Summary

- Kosmos Energy is currently trading at a discounted price, making it an optimal entry point for investors.

- The company's core thesis is the impending startup of the Greater Tortue Ahmeyim-GTA project offshore Senegal and Mauritania.

- Kosmos Energy has taken a 90% stake in the Yakaar-Teranga-Y&T field, which is expected to be larger than GTA and has strong market potential.

- We rate KOS as a strong buy at current prices but may look for a slightly better entry point, given present market conditions.

Santa...Pssst. I'd like a full position in Kosmos Energy in my stocking.

AlexRaths/iStock via Getty Images

Introduction

In my view, we are being given a gift by the market's current disdain for everything related to oil or gas. Burgeoning supplies of oil and gas, combined with demand fears have sent prices toward mid-year lows, and in so doing have knocked the stuffing out of the upstream sector. That's the downside.

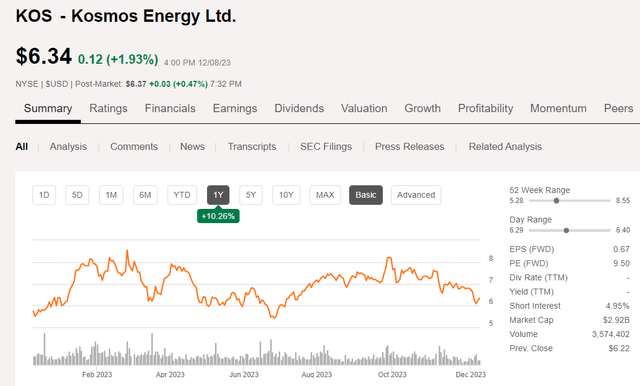

Kosmos Energy price chart (Seeking Alpha)

The upside is that most of the companies we follow are significantly discounted from the pricing of just a few months ago. The goal is to pick an optimal entry point to add or initiate a new position. Kosmos Energy, (NYSE:KOS) is right in that lane currently.

KOS is trading right at the support line of $6.25, and well below the 200-day SMA. Trading has been fairly normal with about 5 mm shares changing hands each trading day, more bearish in the last week or so, than not, if I'm honest. Analysts have KOS solidly ranked as a buy at current levels. The price range runs from $8.00 on the low side to $14.00 on the high side. The median is $9.92, implying a 63% upside to the current price of $6.34. That's enough to move me off the dime, but pricing might get still better in the short run if the Head and Shoulders pattern runs its course toward the mid-year low of $5.61.

Let's review Q-3 for KOS and see where think the company might be a year from now, and how close we can come to that upper end of the range.

The thesis for KOS

The core thesis is the impending startup of the BP, (BP) operated Greater Tortue Ahmeyim-GTA project offshore Senegal and Mauritania. I have covered the details of this project extensively in past articles and the story hasn't changed much, so I will refer you to them if you need a tune up. What's germane to this article is the first shipments of gas from GTA should begin in the first half of 2024, after years of delays. Including one recent delay related to FLNG and FPSO commissioning timelines, that took the stock out of the $7's into the mid-$6's when it was announced. Andy Ingliss, CEO of KOS notes the timeline for GTA to commence operations:

The delivery of gas in the first quarter of 2024, as signalled by BP, the operator, in its third quarter results last week, depends on the execution of this workstream (FPSO and FLNG vessel commissioning), which has the potential to slip into the second quarter of 2024.

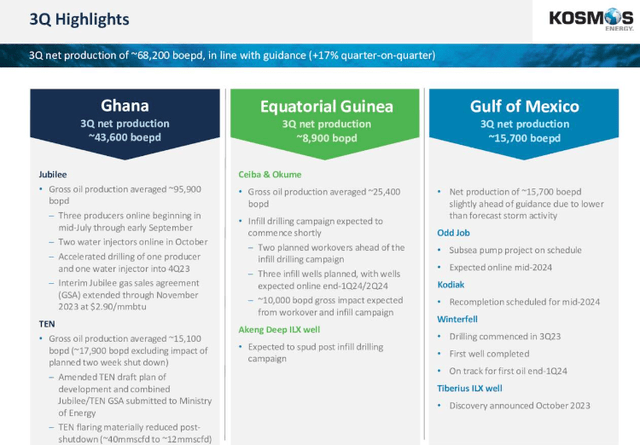

The company's previously discussed projects-Jubilee, on waterflood, offshore Ghana and Winterfell-GoM, are on line or coming on line and set to contribute to revenues in 2024. Jubilee's production is up to 93K BOPD. Another Jubilee producer and injector are planned for 2024 with will boost production another 5-10K BOPD. Winterfell will add two more completions in early 2024, with first oil shortly after that.

KOS Q-3 highlights (KOS)

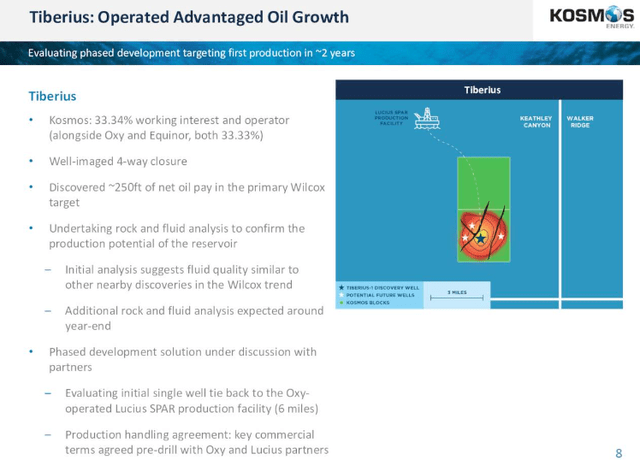

Recently a major discovery was announced at the Tiberius prospect in the GoM with 250' of net pay. If the project is sanctioned, it will be through a subsea well and tied back to Occidental's (OXY) Lucius SPAR host as noted in the linked article. Total recoverable resource at Tiberius was estimated at 135 mm bbl. It wouldn't surprise me to see that upscaled, 250' of net reservoir is pretty hefty. Single deepwater Wilcox wells will make 10-12K BOPD. There is the potential for up to 3 wells as fault block structures are assessed.

KOS Tiberius project (KOS)

A catalyst for KOS 2-3 years down the road

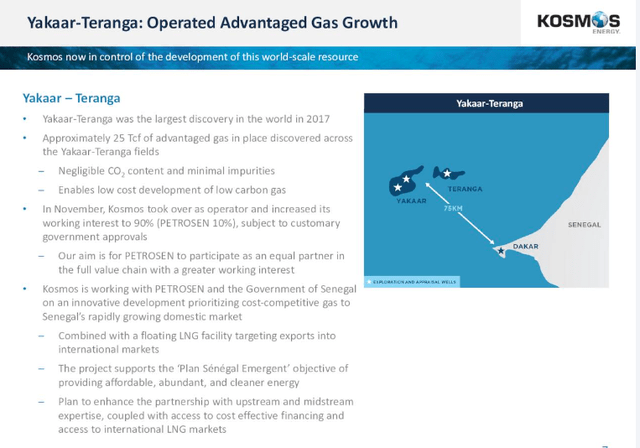

Looking to leverage their experience building FLNG hubs, KOS has taken a 90% stake in the super-giant Yakaar-Teranga-Y&T, field, offshore Senegal. This project will be larger than GTA with 60% more reserves in place, and is advantaged by existing infrastructure and a ready market in Senegal for the gas. KOS has noted its plan to farm down a significant percentage of Y&T to Petrosen, the NOC of Senegal. This could liberate significant capital back to KOS on execution. FID on Y&T is expected at the end of 2024, with first gas a couple of years after that.

KOS Y&T Project (KOS)

CEO Andy Inglis opines on the high level plan for YT in response to an analyst question:

Yakaar Teranga, is a distinctive gas resource. It has low CO2 content. It is close to shore, 75 kilometers of the Dakar Peninsula. And from both a domestic and an LNG perspective, it has a strong market pull. There's a need to replace heavy fuel oil as a source of power in Senegal. Kosmos believes that this gas is distinctive and is well described. Well described, what do I mean by that? I mean that in Tortue, we drilled four exploration and appraisal wells and a DST that enabled us to calibrate the seismic that led to four successful development wells. It's a huge amount of subsurface data that directly correlates to Yakaar Teranga, where we have three exploration and appraisal wells. I think this is a great opportunity for the company. We've inherited our share. We started at 90%. Our objective is for Petrosen to build their share so that they are an equal partner with ourselves and whoever comes in. We'd anticipate, therefore, 25% to maybe 33% shares. We've got work to do now on fully describing the concept that we laid out in the material, and we've got work to do to bring in a partner and underpin the financing. But with all of that done, this is an incredibly commercial opportunity, but it has to be done in a low-cost way that fully leverages all of the subsurface knowledge. With control now of Yakaar Teranga, I think we can then position that as the next building block in that sequence. And I would imagine that Tortue Phase two could sit behind that.

I don't usually do quotes of that length, but I thought in this case it was justified. With their success in developing GTA, I think that there will be a long list of farm down candidates among the various IOC's with interests in West Africa, and don't think it will be long before they can announce this. The logic for gas development offshore Senegal is just too strong.

- YT is advantaged by existing infrastructure.

- Much of the reservoir information collected for GTA is applicable to YT.

- The Market is bifurcated with domestic needs in Senegal, and a straight shot to Europe.

This development just makes sense.

Q-3, 2023, and Guidance

Q-3 revenues rebounded to $526 mm from $273 mm sequentially, and 15% YoY. EBITDA rose sequentially to $278 mm but was down YoY from same period in 2022. The company is generating OCF of about $1 bn on a one-year run rate basis and covering capex of about $7-$800 mm. The company notes

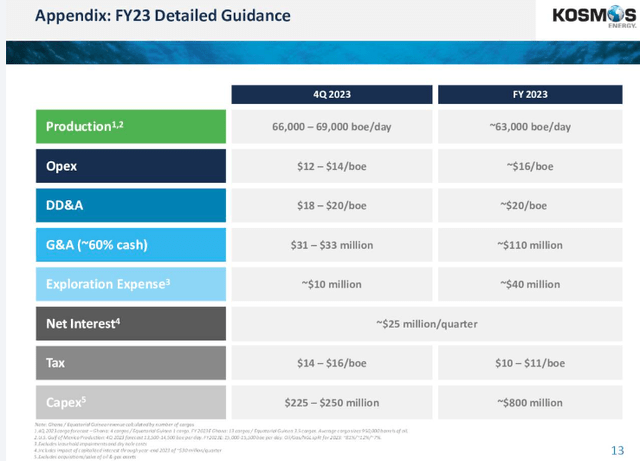

KOS Full Year 23 Guidance (KOS)

That capex is set to decline once GTA, the Jubilee expansion, and Winterfell come on line. CEO Inglis comments:

We expect this growth to drive a material step-up in free-cash flow as these projects are delivered, enabling the Company to further de-lever and ultimately to fund shareholder returns when leverage falls below our target level.

The company is saddled with substantial debt currently of $2.3 bn, but with no maturities before 2025 they have the prospect of making a significant dent in it as the GTA revenues come rolling in.

A reminder on the impact of GTA on revenues for 2024

KOS owns a 28% stake in GTA. When this project ramps to full production - 2.5 mpta, KOS will recognize TTF pricing, currently $12.91 per mm btu. There are 51 mm btu in a ton of LNG, so before costs KOS should recognize another $460 mm in revenue. This could improve seasonally with fluctuations in TTF pricing. BP has agreed to be the off-taker for GTA gas under a twenty-year contract.

Risks

Weather and shipping is KOS' biggest risk. Being a sea based project the entire project rests on the ability of the FLNG and FPSO to stay on station and produce and load cargoes. There will be lightering risks - sea state associated with transfers of LNG cargoes to transit vessels. Minimal, but present none the less. I don't really have the experience to fully assess this risk, but I have spent a lot of time WOW - waiting on weather, when I was offshore.

Your takeaway

Currently, KOS is trading at 4.1X EV/EBITDA on a Q3 run rate basis. With the rise in cash flow forecast from the three 2024 project start-ups we have discussed, EBITDA should come in at ~$1,400 bn for 2024 and justify a higher multiple. 5X that forward EBITDA would take the stock to $15 in the next year, pretty close to what the high end of the analyst range is now.

That's a 2.5 bagger from current prices and is what I have my sights set upon. I will look for an entry point this week to add to my current position.

Comments