A larger-than-expected slowdown in inflation bolstered bets that the Fed would cut interest rates as early as March, but Nike's sharp drop in its full-year outlook weighed on sentiment and the three major U.S. indexes ended the eighth straight week with gains, the first for the S&P since 2017 and the first for the Dow since 2019.

The latest data showed the core personal consumption expenditures (PCE) price index fell to 3.2 percent in November, the lowest since April 2021 and below market expectations. In addition, the PCE price index rose 2.6 percent year-on-year in November, below market expectations of 2.8 percent.

Meanwhile, U.S. durable goods orders rose 5.4 percent in November, the largest increase since December 2022. Signs that inflation is accelerating and slowing have bolstered expectations of an early rate cut, with an 85 per cent chance of a cut in March.

Before the opening of the market on December 25, the National Press and Publication Administration of China issued 105 newly approved domestic game plates, the number of single approvals exceeded 100 for the first time, and the scope of game enterprises covered was also wider, which strongly demonstrated the clear attitude of the competent authorities to actively support the development of online games. Option moves appear to sell put large orders:

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

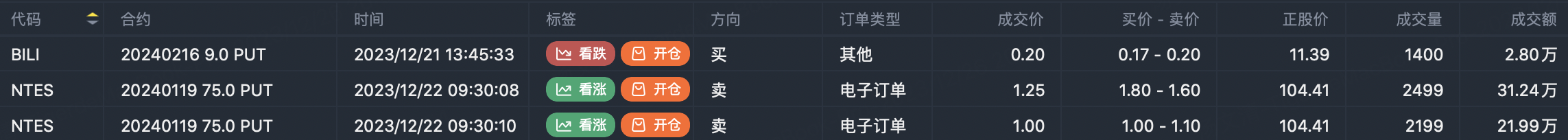

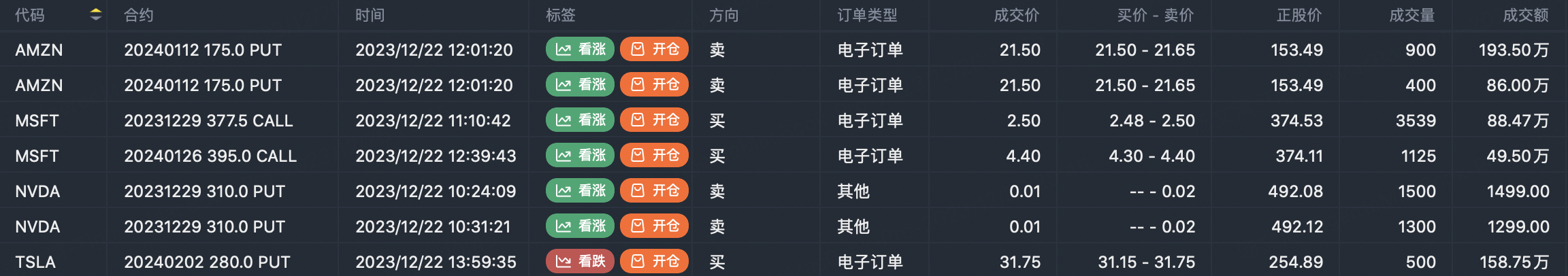

$Amazon.com(AMZN)$ Sell PUT option $AMZN 20240112 175.0 PUT$

$Microsoft(MSFT)$ Buy CALL option $MSFT 20231229 377.5 CALL$ $MSFT 20240126 395.0 CALL$

Option buyer open position (Single leg)

Buy TOP T/O:

$TSN 20250117 50.0 CALL$ $PEP 20240119 185.0 PUT$

Buy TOP Vol:

$AA 20240216 40.0 CALL$ $CCJ 20231229 40.0 PUT$

Note: This image data is from Tiger PC. This screening is a significant buy open position for options contracts in the market. The purchase of a call option means that the trader believes that the underlying has upward momentum, and the purchase of a put option means that the trader believes that the underlying has downward momentum. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

Option seller open position (Single leg)

Sell TOP T/O:

$AMZN 20240112 175.0 PUT$ $JNJ 20240119 175.0 PUT$

Sell TOP Vol:

$PTEN 20240216 9.0 PUT$ $TLRY 20231229 2.5 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

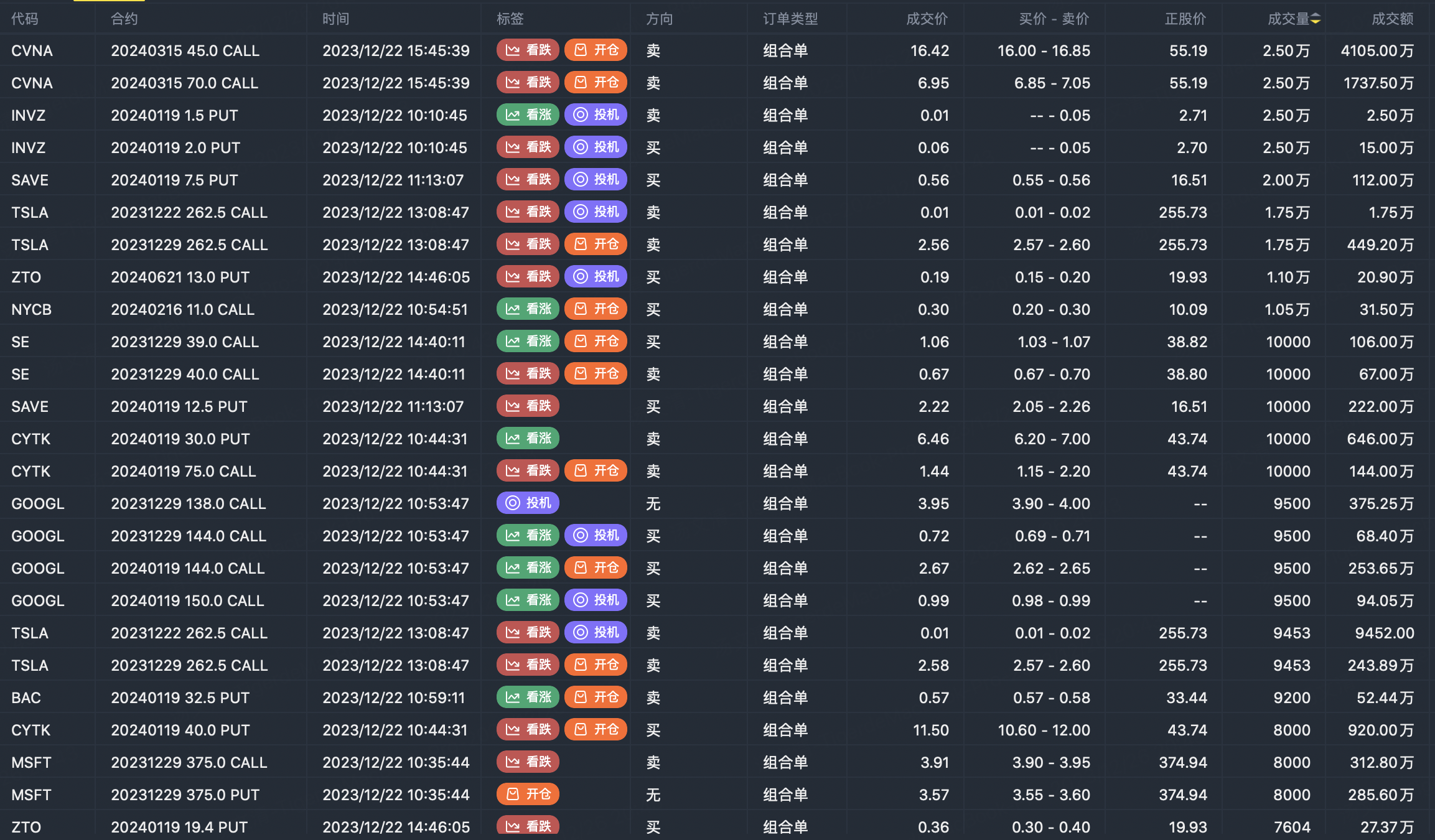

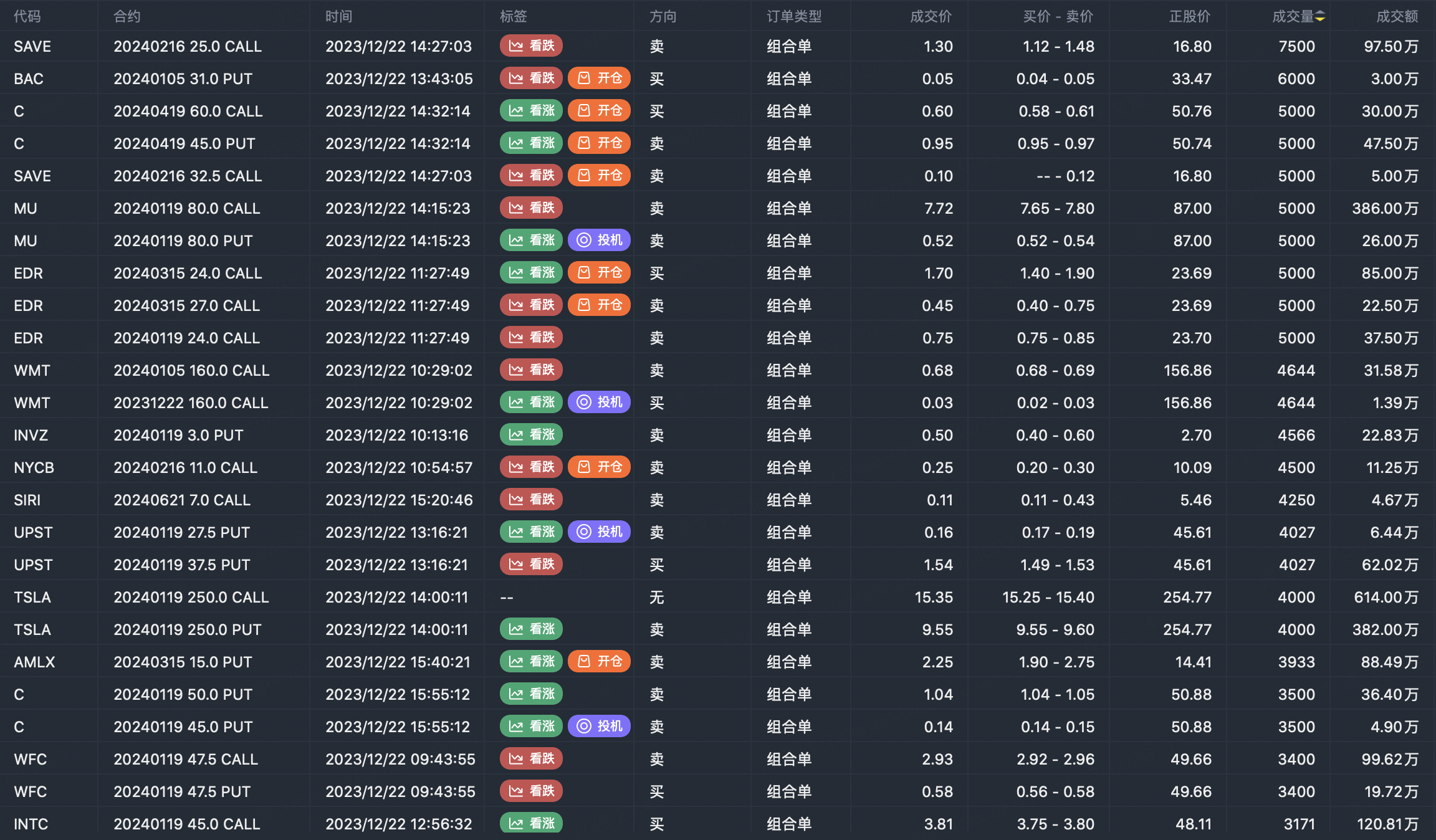

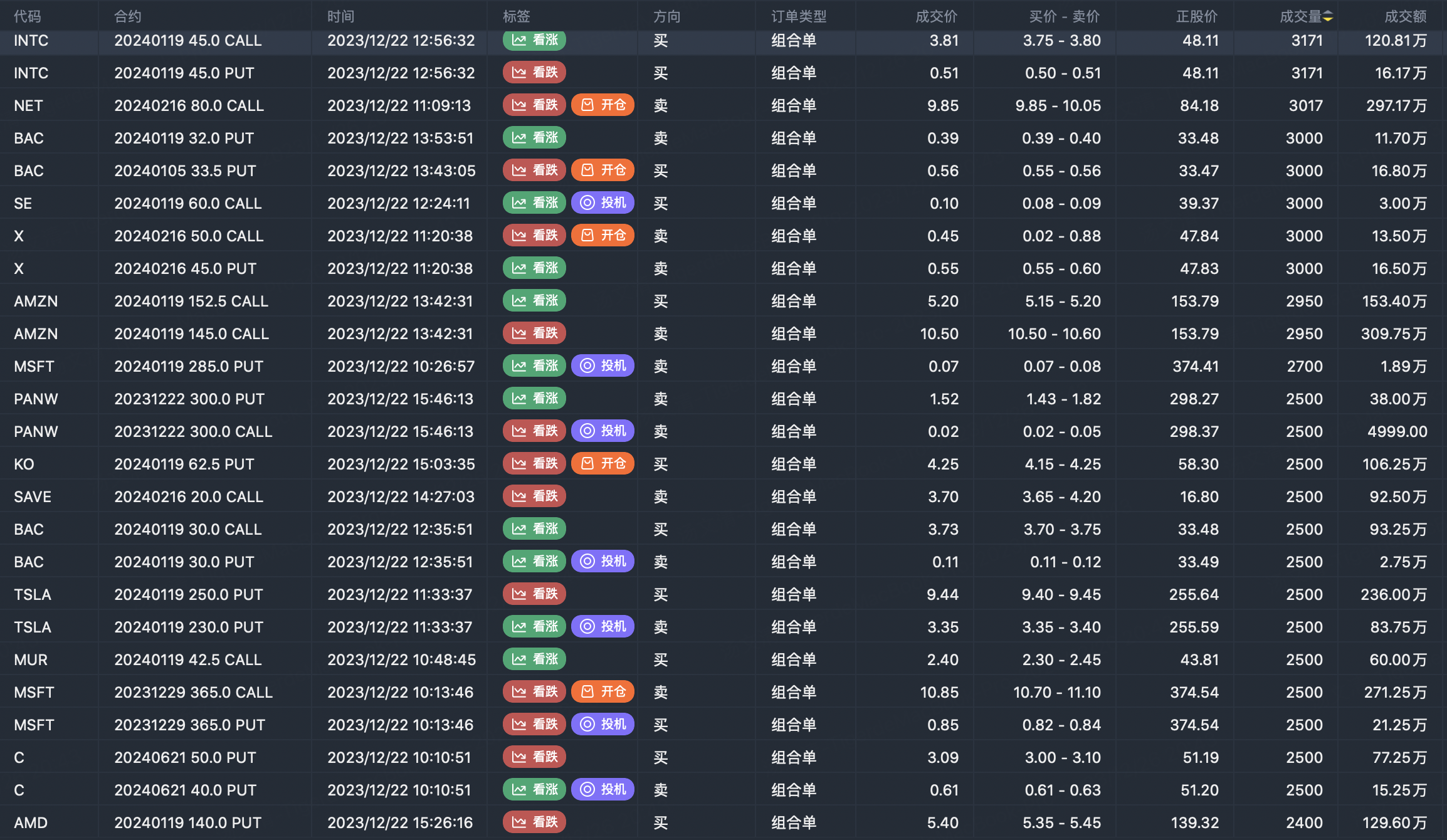

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

A larger-than-expected slowdown in inflation bolstered bets that the Fed would cut interest rates as early as March, but Nike's sharp drop in its full-year outlook weighed on sentiment and the three major U.S. indexes ended the eighth straight week with gains, the first for the S&P since 2017 and the first for the Dow since 2019.

很棒的文章,你願意分享嗎?

Great ariticle, would you like to share it?