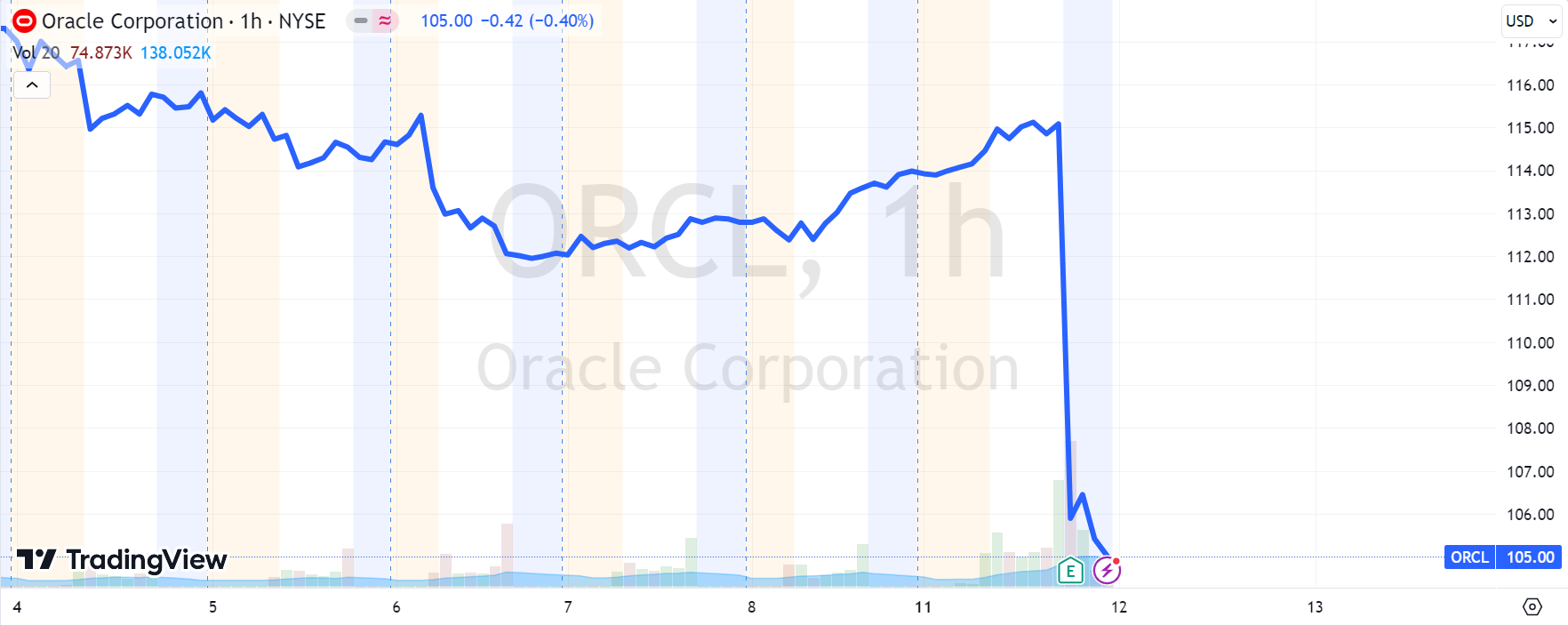

$Oracle(ORCL)$ fell nearly 9% after its 24FYQ2 fiscal report on Monday after market close.

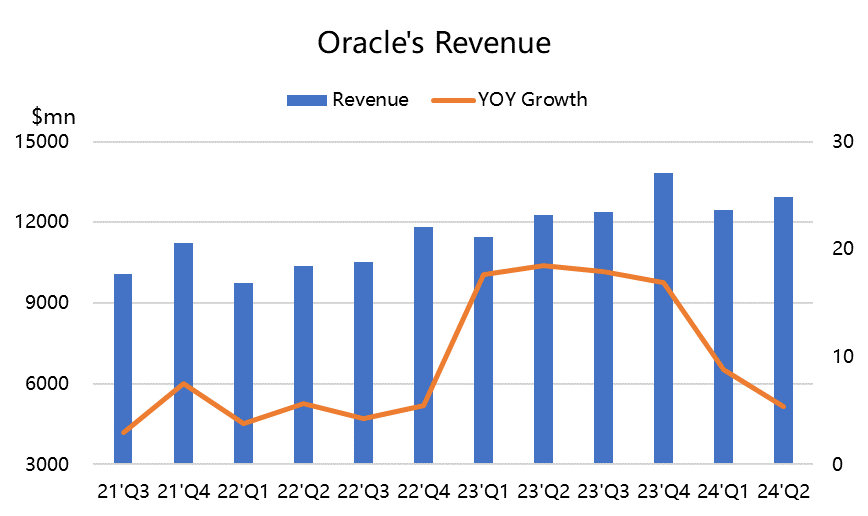

The main reason for the decline was underperformance: Q2 revenue was $12.9 billion, with a YoY growth rate of only 5.4%, and lower than the market's expected $13.05 billion. Earnings per share were $1.34, slightly higher than the market's average expectation of $1.32.

Total cloud revenue was $4.8 billion, with a growth rate of 1.6%, while the market expected $4.86 billion.

Remaining performance obligations were $65 billion, with a YoY increase of 6.2%, exceeding annual revenue.

However, the market was not satisfied with these results because the growth rate of the cloud business was already set very low and still fell short of expectations, considering the significant gap between Oracle and $Amazon.com(AMZN)$ AWS in the cloud industry.

Is Oracle overvalued?

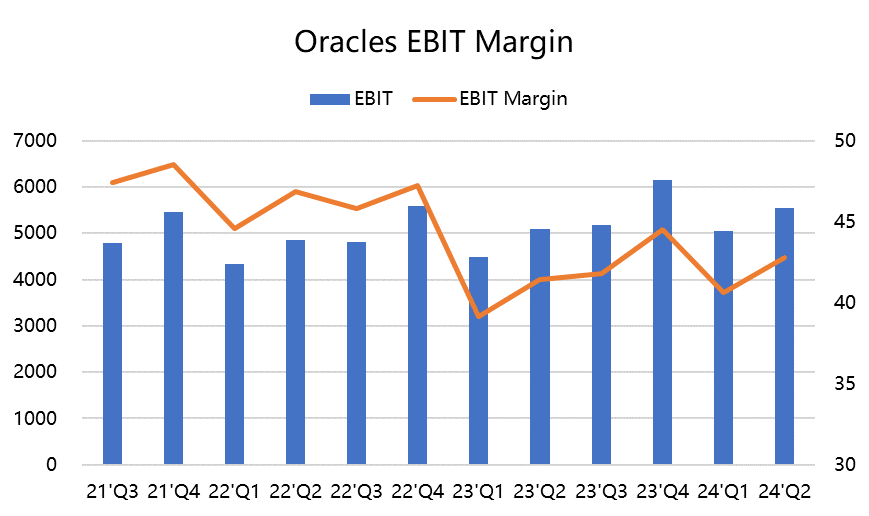

In the company's Q1 fiscal report in August last year, management confirmed a 30% growth rate for the cloud business in fiscal year 2024. Currently, Oracle's P/E ratio is 18 times the expected value, which has not reached the upper limit of its valuation range. Based on its current EV/Sales of nearly 6x and EV/Cash Flow of around 17x, its valuation is comparable to other large technology companies in the same industry.

Therefore, even though its year-to-date increase is nearly 37%, much lower than the Magnificent 7, it cannot be considered cheap.

Comments