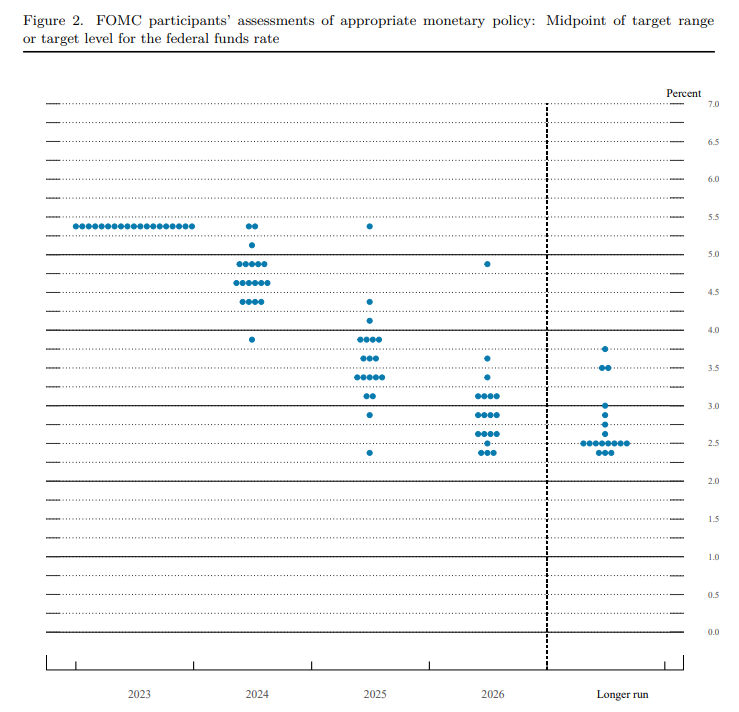

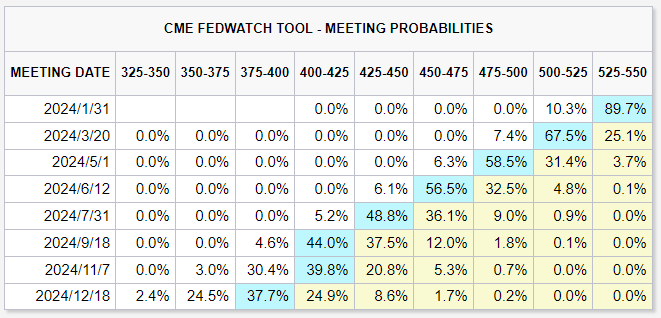

The December FOMC concluded last week with interest rate results in line with expectations, but the unexpected "dovish" turn by Fed Chairman Powell brought excitement to the market. At the same time, the Fed's dot plot showed that the median interest rate for 2024 indicates three rate cuts throughout the year, exceeding the previous market expectation of two cuts.

This move, which aligns with market expectations rather than surprises them, has led to a frenzy in both the stock and bond markets.

A step interest rate cuts

The slowdown in economic growth is the primary consideration for the Fed's interest rate cuts, and the current economic data does not show obvious signs of slowing down, and a "soft landing" is the consensus expectation. Therefore, the Fed's third-in-command has come out with a strong hawkish statement, saying that "there is currently no real discussion of interest rate cuts", implying that the market should not be too happy too early.

Of course, the continuous decline in commodity prices is also a key consideration, because similar to the late 1980s and mid-1990s in history, the decline in commodity prices can trigger an increase in the unemployment rate and a contraction in PMI. At that time, the Fed also carried out "gradual" interest rate cuts—cutting for a while, observing, and if necessary, continuing to cut.

In addition, premature downward financial conditions may re-activate incremental demand for real estate. Currently, mortgage rates have soared to 7.5%, exceeding the 7% rental yield, and the market has adjusted automatically. If the pace of interest rate cuts is too fast, it will stimulate demand again.

At the same time, although the long-term government bond yields have been declining all the way, the disturbance to market supply and demand caused by the issuance of new bonds in Q1 still exists. The US Treasury Department expects a net issuance of $644 billion in US bonds in the first quarter of next year, higher than the fourth quarter of this year, which may bring disturbance to term premiums that have turned negative again.

Could it be the U.S. stocks that benefit the most?

Compared to the uncertainty of U.S. bonds, the current trading of U.S. stocks is more active. Both before and after the FOMC meeting, the three major indices, $S&P 500(.SPX)$ $NASDAQ(.IXIC)$ and $DJIA(.DJI)$ , recorded gains for the sixth consecutive trading day. The Russell 2000 Index ETF (IWM) surged by as much as 2.8%, far exceeding the other three major indices, indicating that investors are very optimistic about the early 2024 economy.

Consumer indicators are crucial in the United States. When the year-on-year growth rate of retail sales, adjusted for inflation, drops by more than 1%, it coincides with the beginning of an economic recession. In November, actual retail sales increased by nearly 1% year-on-year.

An important factor supporting the continued rise of U.S. stock assets is the nearly $6 trillion in idle cash reserves. Currently, this portion of funds is enjoying a money market yield of over 5%. As expectations for a Fed rate cut begin, this short-term benchmark yield will decline, and investors may start reallocating this massive amount of funds to other asset classes. This situation has already begun to occur after last week.

In the future, we may continue to see some outflow from the money market and chasing this upward trend, although not necessarily on a large scale. Investors remain optimistic mainly based on the accumulation of a large amount of liquidity. With the peak of short-term interest rates clearly behind us, this liquidity may reach its peak.

Comments