The latest Federal Reserve meeting minutes came out of the "eagle news", retailers reported mixed results. Federal Reserve officials expressed little interest in cutting interest rates anytime soon at their latest meeting, especially as inflation remains well above target, according to the latest minutes released by the central bank.

Members of the Federal Open Market Committee (FOMC) remain concerned that inflation could persist or move higher and that more action may be needed. Monetary policy needs to remain "restrictive" until data show inflation moving convincingly back to the central bank's 2% target.

Notably, the minutes said officials saw significant risks to the stability of the financial system and noted "high valuations in equities, housing and commercial real estate."

The Chicago Mercantile Exchange's FedWatch tool showed traders see a 58 percent chance the Fed will start cutting rates in May.

In a major blow to the currency world on Tuesday, Changpeng Zhao, the chief executive of the world's largest cryptocurrency exchange Binance, has agreed to plead guilty to money laundering violations under a sweeping deal with the Justice Department that will see him pay $50 million in fines and Binance pay a total of $4.3 billion to end a criminal investigation into the company. Zhao Changpeng stepped down, Binance regional head Richard Teng will become Binance's new CEO.

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

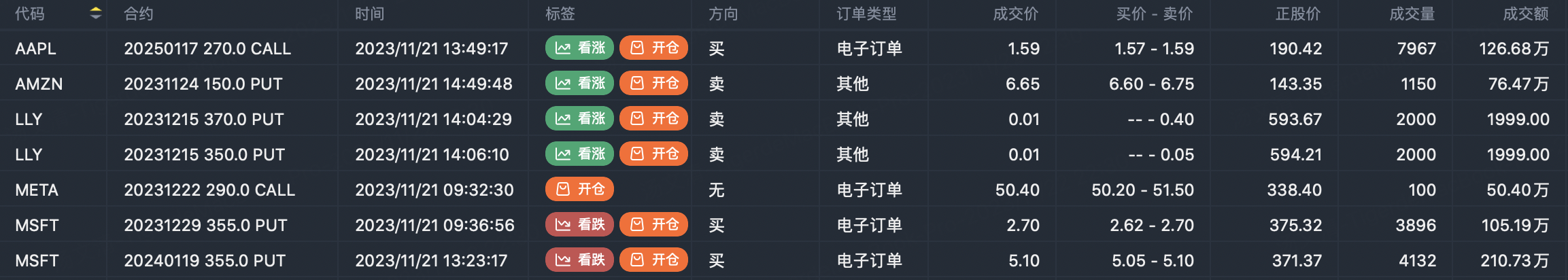

FANNG option active

$Apple(AAPL)$ Buy call options $AAPL 20250117 270.0 CALL$

$Amazon.com(AMZN)$ Sell put options $AMZN 20231124 150.0 PUT$

$Microsoft(MSFT)$ Buy put options $MSFT 20240119 355.0 PUT$

Option buyer open position (Single leg)

Buy TOP T/O:

$JNJ 20240119 170.0 PUT$ $MS 20240119 90.0 PUT$

Buy TOP Vol:

$CHPT 20231215 1.5 PUT$ $GT 20240419 15.0 CALL$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

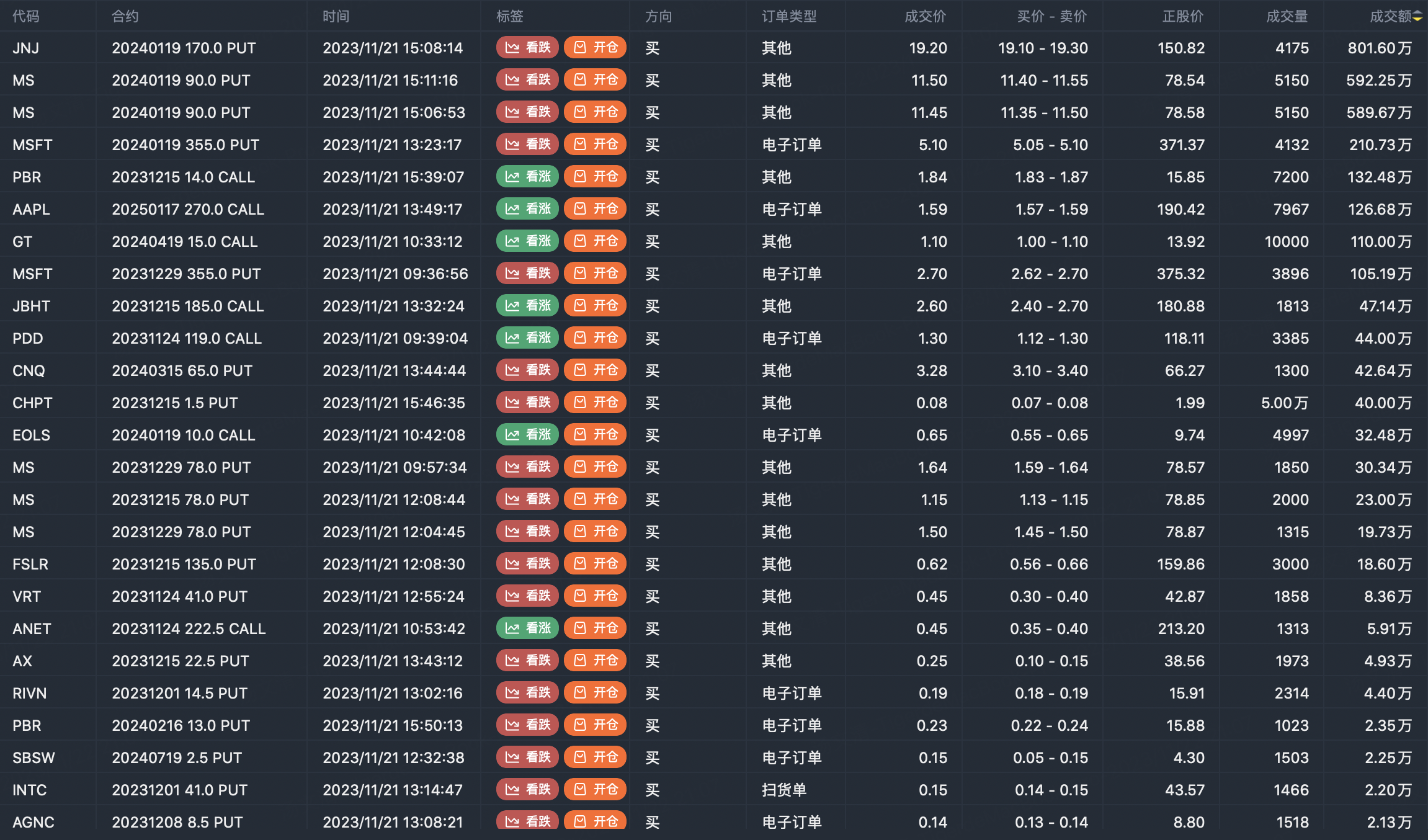

Option seller open position (Single leg)

Sell TOP T/O:

$JNJ 20240119 165.0 PUT$ $RTX 20240119 90.0 PUT$

Sell TOP Vol:

$NKLA 20240119 1.0 CALL$ $CHPT 20240119 2.0 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

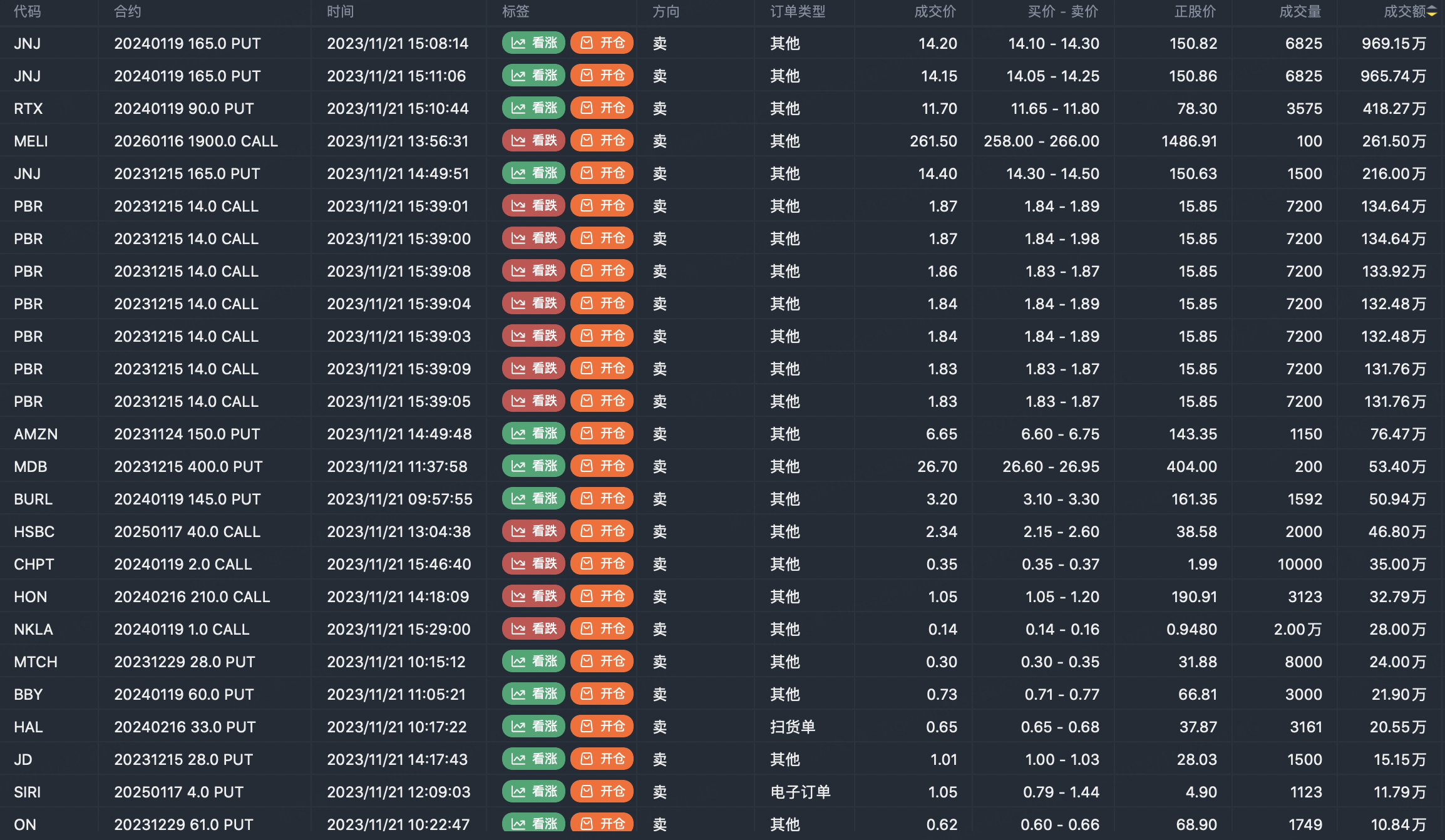

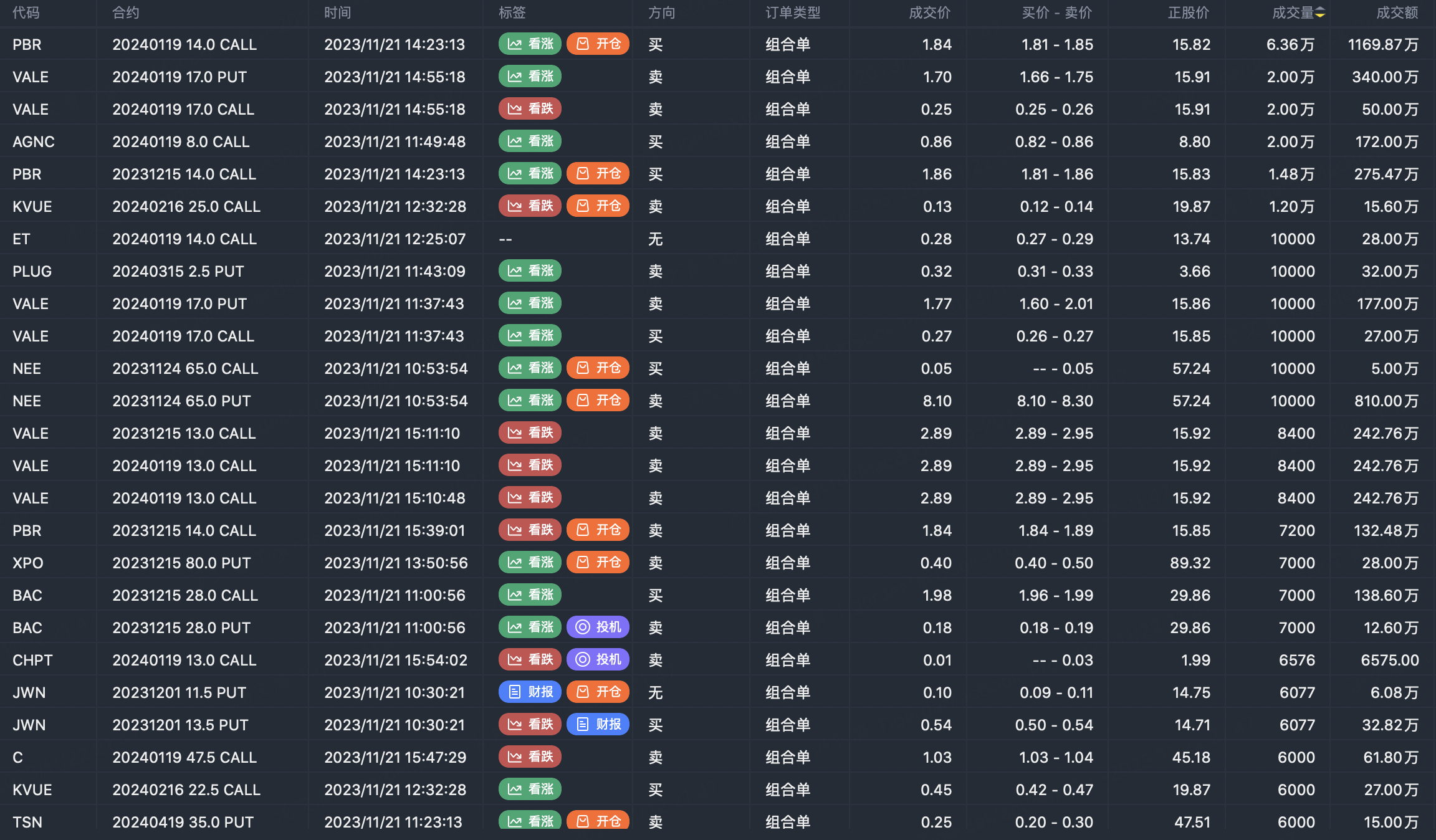

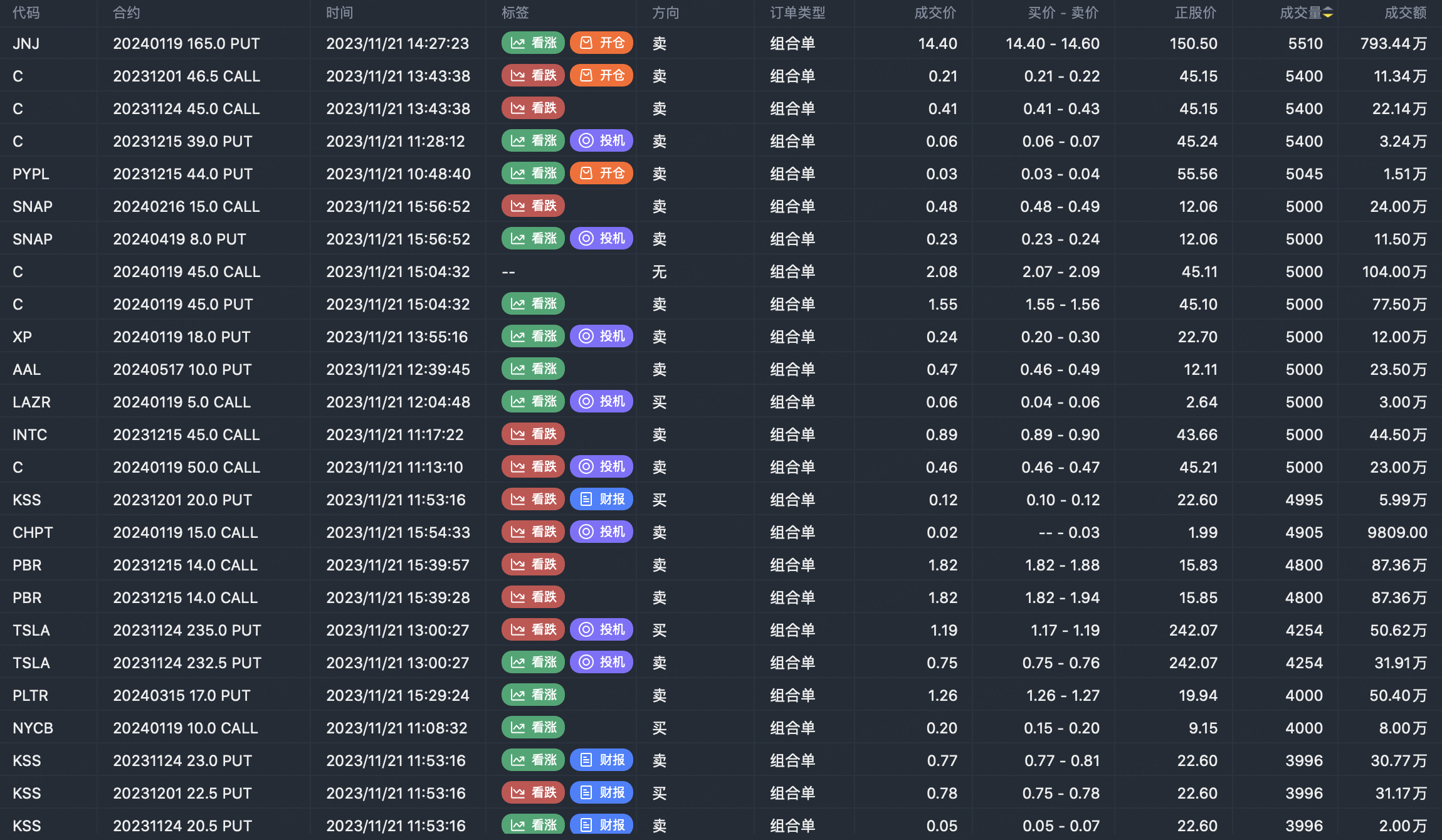

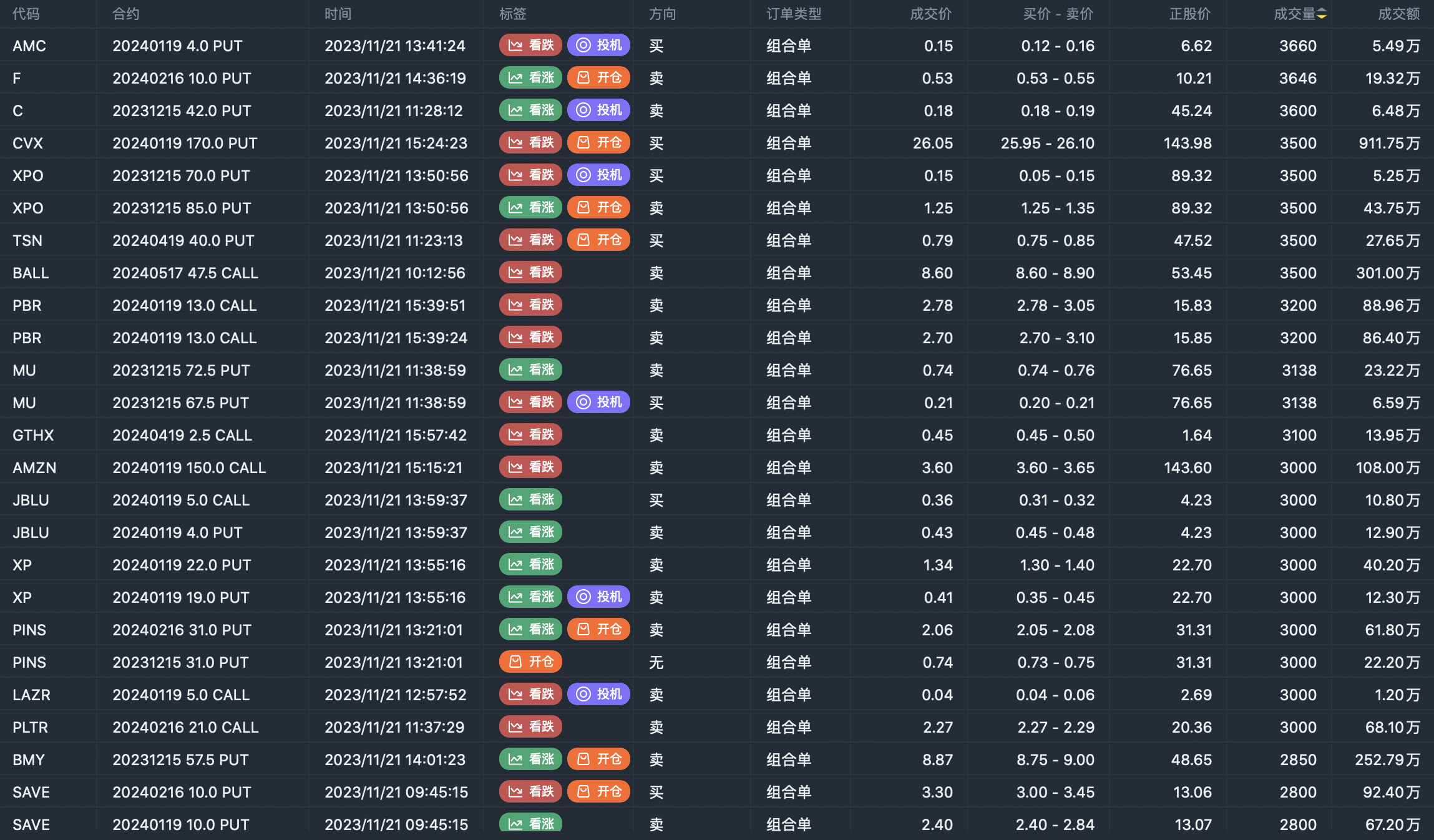

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

Thanks for your analysis and sharing of data, now I can think of a wiser allocation of options protfolio.

Great ariticle, would you like to share it?