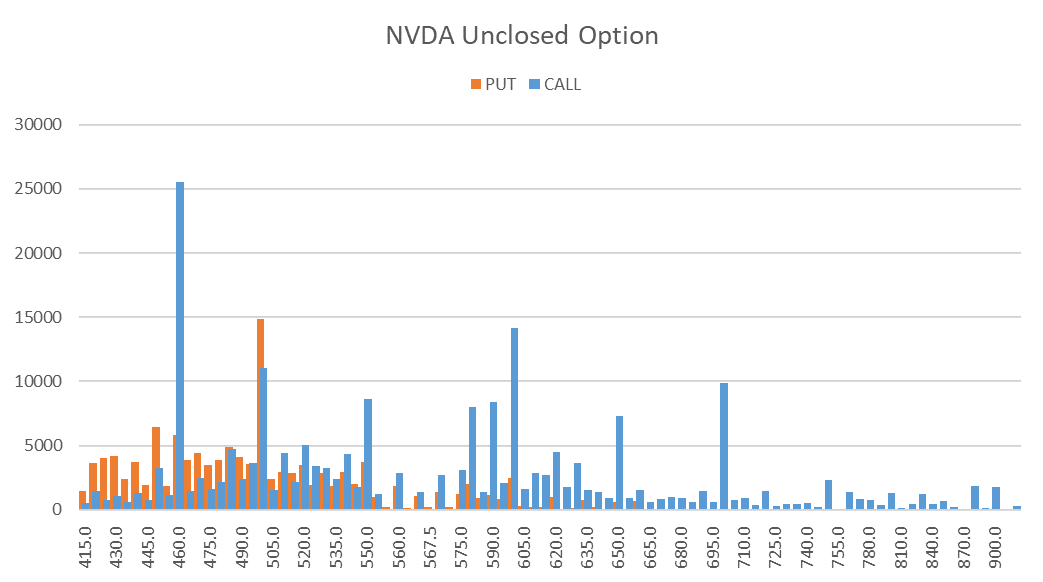

The semiconductor industry is reaching new highs, with NVIDIA (NVDA) seeing a nearly 25% increase in the year. Meanwhile, the new energy sector is in turmoil, with Tesla (TSLA) experiencing a 17% drop in the year, and an additional 25% drop after the release of its financial report on the 24th.

It's uncertain whether those who hold both stocks have hedged their positions effectively.

Despite the short-term fluctuations, Tesla's long-term outlook remains positive due to factors such as the Cybertruck, 4680 battery, FSD authorization, the start of mass production for the Optimus, and the new vehicle plan for 2025, all of which have the potential to change the current pessimistic expectations.

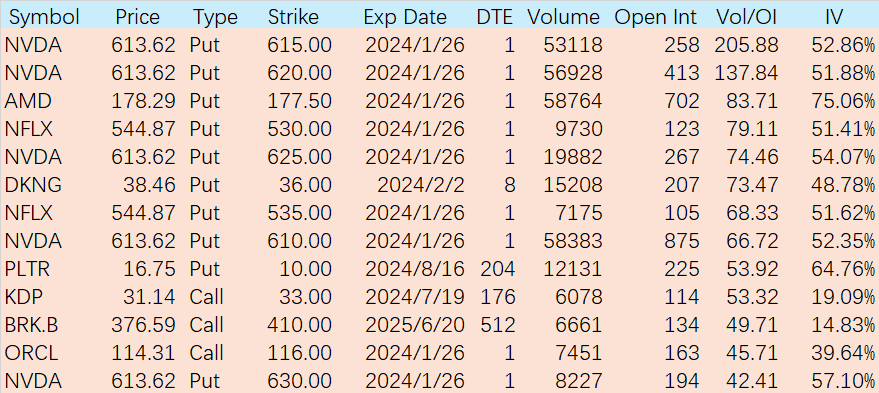

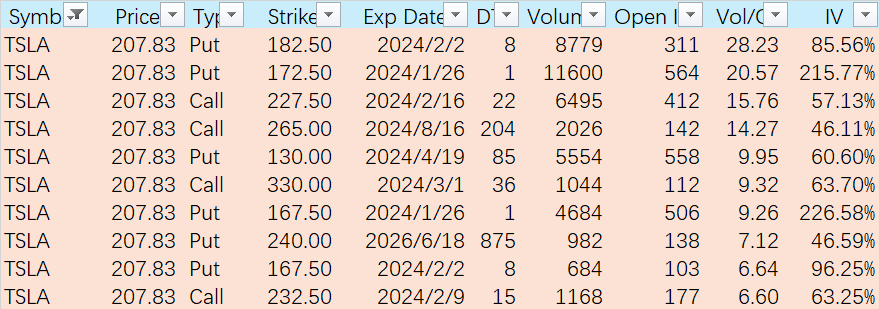

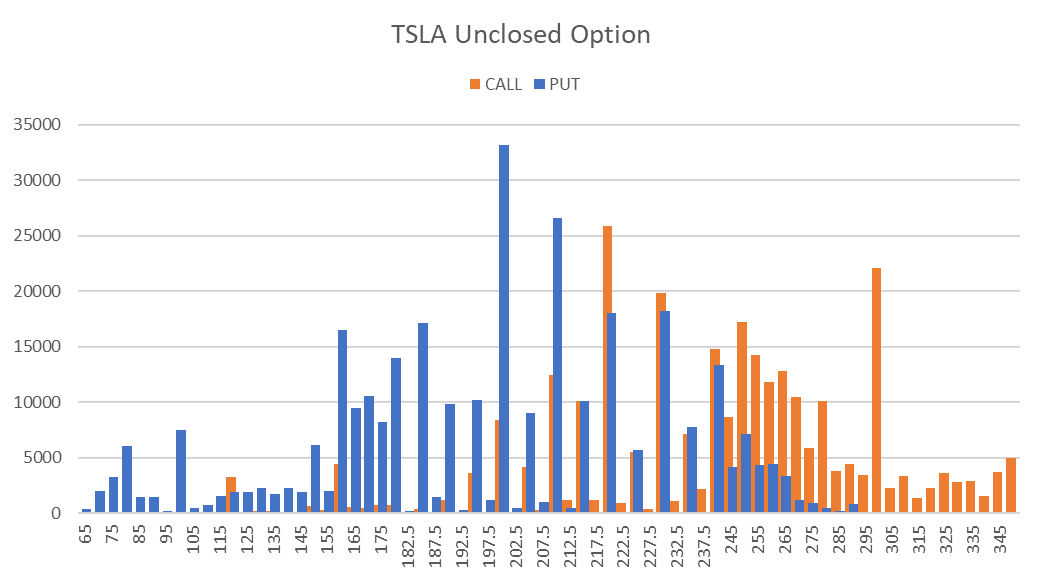

In terms of options trading, there is active trading in NVDA's options, while TSLA's options trading on the day of its financial report release (aftermarket on the 24th) was not very intense, and both the long and short positions in options were not significant.

There was a large volume of closing PUT options in the 1875-185 range for TSLA, indicating a lack of confidence in its future performance.

Looking at the open interest options for this week, there is a significant amount of open PUT options above 200 that may seek to profit from the drop below this level after the financial report. There may also be a battle among the open options in the 160-190 range. The 200 PUT option is a crucial battleground.

On the CALL side, there is a concentration of open interest in the 240-270 range, and those who covered earlier are probably not worried about a potential increase in the next few days. A batch of CALL options around 220 may be the biggest losers.

Therefore, if there is no breakdown tonight, the bulls may target the 200 level, but if there is a breakdown, the price may head towards 185.

As for NVDA, the outlook is very optimistic. Most of the CALL options in the 560-590 range have been closed this week, as the rapid rise does not warrant maintaining positions at this level in the short term. The remaining open interest is around 620.

Comments