The market continued to focus on corporate earnings and the Fed news, the bond market calm pushed the stock market higher, the 10-year US Treasury interest rate was little changed, the US technology stocks led the rally, Microsoft (hit a record high, TSMC surged more than 6%.

On the political and economic front, Federal Reserve Chairman Jerome Powell dashed hopes of a rate cut on Thursday, saying in a speech at an International Monetary Fund event in Washington, D.C., that the Fed may have more work to do.

Powell reiterated that "the Federal Reserve is committed to pursuing a monetary policy stance that is sufficiently restrictive to bring inflation down to 2 percent over time." We are not confident that such a position has been reached. If further tightening is appropriate, the Fed will not hesitate to raise rates."

San Francisco Fed President Mary Daly said on Friday that the central bank may need to raise rates again if inflation progress stalls and the economy develops quickly.

Atlanta Fed President Raphael Bostic sounded a dovish note on Friday, saying policymakers would not need to raise interest rates further to bring U.S. inflation back to target.

In other central bank news, European Central Bank President Christine Lagarde said on Friday that keeping the deposit rate at 4 percent should be enough to keep inflation in check, but officials would consider raising borrowing costs again if needed.

On the geopolitical front, the presidents of the United States and China will meet this week, and the Chinese leader will travel to the United States from November 14 to 17 for the US-China Summit, where he will have face-to-face talks with US President Joe Biden.

* 9:30 ~ 10:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

Special commend: How to achieve an 8%* annualized yield on your Tiger Vault Fund?

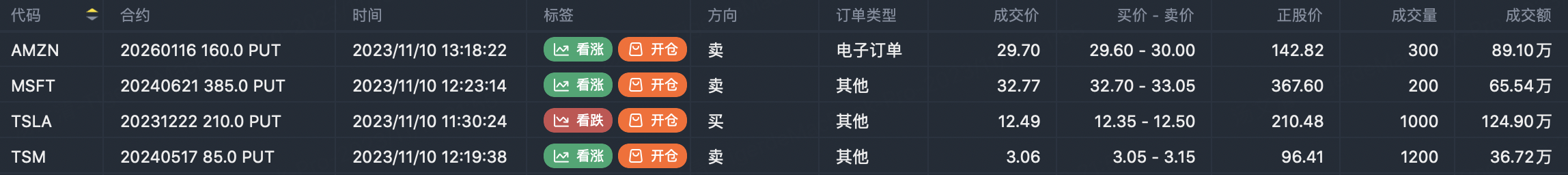

FANNG option active

Buying put potion orders suggests Tesla will remain under pressure in the near term at $TSLA 20231222 210.0 PUT$. The institution believes that there is a high probability that it will continue to fall in the near future.

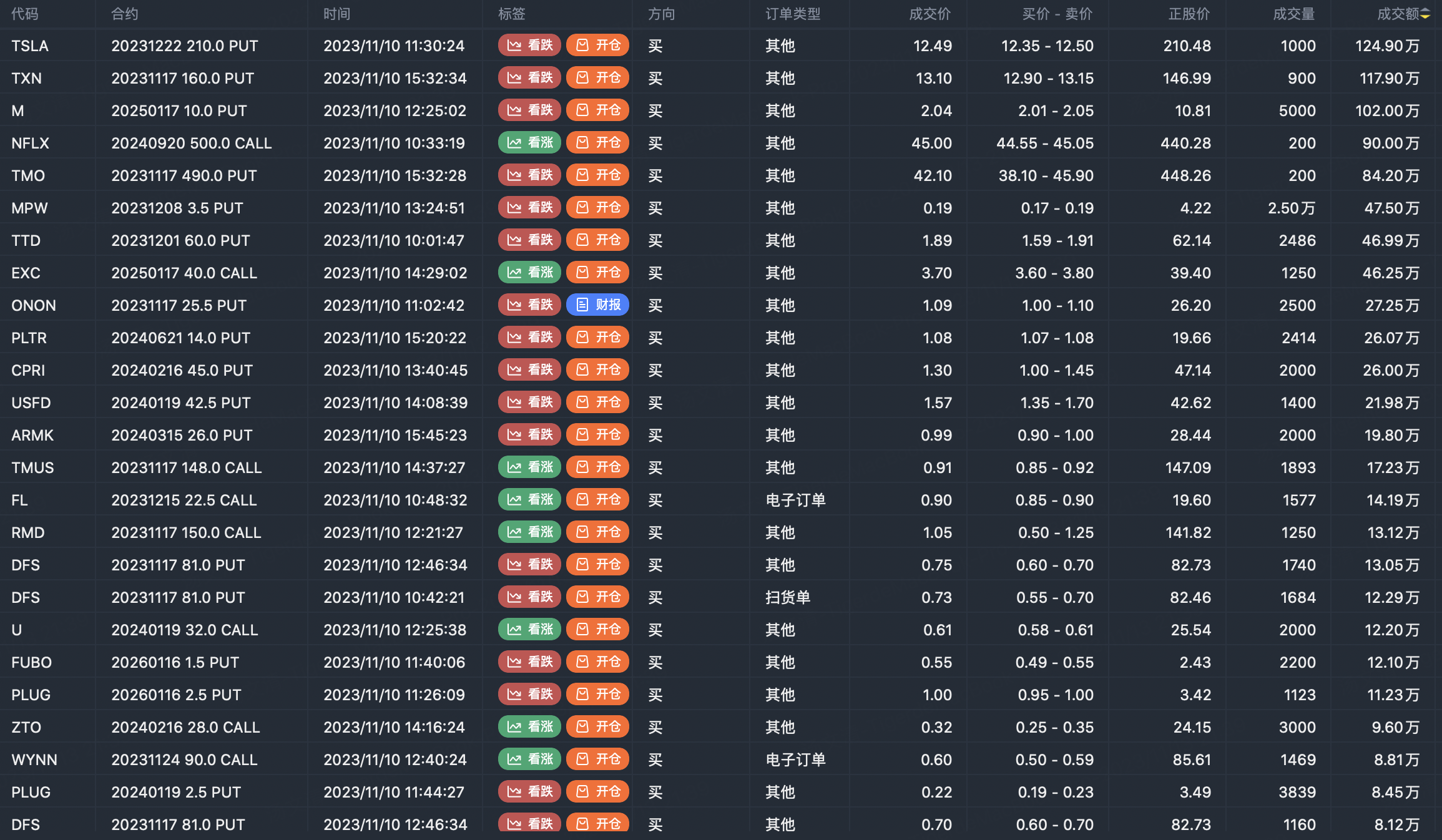

Option buyer open position (Single leg)

Buy TOP T/O:

$TSLA 20231222 210.0 PUT$ $TXN 20231117 160.0 PUT$

Buy TOP Vol:

$MPW 20231208 3.5 PUT$ $M 20250117 10.0 PUT$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Sell TOP T/O:

$GM 20240621 29.0 CALL$ $JNJ 20231117 160.0 PUT$

Sell TOP Vol:

$GM 20240621 29.0 CALL$ $RVMD1 20240119 2.5 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

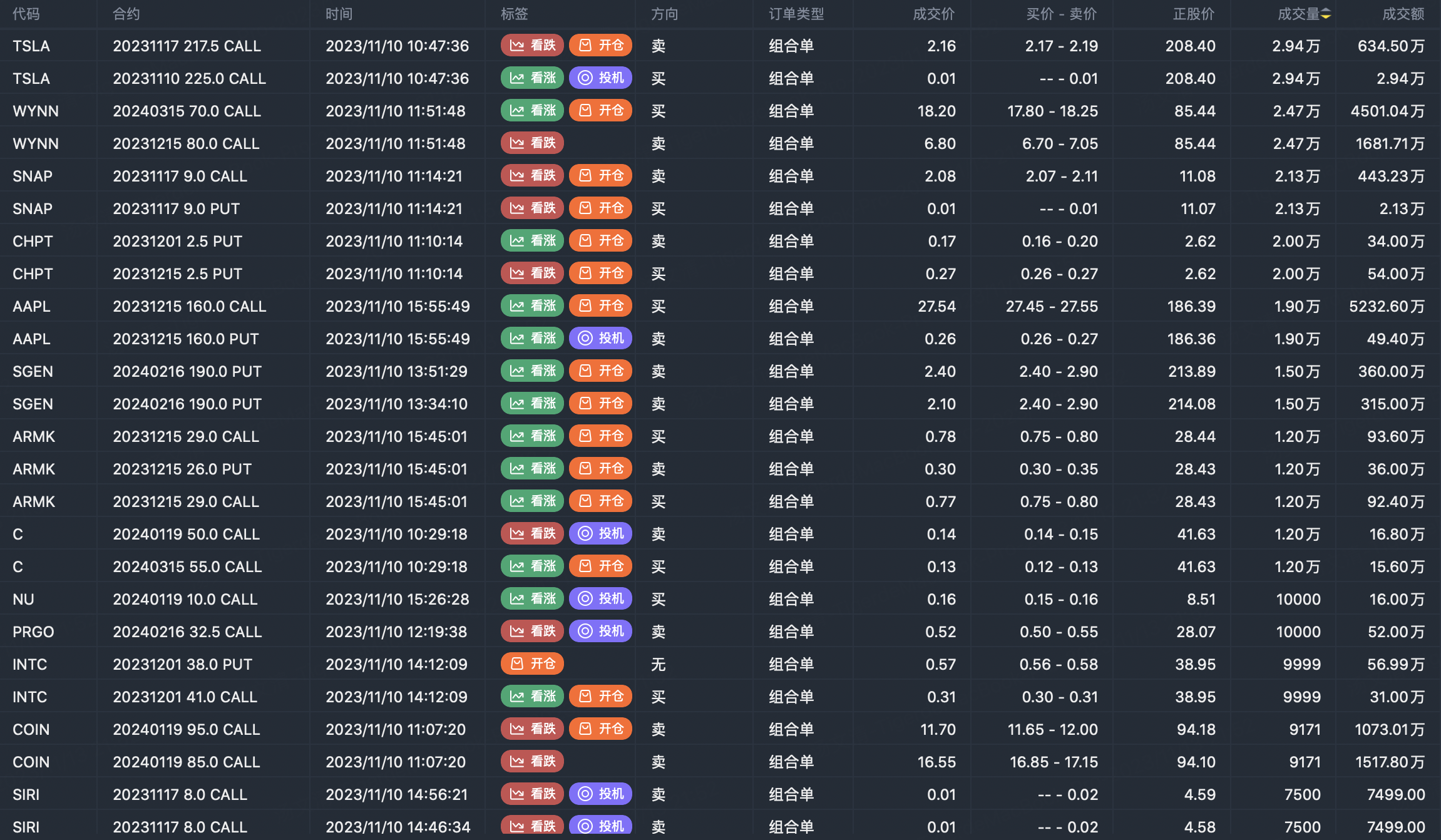

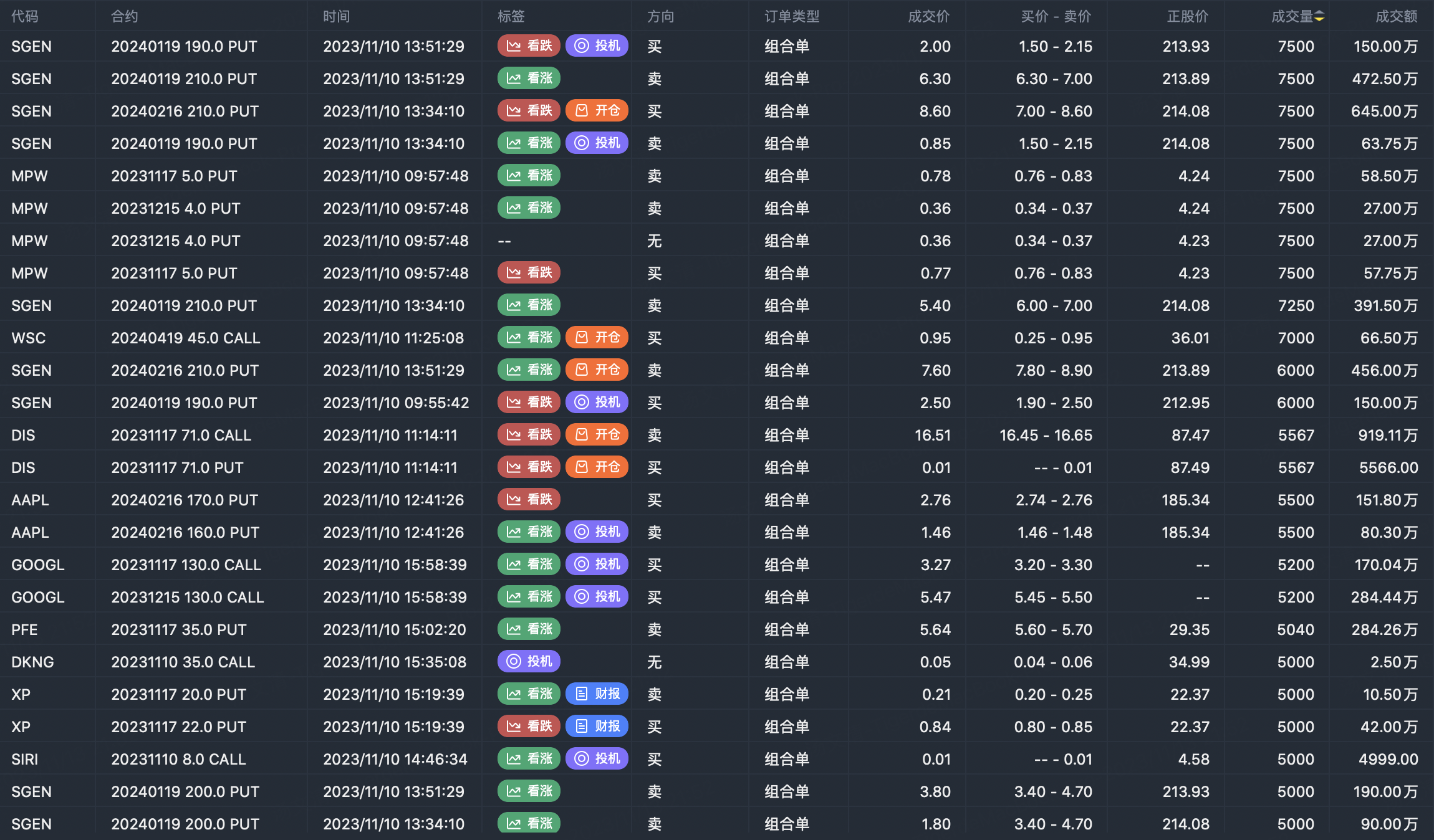

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

Great ariticle, would you like to share it?

Artikel yang bagus, apakah Anda ingin membagikannya?

Artikel yang bagus, apakah Anda ingin membagikannya?