Summary

- Patterson-UTI Energy has positioned itself for growth with strategic transactions and attractive free cash flow yield.

- Positive drivers are emerging for drilling to recover in the macro market, potentially leading to better times for the company.

- Patterson-UTI Energy's acquisitions and market position make it a solid investment case for long-term growth and moderate to increasing income.

- We rate Patterson-UTI Energy stock as a buy at current levels for investors with a healthy tolerance for risk.

vvvita

Introduction

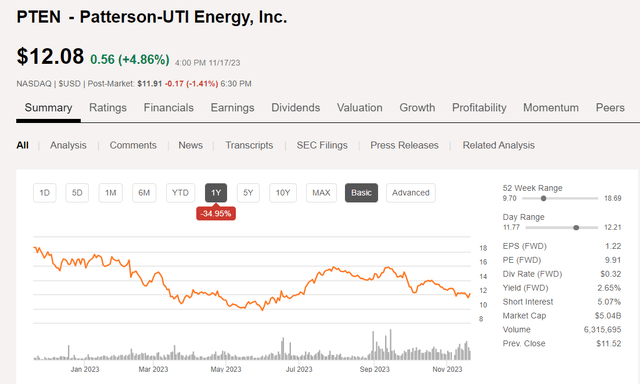

Patterson-UTI Energy (NASDAQ:PTEN) has revamped itself with two strategic transactions closed over the summer that could position it for growth in the coming year. The company is trading an attractive free cash flow yield-14-15%, in comparison with key rival Helmerich & Payne (HP), and has received an upgrade on that basis. That may improve as drilling begins to accelerate in 2024. There are some positive drivers emerging for drilling to recover in the...

PTEN price chart (Seeking Alpha)

macro market that buttress the notion that better times could be around the corner for this drilling and completion services contractor. What's a little unclear is whether this is a sharp, 90 degree corner, or is it sporting a bull nose? We will tackle that question here-in.

As usual the analysts covering the stock speak with mixed messages, ranking PTEN as Overweight, with price targets ranging from $16-$21 and a median of $17. That implies respectable growth from present levels, and justifies some interest on investors part. I said mixed messages, and to that point they are calling for Q4 earnings of $0.21, a step down from Q3's $0.25 - which PTEN missed by $0.05.

So sit back and have that second (fifth?) cup of coffee and let's see where a review of PTEN's Q3 takes us.

The macro U.S. market

The U.S. oil and gas upstream market is a bit of a hot mess right now, particularly on the drilling side. Since late 2022, we've shed about 170 rigs across various basins. Only the Permian can lay claim to being robust, and it's down 43 rigs from its Q4, 2022 peak as well.

And yet, in spite of that U.S. shale production is 350K BOEPD higher than at the start of this year. As we discussed in past articles, process and technical step-changes have delinked production growth from the rig count, certainly as with comparisons of a few years ago. In 2014 it took nearly 2,000 rigs pounding holes into the ground to generate shale production of 5.1 mm BOPD and 43 BCFD. Flash forward to today and we are cranking out 9.6 mm BOPD and nearly 100 BCF/D. An increase that when you account for the doubling of production with only 618 rigs turning to the right, is an efficiency increase of nearly 6X. Clearly the American upstream sector is doing something right. One might say this 100-year-old "Dog" had learned a lot of new tricks.

Does that mean drilling is dead and we are just going to wish oil out the ground? Certainly not. What is does mean is there is a bunch of old iron that's headed for scrap yard as it can't compete with the smart, Super Spec rigs that are nearly 100% utilized now. That's a good thing, as it will drive capital efficiency and profits. Andy Hendricks, CEO, commented on the path forward for Super Spec rigs-

We think super-spec rig activity recovers before the idle lower-spec rigs, which should position Patterson-UTI to outperform the expected recovery over the next several quarters, even as we outperformed the market when the rig count moved lower this past year.

What we are missing now is a strong price signal from the market that will alter investors perception of the industry. It's difficult to say when that will come or exactly what form it will take. Rest assured though, it's on the way.

We are nearly at a balance point between legacy declines in shale and new well production. When the scale tips, as it surely must, the market will get a very robust price signal and it will be good to be long drillers like PTEN.

The thesis for PTEN

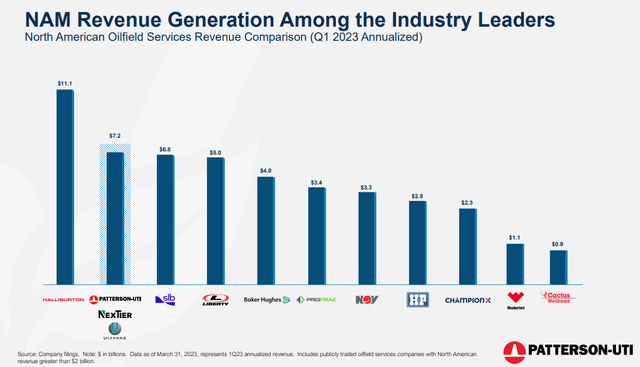

PTEN already was a top-tier drilling contractor and frac services provider. The market was crying out for consolidation in this space as there was simply too much competition, and PTEN made a solid strategic move. By absorbing NexTier earlier this year, PTEN doubled its frac footprint and substantially upgraded it with NexTier's leading edge inventory of natural gas powered efrac pumps. You can see the leapfrog effect here with PTEN revenue coming in right behind segment leader Halliburton (HAL).

PTEN Revenue chart (PTEN)

Let's pay some respect to the Ulterra acquisition as well. One of the first things drilling rigs pick and rack back is the Bottom Hole Assembly-BHA, and next to the rig itself, Directional tools and bits that make up the BHA are among the most profitable items on the AFE.

There is more synergy than you might think in this combination. Wells reach TD in just a few days at present. You need a frac spread ready to deploy ASAP. If it happens a few hours after cementing the liner, as opposed to a day or two, you are fitting more uptime into the schedule. Ulterra also makes sense as well. Ulterra already was one of the leading PDC bit suppliers in North America. Mating these three complementary technologies in the same service...

PTEN Ulterra BIt chart (PTEN)

organization just makes sense. After all, Halliburton does just that. Ulterra leads in two critical metrics-footage drilled without making a bit trip, and Rate of Penetration-ROP. Both of these impact rig costs in terms of how fast it can reach TD-total depth, and you better believe operators have this in mind when selecting vendors.

PTEN Drill bit performance (PTEN)

A catalyst for PTEN

Industry sources tell me that the North American market should see modest growth in the coming year. One area that should see growth is the drilling market. DUCs are at a low point currently after 2-years of withdrawal, and they are being put back into inventory. That means the long slide in the rig count should be coming to an end. At least temporarily.

Where will this come from? I think gas drilling is going to pick up, particularly in the Haynesville and Marcellus. Those two basins are down 40-50% from the first of the year, and are due for a comeback. Gas prices are up 30% from their summer lows, and are headed into a period of strength from the weather and emerging need for new supply for LNG. This is a structural move for the market and we should see the follow-through. Andy Hendricks commented on the upcoming cycle:

Absent a major macro event, we believe the global balance will need U.S. shale production to grow modestly over the next several years and U.S. shale activity likely need to stabilize just to keep production flat.

The delayed activity response so far should mean activity will have to catch up with deferred activity, which should be a tailwind in 2024. On the natural gas side, we believe the shape of the forward strip is telling us that there needs to be more activity in the gas basins just to meet current natural gas demand. And as we get closer to completion of new LNG export capacity later next year and into 2025, we will likely need to see natural gas activity rise again.

Our take- even though PTEN has spent a lot of money making these acquisitions, they have done it on the cusp of an up market in the coming year. They should retain pricing power through this cycle thanks to consolidation and their market position. Andy Hendricks noted expectations for rig day rates in the next year:

In terms of leading-edge rates, they were higher earlier in the year. They've softened a little bit, but they really haven't come down that much. I'd say it is mid- to low 30s because it's more in the mid than it is in the low. So that's kind of how I characterize it. And I do expect that, that will start to move up early next year as the rig count starts to push up as well past this inflection that we're seeing.

Risks

Risks abound in the drilling/frac contractor business, but nothing figures more prominently in expectations than commodity prices. We've had a dip into the mid-$70's in November, and that won't impact E&P budgets. Any time spent in the $60's will. Let's hope that our favorite swing producer, Saudi Arabia and their running buddies-the rest of OPEC - and the lovable Russkies - take the short-term demand picture into account when they have their big night out in Vienna toward the end of this month.

Q3 2023 and forward guidance

Total reported revenue for the quarter was just over $1 billion, which included $70 million in merger and integration expenses, partially offset by the recognition of $29 million of previously deferred revenue. Adjusted net income attributable to common shareholders was $55 million or $0.20 per share. This excludes the merger and integration expenses. Adjusted EBITDA totaled $277 million.

The weighted average share count was 280 million shares during Q3, and PTEN exited the quarter with 417 million shares outstanding. Through the third quarter, PTEN returned $191 million to shareholders through a combination of share repurchases and dividends. Dividend for Q4 has been set at $0.08 per share dividend for Q4, and there have $281 million remaining on the share repurchase authorization. PTEN intends to return at least 50% of free cash flow to shareholders annually, consistent with previous capital allocation strategy.

During the third quarter, Drilling Services revenue was $489 million, which includes the recognition of $29 million in previously deferred revenue. Drilling Services gross margin totaled $209 million during the quarter. Direct operating costs included $9 million associated with insurance reserve adjustments and inventory write-downs.

Average rig revenue per day increased to $38,110 with the previously deferred revenue item positively impacting reported revenue per day by $2,630. Average rig operating cost per day were $19,870, including $790 per day in costs associated with the previously mentioned insurance reserve adjustments and inventory write-downs. The average adjusted rig margin per day was $18,240 and $1,330 per day increase from the previous quarter.

For the fourth quarter, in U.S. Contract Drilling, PTEN expects to average 118 active rigs and exit the quarter with 120 rigs operating. They expect an adjusted gross margin of $16,100 per day with revenue per day expected to average $35,400 and rig operating cost per day expected to average $19,300.

PTEN expects activity and pricing is likely to stay relatively steady at current levels through the rest of the year, aside from typical seasonality. For Q4, Completion Services revenue of $950 million with an adjusted gross margin of $200 million is expected. SG&A is expected to decline over the next year as synergies from the merger with NexTier are realized.

During Q3, total CapEx was $160 million, including $89 million in Drilling Services, $56 million in Completion Services, $8 million in Drilling Products and $7 million in Other and Corporate. CapEx in Q4 is expected to be $190 million, comprised of $65 million for Drilling Services, $105 million for Completion Services, $15 million for Drilling Products and $5 million for Other and Corporate. The CapEx includes maintenance spending as well as some investments in NexTier's Power Solutions natural gas fueling business and other upgrades on both the completions and drilling fleets.

By the end of Q4, the company anticipates reaching an annualized synergy run rate of more than $100 million, which will mostly be back-end weighted and will be more impactful to Q1 results. They are targeting $200 million in annual synergies associated with the NexTier merger by the first quarter of 2025.

During the quarter, PTEN successfully completed a 10-year $400 million senior notes offering, and closed Q3 with nothing drawn on their $600 million revolving credit facility as well as $67 million in cash on hand.

PTEN now has investment-grade credit ratings from all 3 major credit rating agencies.

Your takeaway

We have been tracking Patterson-UTI Energy for some time now looking for an entry point. We could be very near with recent weakness. I think the company rates a place in investor's portfolios for long-term growth and moderate to increasing income. It's position of leadership in the market raises its profile, not to Halliburton or Schlumberger status, but well above the typical rating of independent OFS companies.

The company is trading at 5X EV/EBITDA, which is on the low side for an OFS company. As the analyst noted in his upgrade call, PTEN's Free Cash Flow yield is best in class at 15-17% That compares well to Helmerich & Payne trading at 7-8% FCY.

I think PTEN makes a very solid investment case if my expectations for the market in 2024 are realized. The upper range of the analyst expectations for price improvement appear plausible, and I think they are being a little timid with the Overweight rating. I would give them a buy and monitor trading this week to see if any deterioration in the market improves the Patterson-UTI Energy, Inc. pricing at all.

Comments