Investors digested signs of an economic slowdown as major retailers reported strong results.

U.S. apparel brand GAP and U.S. discount retailer Ross Stores led retail stocks higher as earnings beat expectations. Energy stocks rose on Friday on the back of higher oil prices, reversing losses from the previous day, but ended down for a fourth straight week as investors fretted over signs of rising energy supplies and deteriorating global demand.

Data this week pointed to downside risks to economic growth, growing hopes for a peak in Federal Reserve interest rates, the number of Americans continuing to claim unemployment benefits rose for an eighth straight week and U.S. retail sales fell for the first time in seven months in October, pointing to a slowdown in demand early in the fourth quarter.

On the housing front, housing starts came in at 1.372 million units in October, slightly above expectations and higher than the previous month. The total number of building permits rose to 1.487 million units in October, also higher than expected and the highest since May last year.

In political and economic terms, before the US government shutdown deadline on the 18th, US President Joe Biden signed a two-stage funding stopgap spending bill at the Palace of Veterans Museum in San Francisco, so that federal government agencies can continue to operate until January next year.

Markets continued to watch comments from Fed officials, with Chicago Fed President Austan Goolsbee, a voting member of the Federal Open Market Committee this year, arguing that inflation is on track to fall back to its 2 percent target if house price pressures ease as expected.

Michael Barr, who oversees financial regulation on the FOMC's voting committee, has sounded a dovish note this year, reiterating his view that interest rates are close to peaking. Boston Fed President Susan Collins, however, stuck to her hawkish stance and said the Fed should not rule out further rate hikes.

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

Special commend: How to achieve an 8%* annualized yield on your Tiger Vault Fund?

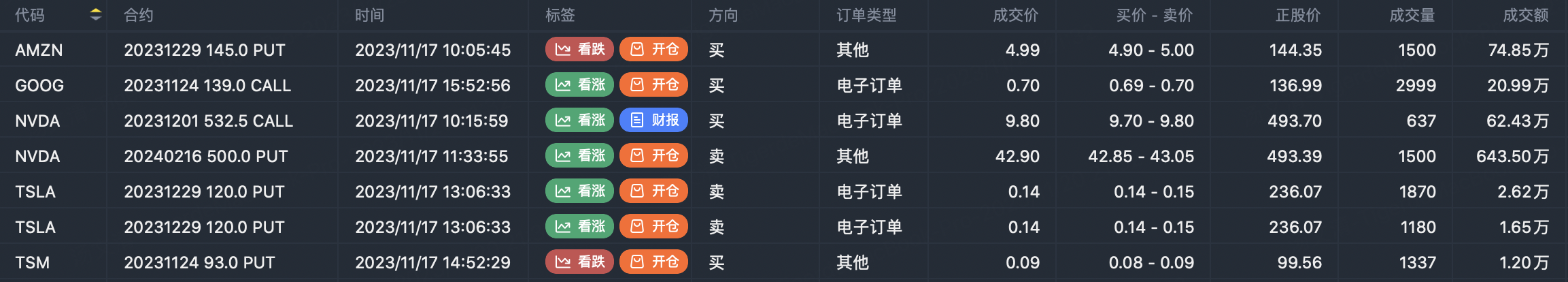

FANNG option active

$Amazon.com(AMZN)$ Buy put option $AMZN 20231229 145.0 PUT$

$Alphabet(GOOG)$ Buy call option $GOOG 20231124 139.0 CALL$

$NVIDIA Corp(NVDA)$ Buy call option $NVDA 20231201 532.5 CALL$ Sell put options $NVDA 20240216 500.0 PUT$

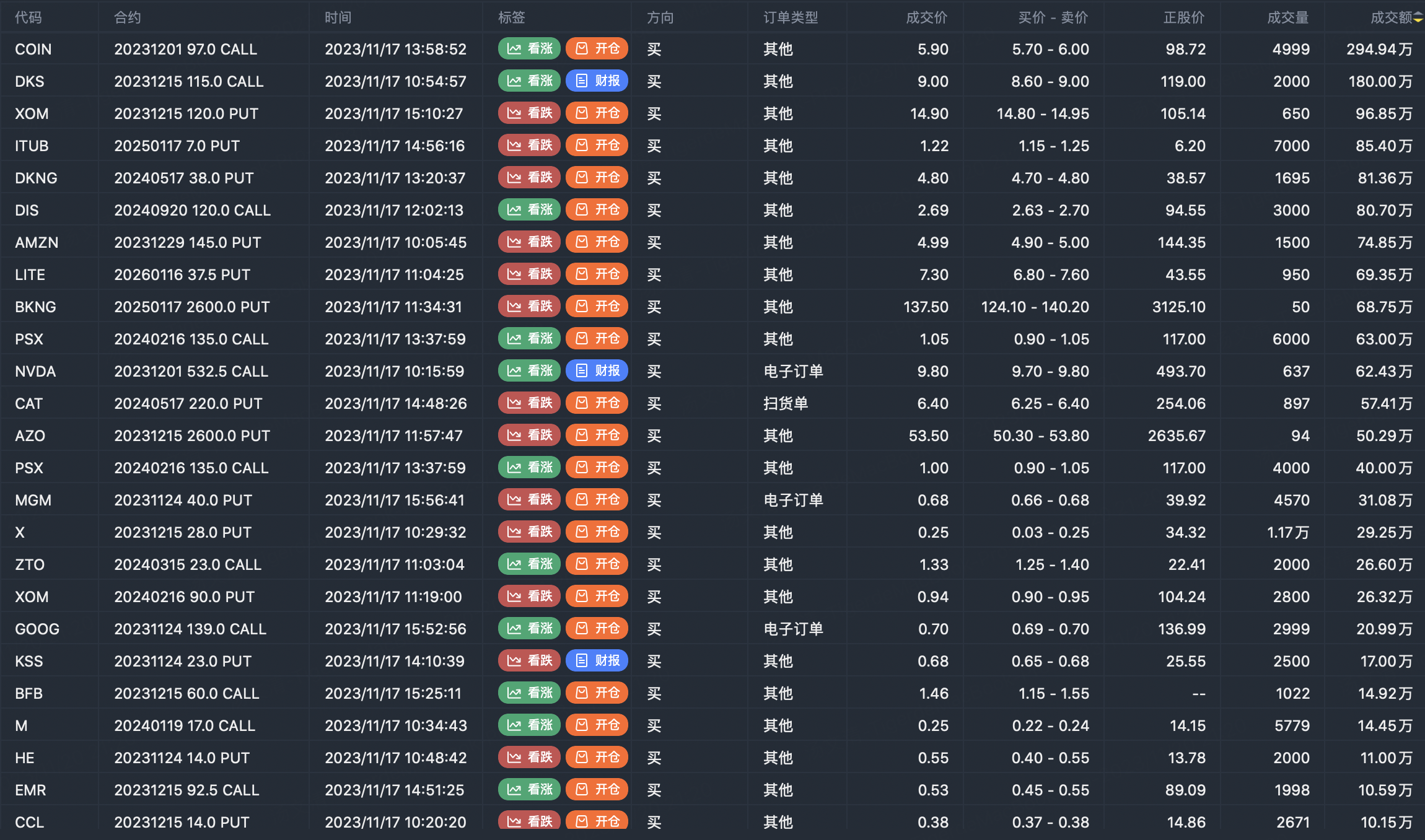

Option buyer open position (Single leg)

Buy TOP T/O:

$COIN 20231201 97.0 CALL$ $DKS 20231215 115.0 CALL$

Buy TOP Vol:

$X 20231215 28.0 PUT$ $ITUB 20250117 7.0 PUT$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

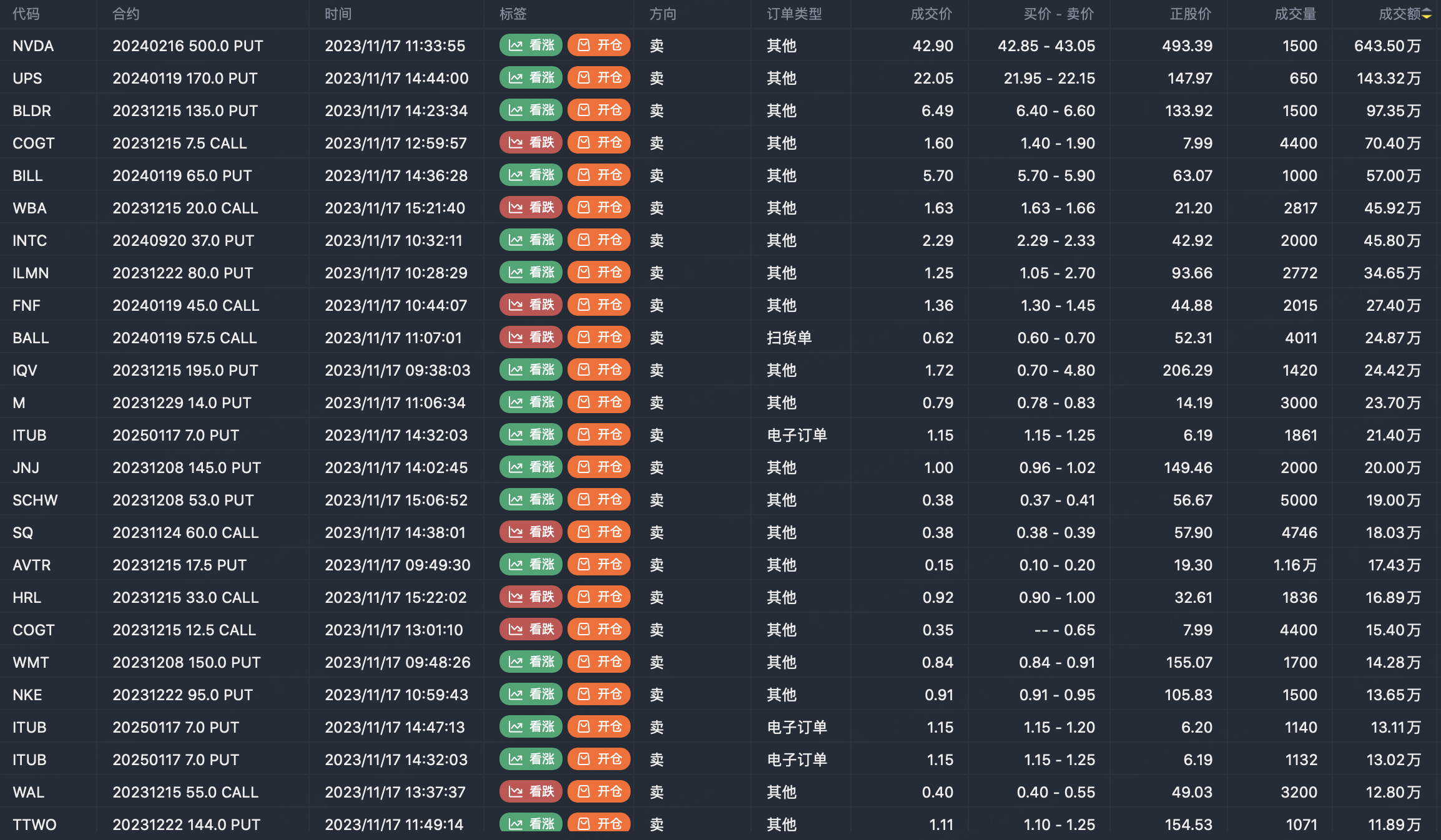

Option seller open position (Single leg)

Sell TOP T/O:

$NVDA 20240216 500.0 PUT$ $UPS 20240119 170.0 PUT$

Sell TOP Vol:

$CHPT 20231201 2.5 CALL$ $AVTR 20231215 17.5 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

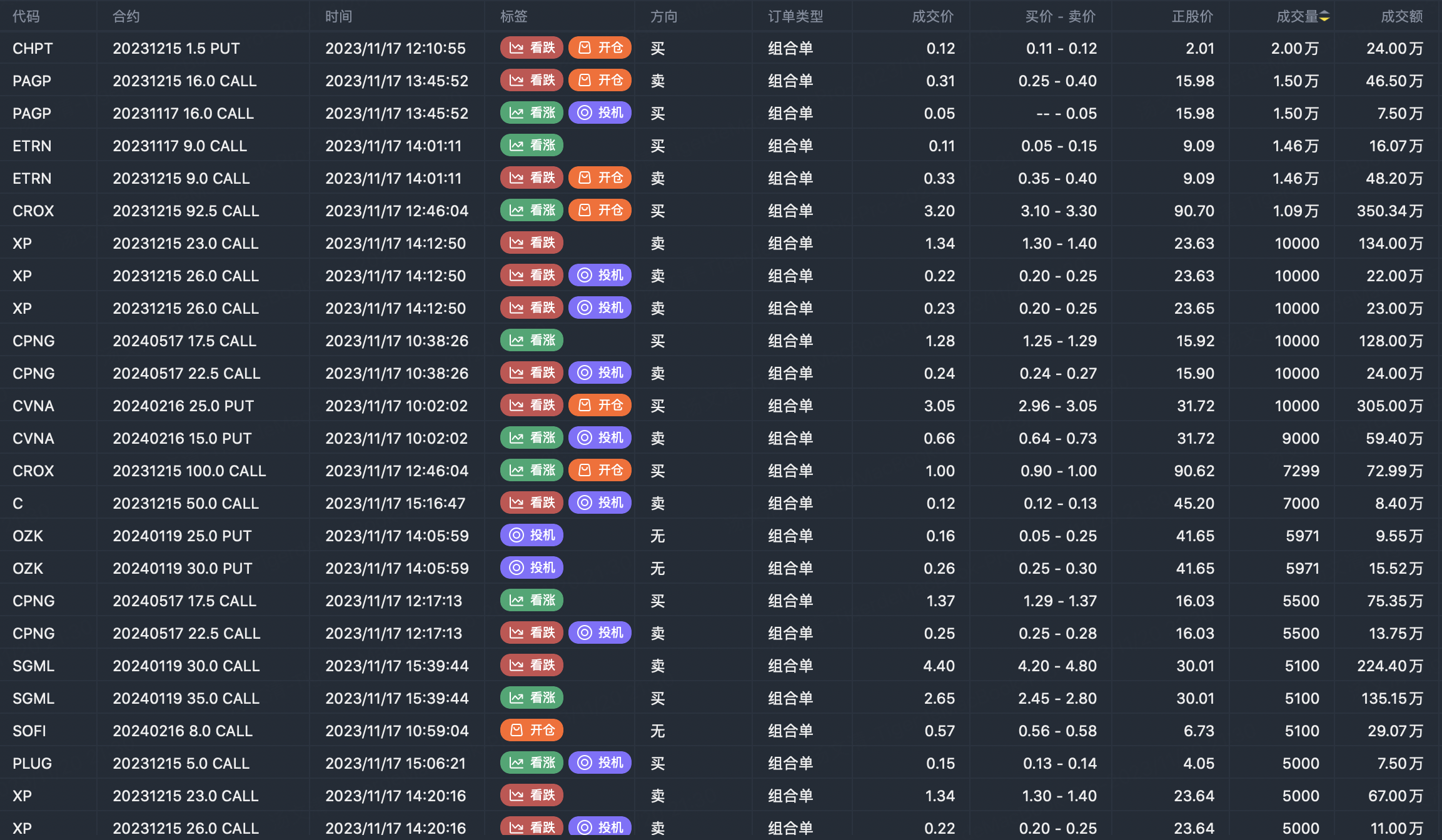

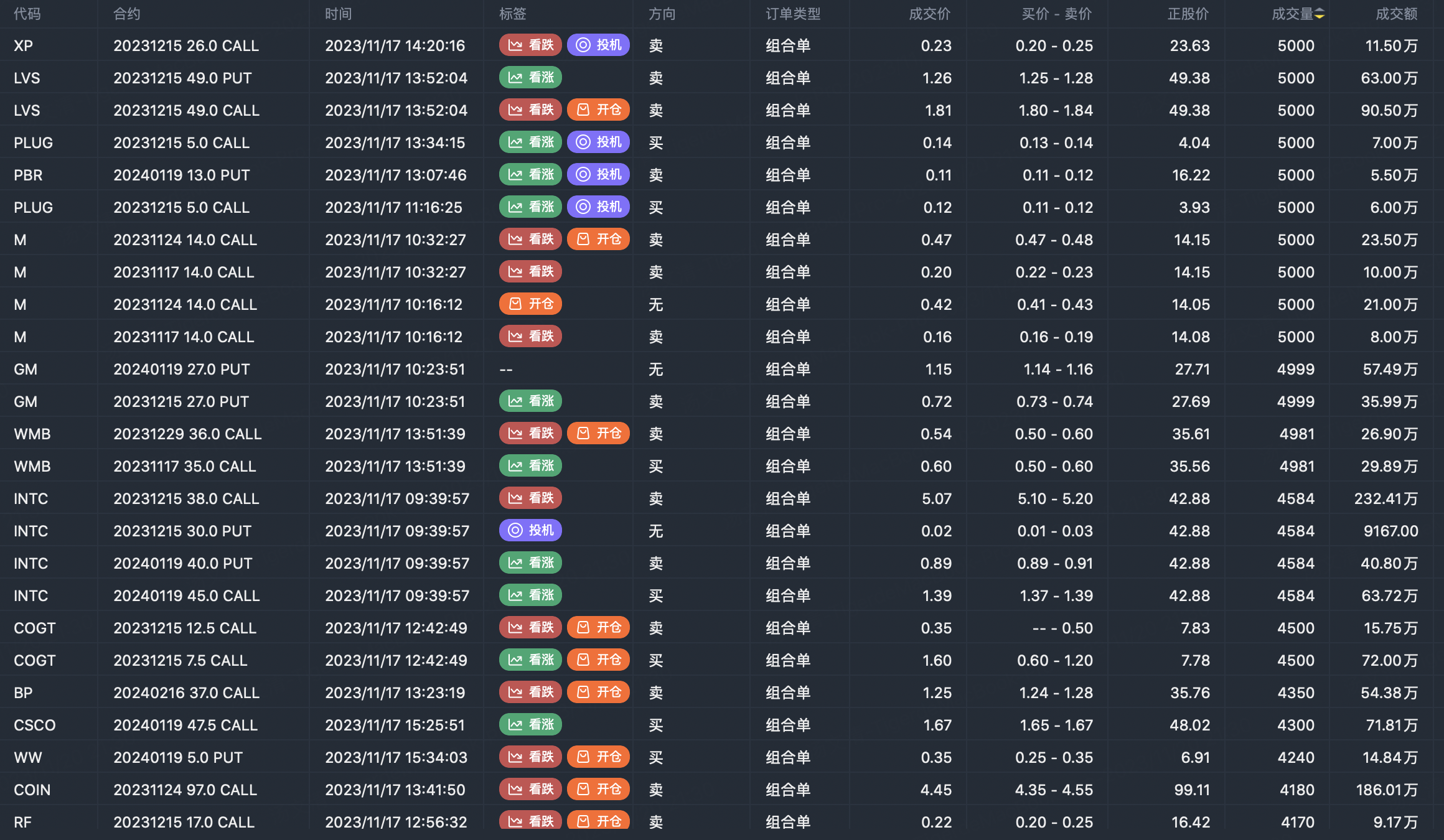

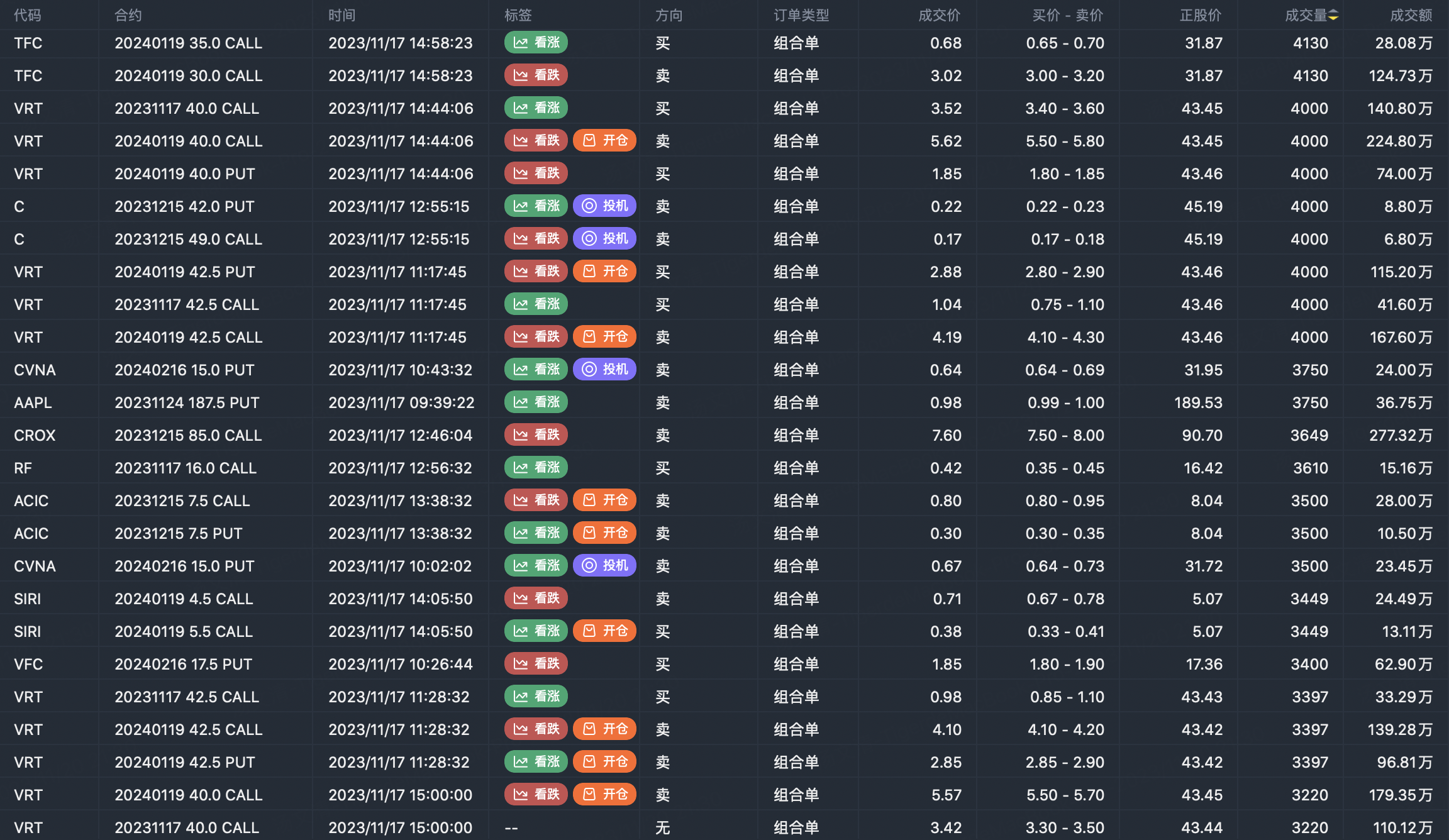

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

Share

cuaaaak