$Adobe(ADBE)$ tumbled 7% after hours due to the earnings. The conservative guidance for the FY2024, as well as the impact of an ongoing communication into its subscription business from FTC, made investors frightened.

Is that a worry, or a dip to buy?

Earnings Review

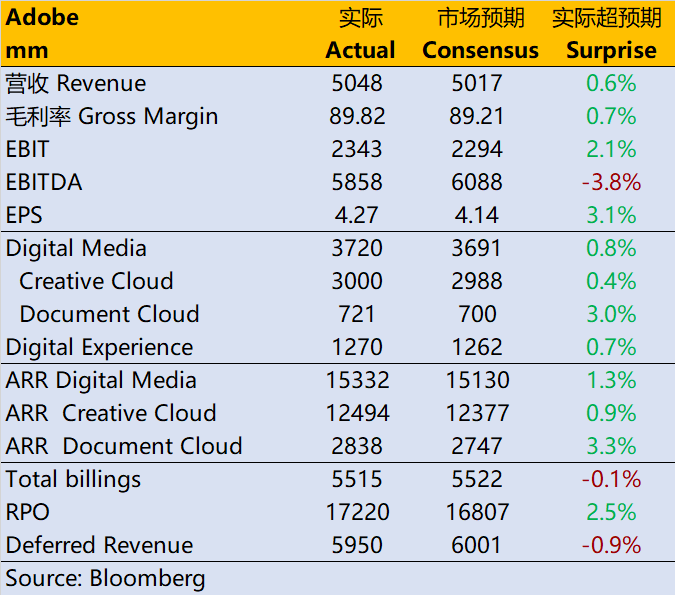

23FYQ4 performance still slightly exceeded expectations.

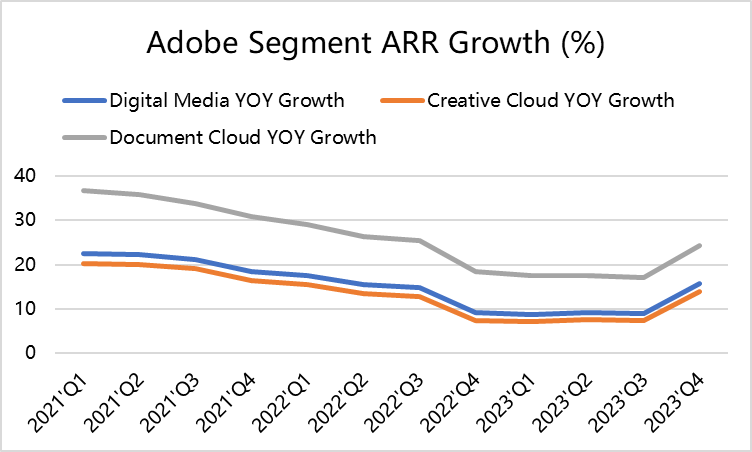

Revenue reached $5.05 billion, a 12% YoY increase, slightly surpassing the market's expectation of $5.02 billion. Digital media revenue grew by 13% YoY, reaching $3.72 billion, while creative revenue was $3 billion, and document revenue increased by 16% YoY to $721 million.

ARR (Annual Recurring Revenue) for digital media was $569 million, bringing Adobe's total net new ARR in that business area to $15.17 billion. Creative ARR increased to $12.37 billion, while Document Cloud ARR at the end of the period was $2.81 billion.

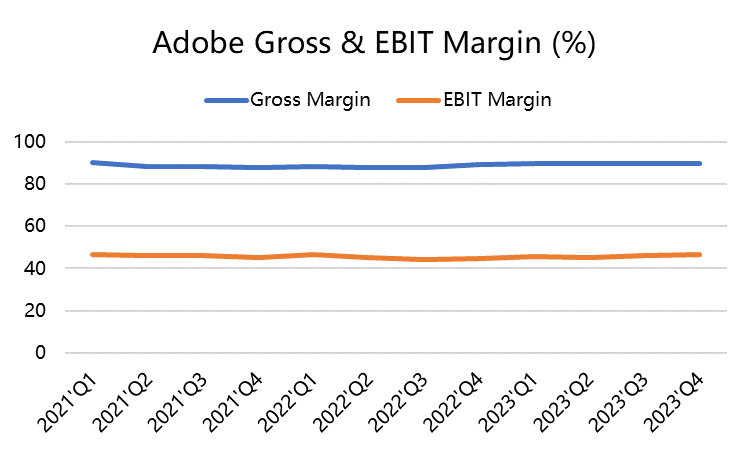

Revenue for the Digital Experience segment grew by 10% YoY, reaching $1.27 billion. In terms of profitability, adjusted earnings per share were $4.27, exceeding the market's expectation of $4.14 per share. The gross margin remained at 89.82%, and the EBIT margin was 46.4%.

It is more conservative towards the guidance for the fiscal year 2024.

Total Rev between $21.3 billion and $21.5 billion, with the midpoint below the expected $21.74 billion. Earnings per share are projected to be between $17.60 and $18. The net new annual recurring revenue for digital media is estimated to be around $1.9 billion.

For Q1, digital experience revenue is expected to be between $1.27 billion and $1.29 billion, while digital media revenue is projected to be between $3.77 billion and $3.8 billion.

The company also mentioned that it received a communication letter from the Federal Trade Commission regarding its subscription business in November. This matter may involve "significant economic costs."

Is this a buying opportunity?

Firstly, Adobe will continue to benefit from the AIGC trend, and the recent upward trend is also a response to the launch of its new AI model, Firefly. The enhanced practicality of the new model, combined with Adobe's large user base, will generate greater stickiness.

Secondly, although monetization may not be as fast as market expectations, it is more likely that the company's guidance is conservative as a strategic retreat. Adobe is known for its conservative guidance in performance. After all, the company has also raised subscription product prices. This is better than setting high targets but falling short of expectations.

Thirdly, the strategic opportunity of acquiring Figma remains attractive in advancing product design and accelerating collaborative creation. Of course, the company will also continue to engage with antitrust scrutiny from Europe, the UK, and the US Department of Justice.

Most importantly, software companies often receive favor during an interest rate cut cycle due to their low asset base and high return on investment.

Due to Adobe's high stock price, institutional investors dominate trading, which also reduces the volatility of the company's stock price.

Comments