Since being included in the $S&P 500(.SPX)$ index, the stock price of $Lululemon Athletica(LULU)$ has continued to rise. Despite not experiencing a significant jump on the quarterly earnings report on December 8th, it reached a new all-time high during the day's trading.

Currently, LULU has a price-to-earnings ratio of 44 times, which, although lower than the 60+ times at the beginning of the year, is still the highest in the apparel industry (ahead of $Nike(NKE)$ 36 times).

Can this valuation support the stock price?

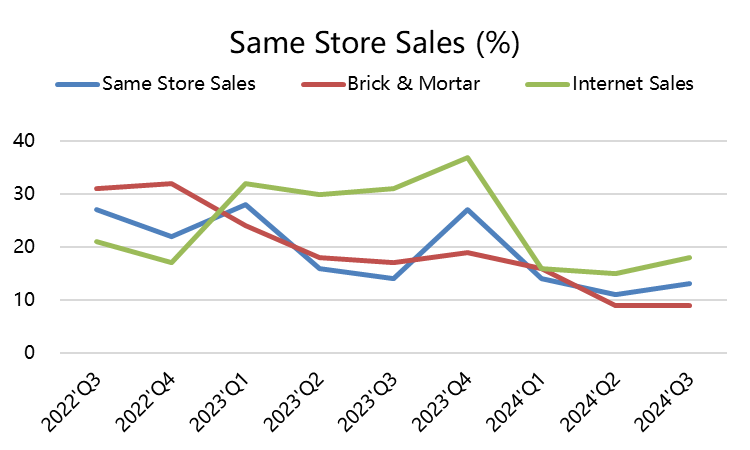

First, let's look at the growth rate. LULU used to heavily rely on in-store sales because its clothing was difficult to purchase online and required a "perfect fit." However, the pandemic has changed many consumers' shopping habits, and with an increasing number of members, they have become more accustomed to online shopping. As a result, online store growth has been faster in recent years.

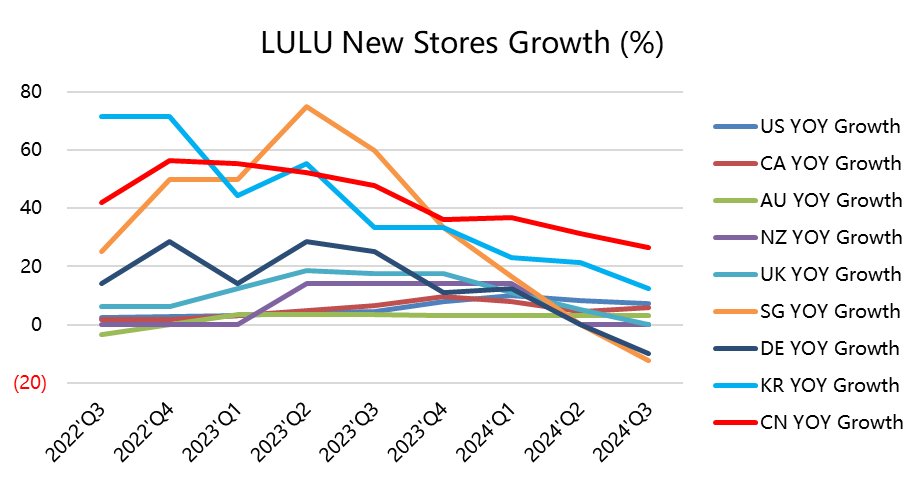

In terms of physical stores, LULU has been focusing on new openings in Asian regions, primarily China, South Korea, and Singapore. In terms of absolute numbers, they have 361 stores in the United States, 70 in Canada, and 133 in China. Therefore, most of the growth comes from China.

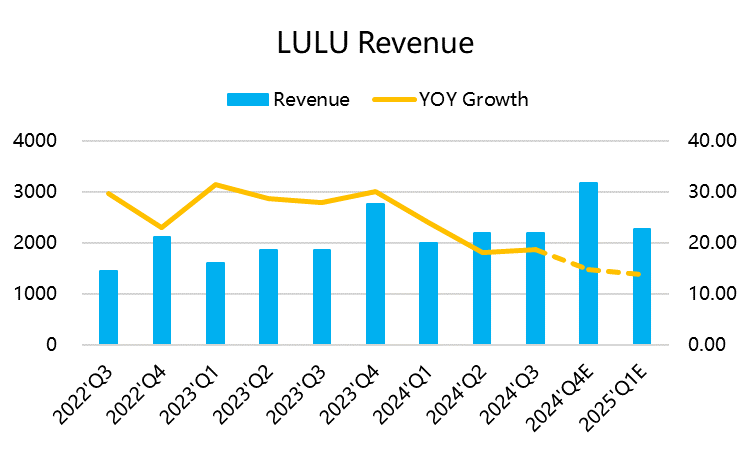

Consistently achieving high growth

LULU's performance over the past five years has far exceeded the initial plan, enabling the company to achieve $12.5 billion in annual revenue earlier than expected. On one hand, the continued growth of the athleisure industry and the stronger-than-expected growth in the Chinese market have contributed to this. Even in 2022, affected by the pandemic, LULU's revenue increased significantly by 30%, surpassing the projected compound annual growth rate of 15% for the period from 2022 to 2026. It is expected to maintain double-digit growth close to 20% in 2023-2024.

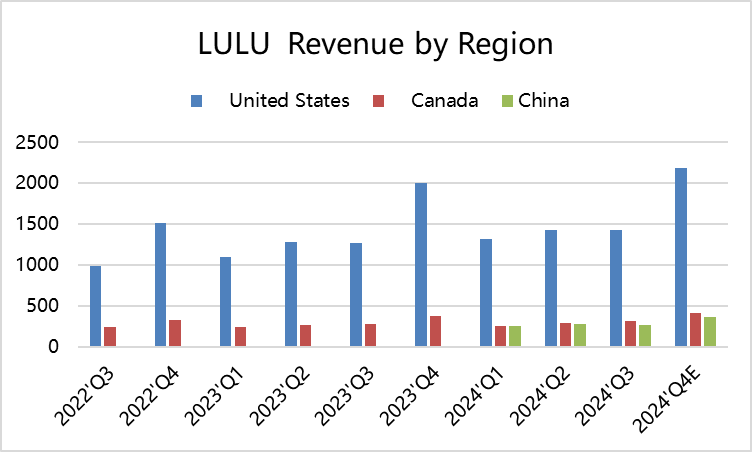

China is the key to growth

LULU has expanded its operations in China through localized e-commerce, investing more funds, creating localized marketing content, providing region-specific product choices, and strengthening its online presence through partnerships with Alibaba's Tmall and JD.com. It also utilizes social commerce through Tencent Holdings' WeChat Mini Program.

The company's growth strategy includes expanding its physical stores in first-tier cities, with a goal of accounting for 40% of its total network by 2026. They also plan to expand into second-tier cities and may increase the number of Chinese stores to 220 by 2026, a 65% increase from the current 133 stores.

Doesn't it sound a bit like $Starbucks(SBUX)$ first to Chine? Or more aggressive, somewhat resembling $Luckin Coffee Inc.(LKNCY)$

Growth rate makes the valuation

However, even with strong growth in China, there could be unexpected changes due to base effects, overall consumption trends in the Chinese market, and profitability (price wars) in that market.

The current PE ratio is 44 times, which means that if we assume an average profit growth rate of 30% for 2022 and 2023, the forward PE ratio for 2025 would be 26 times.

Of course, if they can maintain a profit growth rate of 20% even with less than 20% revenue growth, the PE ratio for 2025 would be 30 times, on par with the industry.

Comments

Great ariticle, would you like to share it?