The sharp rise in U.S. bond interest rates rattled investors, Fed Chairman Powell's hawkish rhetoric spooked U.S. stocks, Tesla fell 5 percent, and the S&P ended an eight-day winning streak.

"The FOMC is committed to achieving a stance of monetary policy that is restrictive enough to bring inflation down to 2 per cent over time, and we do not believe we have reached such a stance," Mr Powell said on Thursday.

Still, Powell said, "The Fed will continue to tread carefully to address the risk of being misled by several months of good data, and the risk of tightening too much." If appropriate, the Fed will not hesitate to raise rates."

On the same day, Federal Reserve Governor Bowman also released a "hawk" message, saying that she expects the FOMC will need to continue to raise interest rates several times to bring inflation back down to the 2% target.

The market basically believes the Fed has completed this cycle of rate hikes. According to the CME FedWatch tool, traders see less than a 10 percent chance that the FOMC will raise rates at its Dec. 12-13 meeting and expect the Fed to start cutting rates next year, possibly around June.

In addition, the U.S. government shutdown deadline (November 18) is approaching, and the new speaker of the House of Representatives has less than a week to start the opening battle, but the new speaker has not yet indicated to top Republicans what path he will take to fund the government, either publicly or privately, and if Congress does not act by next Friday, the possibility of a government shutdown will increase. And further expose internal divisions.

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

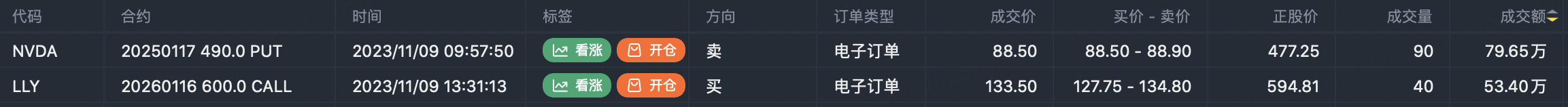

FANNG option active

FANNG options large orders traded sparsely due to Powell's hawkish comments, with only Nvidia selling forward expiration puts

Option buyer open position (Single leg)

Buy TOP T/O:

$SLG 20240216 30.0 PUT$ $AMLX 20240119 12.5 PUT$

Buy TOP Vol:

$Z 20231117 35.0 PUT$ $AMLX 20240119 12.5 PUT$

$Amylyx Pharmaceuticals, Inc.(AMLX)$ Amylyx Pharmaceuticals fell 25 per cent to a more than one-year low of $13.50. Net product revenue for the third quarter was $102.7 million, compared with analyst estimates of $113.66 million. Net income for the three months ended Sept. 30 was $20.9 million, or 30 cents per share, compared with a net loss of $53.8 million, or 92 cents per share, a year earlier.

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

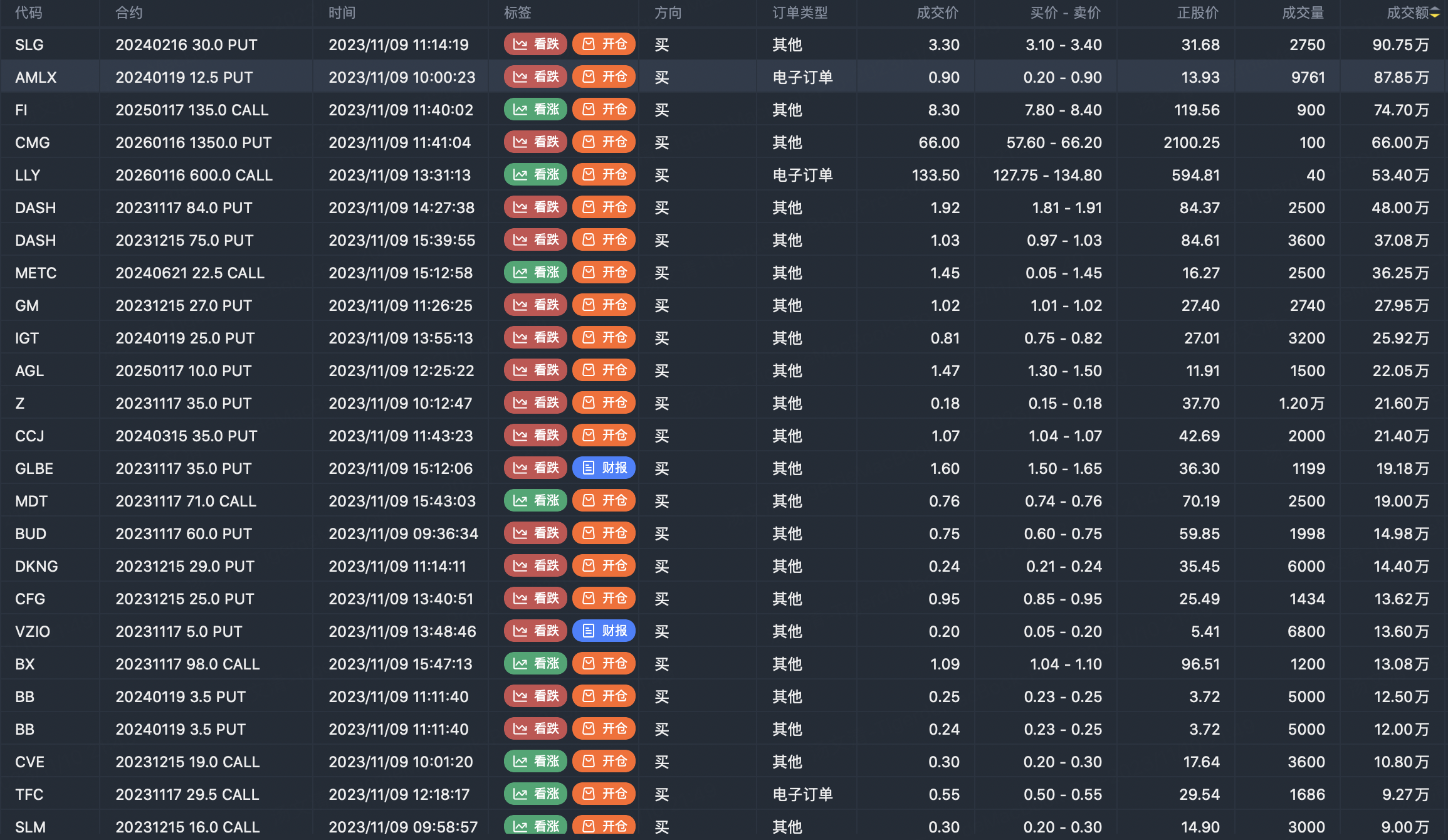

Option seller open position (Single leg)

Sell TOP T/O:

$LCID 20240419 3.5 PUT$ $NWL 20251219 5.0 PUT$

Sell TOP Vol:

$LCID 20240419 3.5 PUT$ $NWL 20251219 5.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

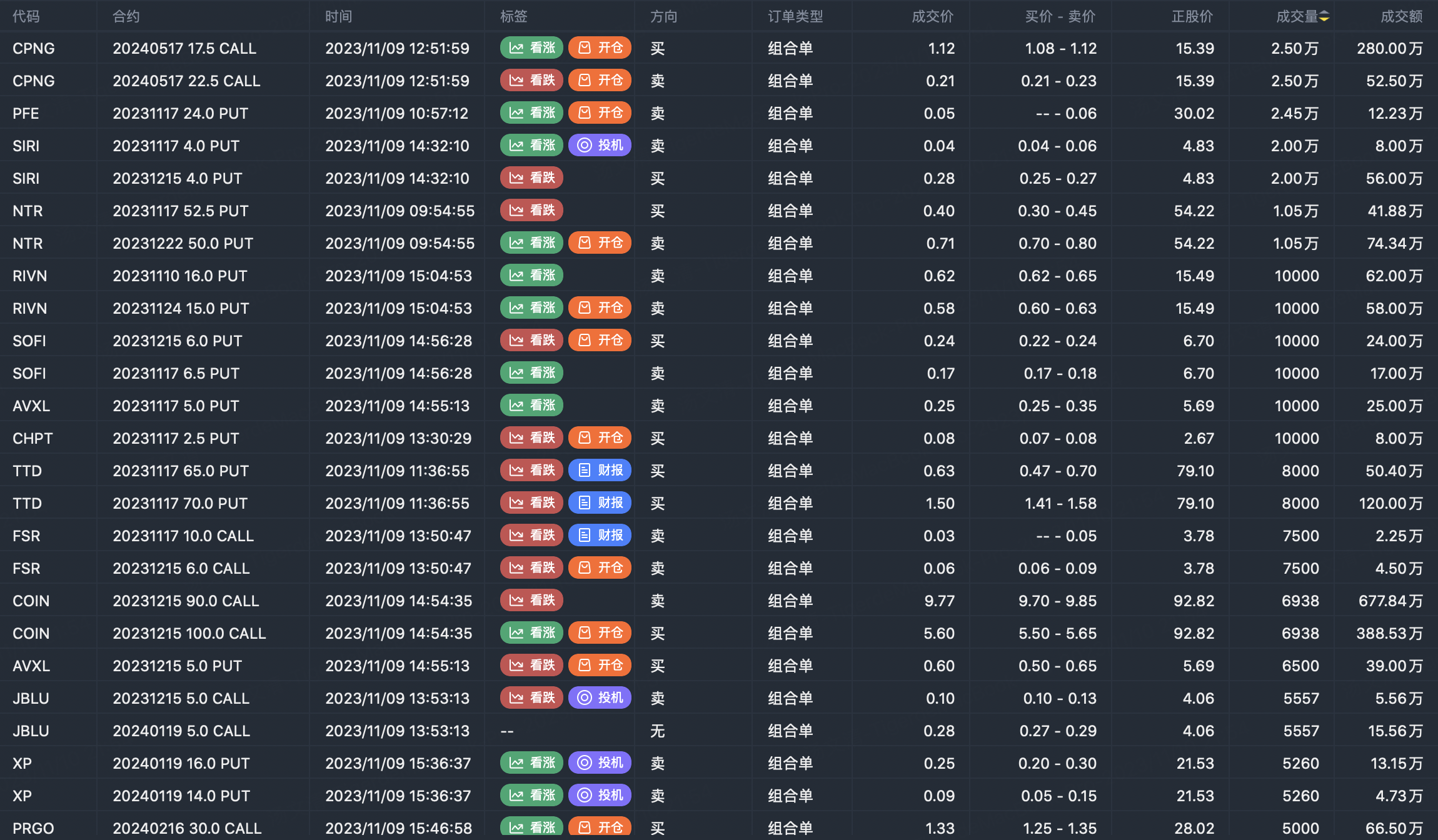

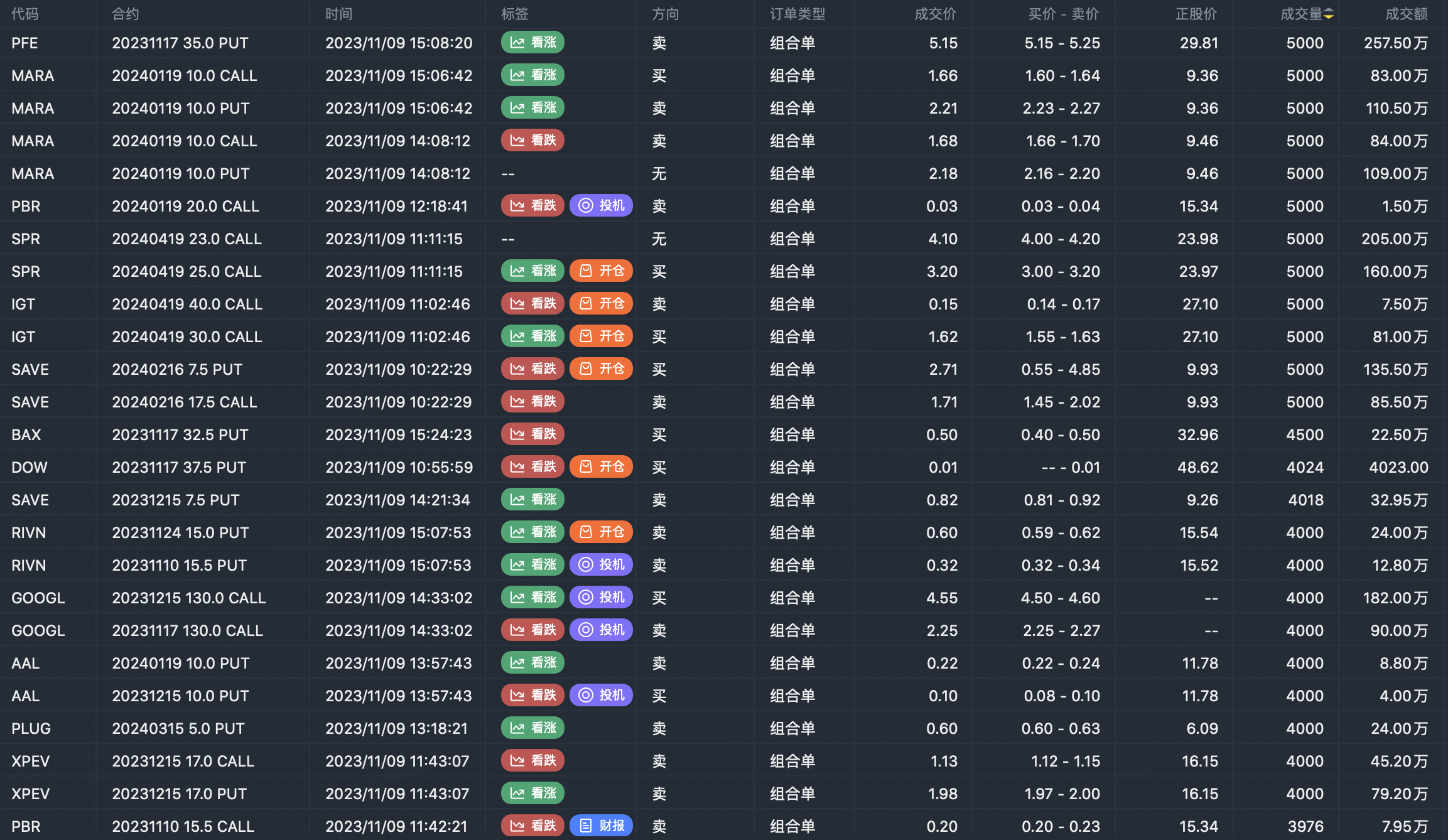

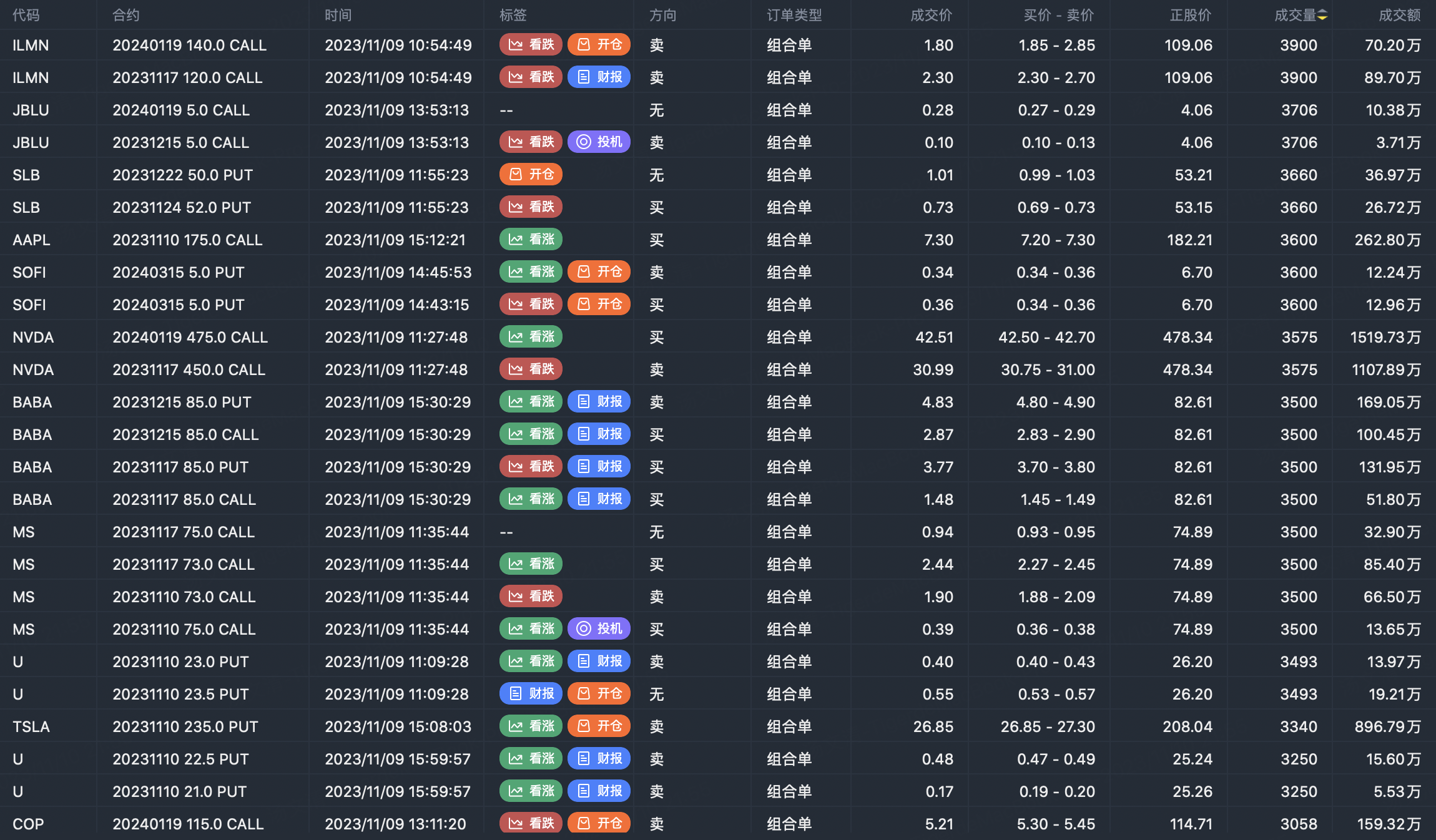

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

很棒的文章,你愿意分享吗?

Great ariticle, would you like to share it?