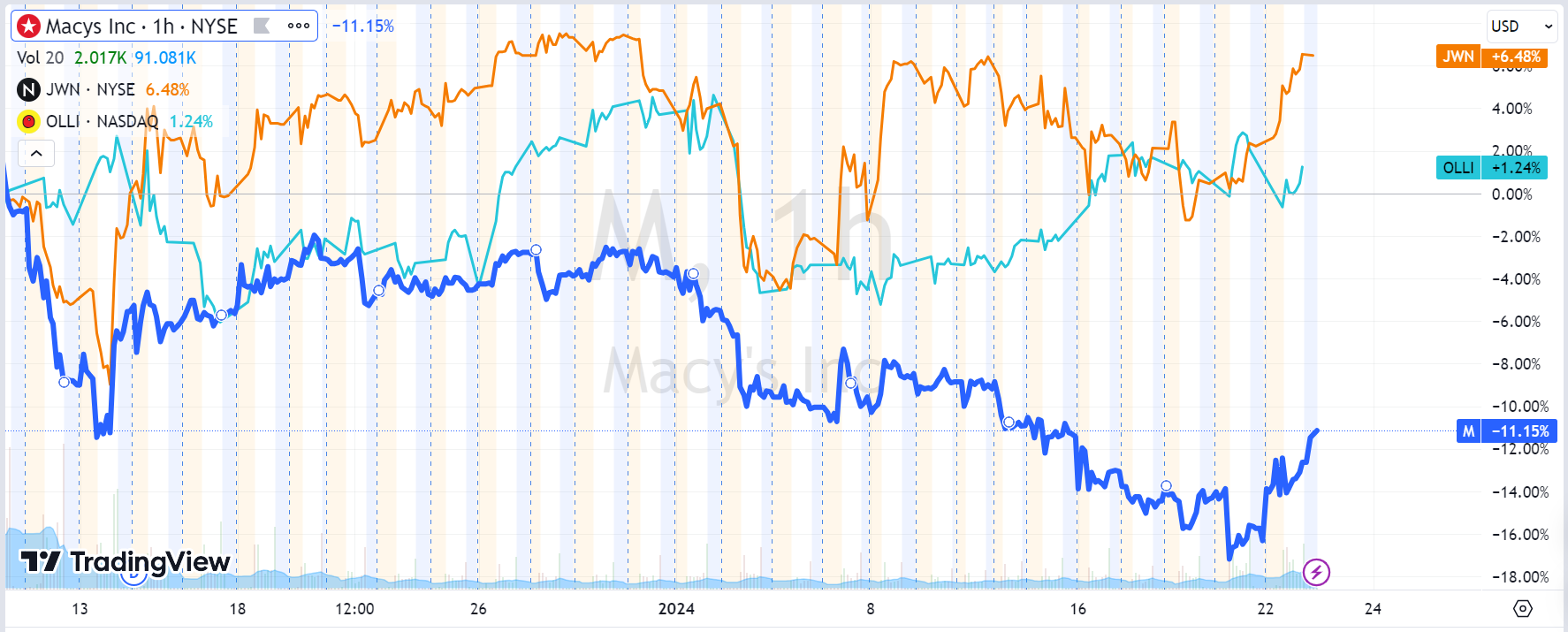

Macy's (M) rejected a $21 per share acquisition offer from private equity firms Arkhouse Management and Brigade Capital Management. In fact, this news should have leaked to some extent last week, as M's stock price dropped abnormally last week and performed significantly worse than its peers after the privatization offer was announced.

This is very unusual.

Generally, when there are acquisition or privatization offers, the stock price will be restricted. So, after the formal rejection by Macy's shareholders, the stock price actually rose. It looks like it will rise further.

Arkhouse and Brigade had previously threatened to directly approach shareholders with the acquisition of the chain store and stated that they were highly motivated to complete the acquisition of Macy's and were prepared to take all necessary measures, including direct contact with shareholders, to achieve this goal.

The attitude of Macy's board of directors, in simple terms, is that they have "serious reservations" about the ability of the two investment firms to make an offer and hope that they will increase their offer after conducting due diligence.

Arkhouse also responded by stating that if given the authority to conduct necessary due diligence, they believe that the original proposal could be significantly increased. In addition, private equity firm Sycamore Partners is also considering a bid.

In my personal opinion, selling PUT options is relatively stable, and if caught in a position, it's not a big problem. It will be resolved sooner or later.

1. Increasing the acquisition price would be the best outcome, of course, it's better for holders of stocks or Calls.

2. Not increasing the price, but making a forced offer and buying from the market will definitely affect liquidity, and the secondary market will definitely rush to buy.

3. If there is no offer, the recent lack of increase in M's stock price will be compensated.

The expected return is greater than the risk.

Comments