Takeaways

📈 Economic Indicators: December data, including ISM Manufacturing PMI, Non-farm Payrolls, CPI, PCE, housing starts, and retail sales, exceeded expectations, indicating resilience in U.S. households and manufacturing.

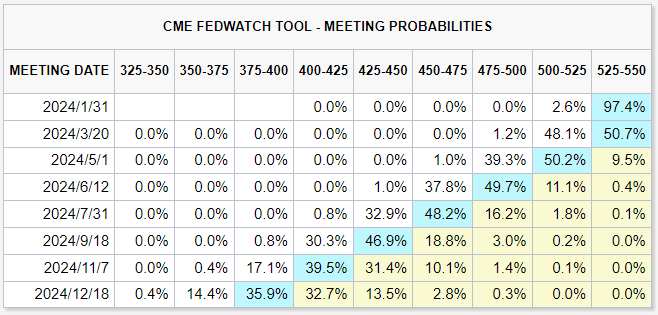

🔄 Market Reassessment: Probability of a rate cut in March decreased to around 50%, and the 10-year U.S. Treasury yield rebounded to 4.1% as the market reevaluated interest rate expectations.

💧 Liquidity Abundance: Abundant liquidity in the market is attributed to fiscal policies injecting funds, maintaining overall liquidity despite the Federal Reserve reducing its assets.

💰 Fiscal Policy Impact: The fiscal deficit expansion, increased short-term bond issuances, and higher risk tolerance in an election year contribute to the liquidity surplus.

🗓 Policy Path in 2024: The political landscape, especially the dominance of Trump in the Republican primaries, suggests a continued accommodative monetary policy in 2024, with fiscal and monetary policies likely to cooperate.

💸 TGA Account Dynamics: The Treasury General Account (TGA) balance affects the urgency to end balance sheet reduction; its decrease may delay, while slower reduction or no decrease may expedite the end of the reduction.

📉 Impact on Assets: With ample reserves, U.S. stocks historically perform well; however, increased fiscal and monetary easing may lead to stronger economic resilience, potential inflation, and a shift in favor of assets with stable cash flows or high quality.

The economic data for December has been released, with important indicators such as ISM Manufacturing PMI, non-farm payrolls, CPI, PCE, new home starts, and retail sales all exceeding expectations, gradually confirming the resilience of American households and the manufacturing sector.

The market has adjusted its expectations for interest rate cuts, with CME Fedwatch showing the probability of a rate cut in March falling to around 50%. The 10-year U.S. Treasury bond yield has rebounded to 4.1%, indicating that the market anticipates that an early rate cut could lead to inflation risks.

In the short term, as the market anticipates the opening of rate cuts and the continued resilience of economic growth, the over-adjustment and swings in rate cut expectations may continue before the rate cut is initiated.

Why market liquidity remains strong?

This is because fiscal policy has "loosened," supplementing liquidity.

From the perspective of overall liquidity, from June 2022 to June 2023, the Fed reduced its assets by $527.5 billion. On the liability side, fiscal savings have supported this reduction, with the TGA account decreasing by $772.6 billion, while at the same time overnight reverse repos increased by $276.3 billion. Since June 2023, although the TGA account has increased, the overall impact of fiscal policy remains "loosening."

Since the passage of the debt ceiling law in June, the U.S. has issued a net $2.1 trillion in debt as of January 18th. During this period, the TGA balance increased by nearly $700 billion, seemingly "absorbing liquidity" from the market. However, in reality, reserves increased by $302.3 billion during this period, leading to increased market liquidity. The reason for this is that the expansion of the fiscal deficit has not weakened, and the large issuance of short-term bonds has compensated for the previous shortage of short-term government bond supply, thereby limiting the problem of money market fund holdings.

At the same time, there is a higher risk appetite for monetary policy in an election year - the Biden administration and the Federal Reserve would rather risk economic overheating than bear the risk of economic recession or financial crisis.

Therefore, in an election year, with the motivation to prevent financial crises and recession risks, fiscal and monetary policies will probably work together to ensure sufficient liquidity.

In a situation where fiscal policy is clearly "loosening," the urgency to end balance sheet reduction will diminish.

What is the policy path in 2024?

The political factors of the election year continue to be the key influence on the direction of fiscal and monetary policies. Especially with the recent clear advantage of Trump in the Republican primary and polls showing his support surpassing Biden's (especially in key states). In consideration of preventing financial risks and economic recession, it is expected that monetary easing will still be the main theme this year.

Fiscal policy and monetary policy may continue to "coordinate" to provide relatively ample liquidity for the US dollar.

If the financing speed slows down and fiscal spending is strong, and the TGA rapidly decreases, the urgency to stop shrinking the balance sheet will decrease. The TGA account has now accumulated to $748.8 billion, exceeding the target set by the TBAC meeting at the end of October last year for the end of the first quarter of this year, and the Fed's time to end balance sheet reduction may be pushed back.

If fiscal spending is restricted, the TGA does not decrease or decreases slowly, then the end of balance sheet reduction may be advanced. Due to the limitation of the debt ceiling law on the disposable income for the 2024 fiscal year of $1.59 trillion, it may be difficult to enhance the fiscal deficit intensity in 2024 compared to last year. In order to maintain an adequate reserve size, monetary easing may have to be carried out earlier, and the pace of balance sheet reduction may have to be slowed down.

How will stocks and bond be affected?

Based on the experience of the past 20 years, with ample reserves, the performance of US stocks is generally not bad. With fiscal stimulus and possible monetary easing, the US economy has strong resilience, supporting stock profits.

Of course, with the inherent strength of the US economy, loose fiscal and monetary policies may help to drive secondary inflation. Political pressure from monetary easing often leads to a strong and sustained increase in inflation and inflation expectations. This early easing may trigger a disanchoring of inflation expectations, lifting the inflation center, and signaling the end of the era of low interest rates.

Therefore, the arrival of higher interest rates and the end of "cheap money" may favor assets that can generate stable cash flow or have higher asset quality. Value stocks, as well as small-cap growth stocks, may have greater opportunities.

As for US bonds, although the issuance of short-term bonds may be coming to an end, the issuance of long-term bonds may still be biased towards more supply. Historical data also shows that if there is a rate cut without quantitative easing (QE), most 10-year US bond yields tend to rebound after the rate cut. Therefore, US bond yields may experience wide fluctuations this year, with 10-year bond yields fluctuating in the range of 3.8% to 4.3%.

Assuming there is no major financial risk, after a rate cut, US bond yields may show a trend reversal upwards.

Currently, hedge funds are key providers of liquidity for US bonds, and basis trading is a potential threat to and amplifier of bond market liquidity volatility, which could lead to liquidity crises or even systemic financial risks. The best way to prevent a crisis is to end balance sheet reduction in advance.

Comments