per share were -$2.32, lower than the expected -$1.93.

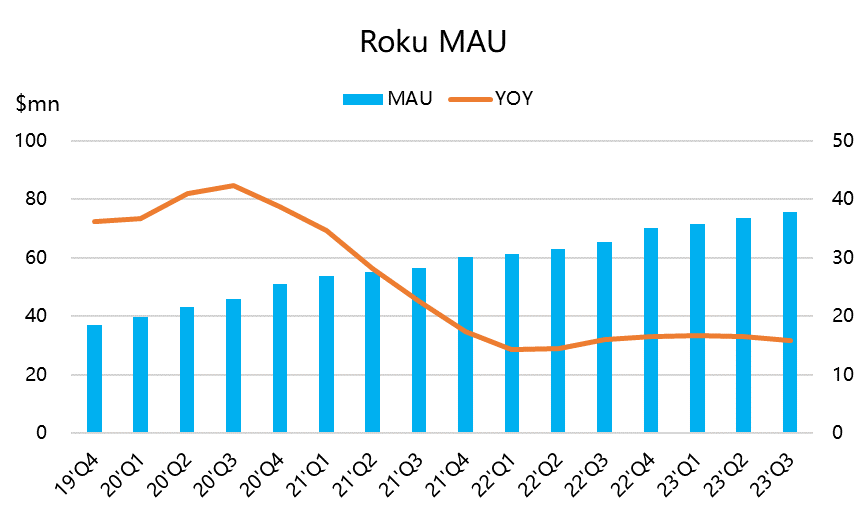

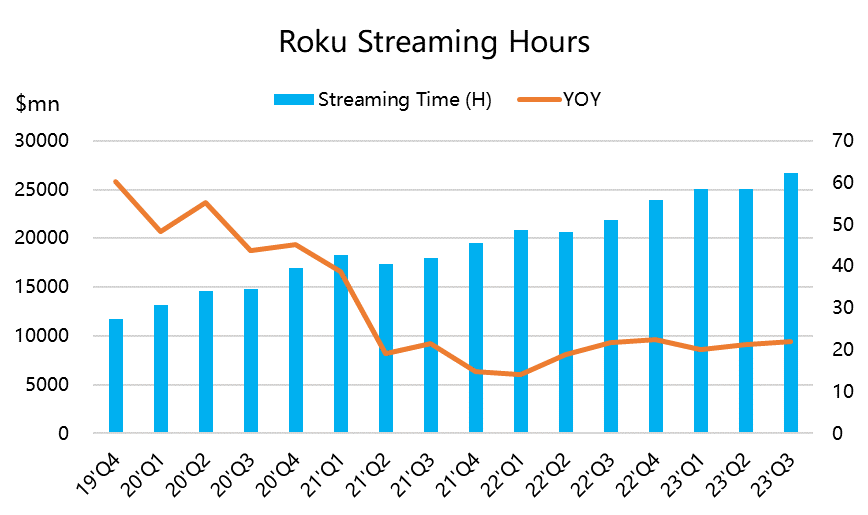

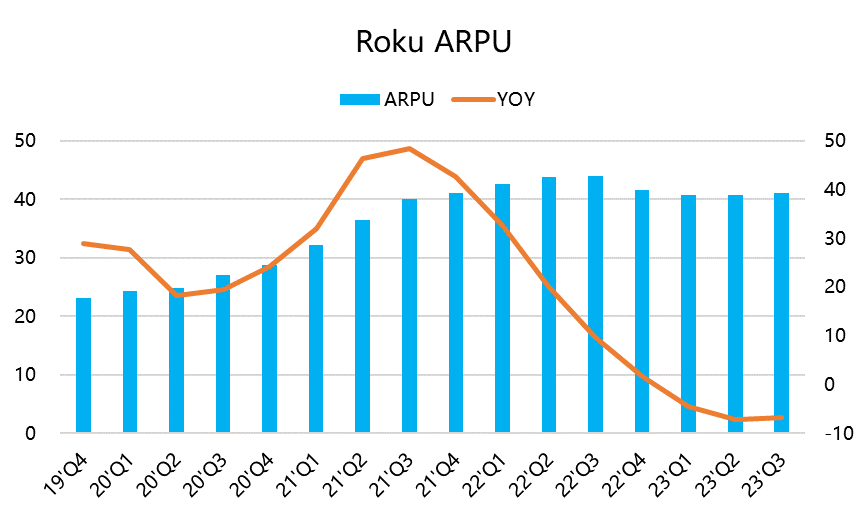

In terms of users, MAU reached 75.8 million, a year-on-year growth of 16%, surpassing the market expectation of 75 million; user hours of usage were 26.7 billion, a year-on-year increase of 6.4%, higher than the expected 25.9 billion hours; ARPU decreased by 7% year-on-year to $41.03, while the market expectation was $41.26.

In terms of guidance, Q4 revenue is expected to be $955 million, surpassing the market expectation of $951 million, and gross profit is projected to be $405 million.

Investment Highlights

1. The cabinet TV advertising market continues to face pressure, so the market's expectations for the entire media advertising were not very high. However, Roku has proven the continued recovery of streaming media advertising.

2. Companies like $Amazon.com(AMZN)$ and $Alphabet(GOOG)$ have similar businesses, but because the proportion is not high in their revenue, it may have been overshadowed by other items.

3. $Netflix(NFLX)$ has impacted shared accounts and launched an ad-supported low-cost package, increasing the overall number of streaming media users and improving user viewing time. Roku's user viewing time this quarter exceeded expectations, with an average of 3.9 hours of streaming media viewing per active account per day, a year-on-year increase of 5%. These are all necessary conditions for the growth of advertising revenue.

4. Streaming CTV ads have proven to be favored by advertisers and may grab more market share from traditional media. At least it proves that the macro environment is not so bad. The company also stated that the positive momentum in advertising is partly due to the diversified demand from advertisers on our platform and the expansion of partnerships.

Including after-hours gains, Roku's stock price has risen by 74% this year. The reason for the large rebound is that the company's business is relatively single and has greater elasticity. Due to the Q2 financial report also significantly exceeding expectations, the market reaction was also very optimistic, with the stock price peaking at $98 and now trading at around $70 after hours, still at a considerable premium.

If combined with the possibility of the Fed stopping interest rate hikes and the return of market risk sentiment, high-beta companies like Roku may have continued upward momentum.

Comments