Federal Reserve Chairman Jerome Powell doused hopes of a March rate cut as strong economic data reinforced the view that the Fed is not ready to declare victory over inflation. On the data front, the US ISM non-manufacturing index for January this year was 53.4, beating market expectations and the largest increase in a year, further reducing the possibility of the Federal Reserve to cut interest rates in March.

On the political and economic front, Fed Chairman Jerome Powell said policy makers may wait until after March to cut interest rates, officials want to see more data to ensure that inflation is sustainable to achieve the 2% target, and any signs of weakness in the U.S. labor market or clear lower inflation will prompt the FOMC to act faster. Powell hinted that the first rate cut this year could come around the middle of the year and expects three rate cuts this year.

As the world races to develop AI, the Semiconductor Industry Association (SIA) predicts that the global chip industry is expected to rebound sharply this year due to increased demand for electronic components in various industries, forecasting that sales will grow 13% this year to reach nearly $600 billion.

Former U.S. President Donald Trump, the front-runner for the Republican presidential nomination, said he would consider imposing tariffs of 60 percent or more on Chinese goods across the board if he is re-elected in November.

Tesla shares closed down 3.65 percent on Monday after German software company SAP plans to stop buying electric vehicles from Tesla and financial firm Piper Sandler cut its price target due to lower delivery expectations for the automaker this year. Options transaction shows the advance placement of large put options orders on Friday$TSLA 20240308 150.0 PUT$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Amazon.com(AMZN)$ Sell PUT option $AMZN 20240719 145.0 PUT$

Option buyer open position (Single leg)

Buy TOP T/O:

$GOOG 20250620 145.0 CALL$ $HUM 20240209 410.0 PUT$

Buy TOP Vol:

$XP 20240301 22.0 PUT$ $ARMK 20240315 29.0 PUT$

Option seller open position (Single leg)

Sell TOP T/O:

$ARM 20260116 65.0 CALL$ $AMZN 20240719 145.0 PUT$

Sell TOP Vol:

$CCJ 20240216 43.0 PUT$ $BMBL 20240308 10.5 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

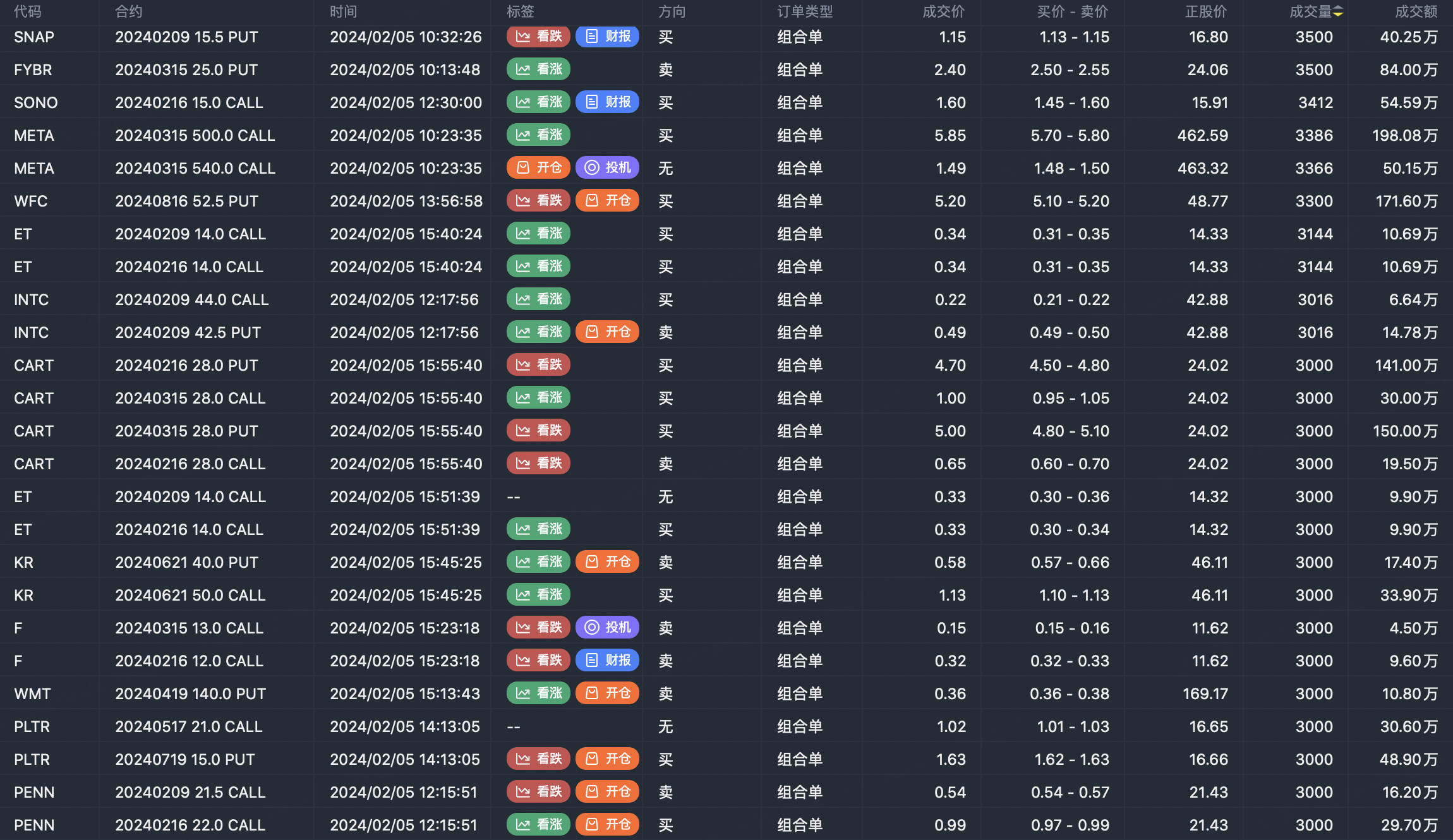

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?