Big-Tech’s Performance

As the Nasdaq hits new highs, the risk sentiment for tech stocks has risen again. In addition to growth stocks that have seen significant fluctuations due to earnings reports and digital currency, big tech companies are also trading at high levels.

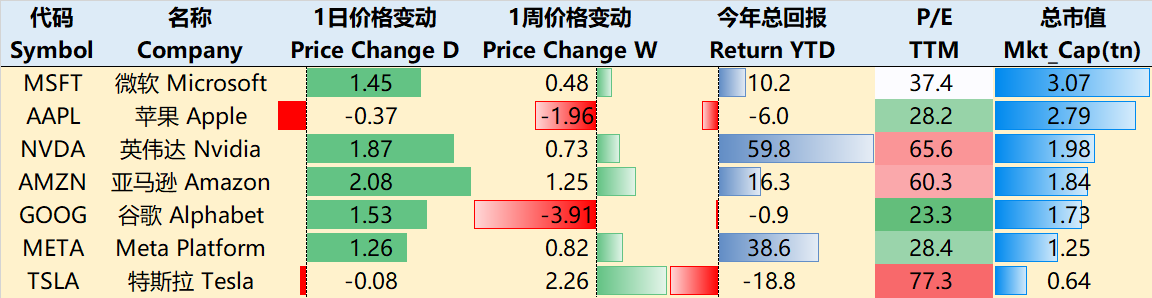

As of the close on February 29th, the best performing big tech companies in the past week were $Tesla Motors(TSLA)$ +2.26%, followed by $Amazon.com(AMZN)$ +1.25%, $Meta Platforms, Inc.(META)$ +0.82%, $NVIDIA Corp(NVDA)$ +0.73%, $Microsoft(MSFT)$ +0.48%, $Apple(AAPL)$ -1.96%, and $Alphabet(GOOGL)$ -3.91%.

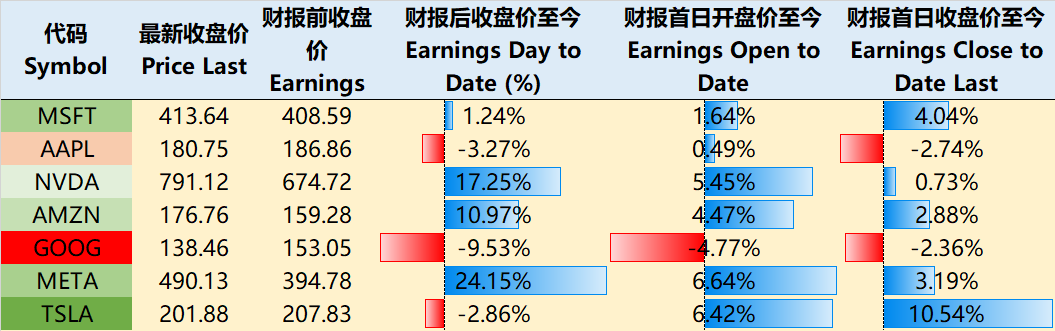

During the recent earnings season, the performance of the seven major tech stocks was as follows:

Big-Tech’s Key Strategy

What has Apple given up and what does it want to create?

During this earnings season, it's clear that Google and Apple have fallen behind. Google has been overshadowed by ChatGPT, and even with only a six-month difference, Gemini will take several years to catch up. With OpenAI launching GPT4.5 "at any time," it's understandable that investors are concerned.

Meanwhile, hardware giant Apple is also facing anxiety. Not only did it underperform its peers after the earnings report, but its performance has also been far below the market since the second half of last year, despite continuous buybacks by the company.

Three major events have recently surrounded Apple:

1. The cessation of its car manufacturing project after many years, with resources shifting toward AI.

2. iPhones are still not selling well in China (without significant price increases).

3. There has been a significant slowdown in demand for Vision Pro in the U.S. market.

Apple's difficulties in entering the electric car market are threefold:

1. Slowing demand for electric cars and increased competition within the industry.

2. The capital-intensive, technologically complex, and fiercely competitive nature of the industry may not yield sufficient returns to offset its risks and challenges.

3. The challenge of establishing sales and service networks, as the channels for consumer electronics products differ from those for automobiles.

However, entering the field of AI, whether late or not, is the right decision at present.

1. Focusing on software development rather than directly manufacturing cars, leveraging its strengths in software and interface design to create value for car users. Any car manufacturer's CarPlay would eagerly embrace an integrated system that connects directly to the iPhone.

2. Shifting focus from car manufacturing to high-growth areas such as generative AI aligns with the long-term interests of the company.

Moreover, with Apple's attitude of "making a splash" with new products, abandoning the possibility of an "outstanding" car, and turning to generative AI, it is even more likely to produce disruptive products. However, it is also important to note that large companies also have the drawback of being "difficult to turn around."

Looking at the overall shareholder return, cutting the car-making business will further reduce expenses. Of course, investment in AI is inevitable, so as long as the company maintains its current profit margin, the return to shareholders should not decrease.

Investors like Buffett, who are heavily invested in Apple, did not mention Apple much in this year's shareholder letter. For a heavily weighted stock that makes up half of the portfolio, it is not so easy to "walk away." Although he did not list Apple as a "long-term investment," Apple's current focus on doing what it does best aligns with Buffett's philosophy.

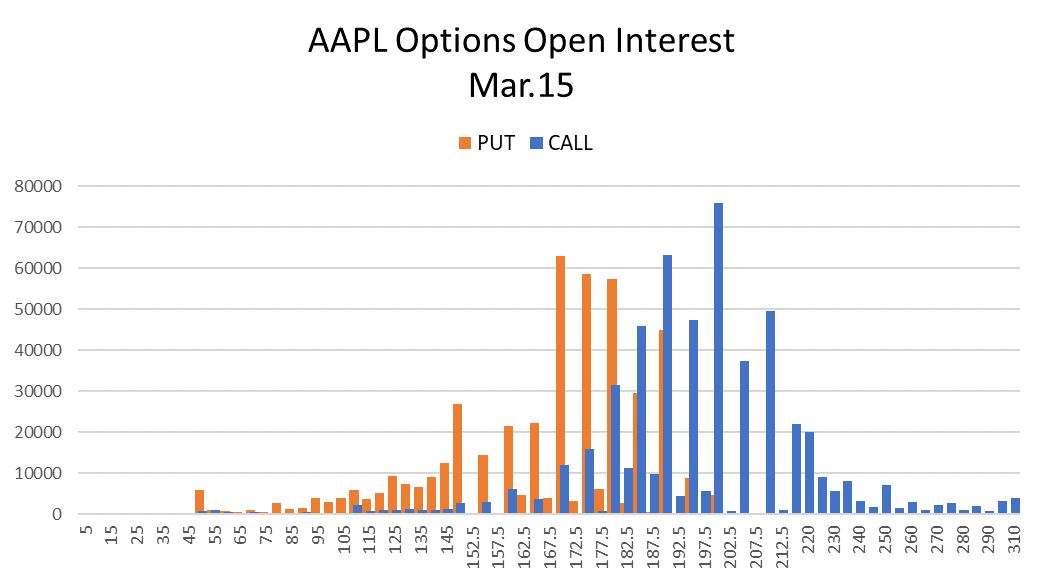

Big-Tech Weekly Options Watch

The volume and open interest of options trading before and after Apple's financial report did not change significantly. Looking at the monthly options expiring on March 15th, the PUT volume is relatively more concentrated than CALL, and there are more open PUTs in-the-money. In the short term, investors who believe that there will be limited upside also have a significant presence in Covered Call strategies.

Big-Tech Portfolio

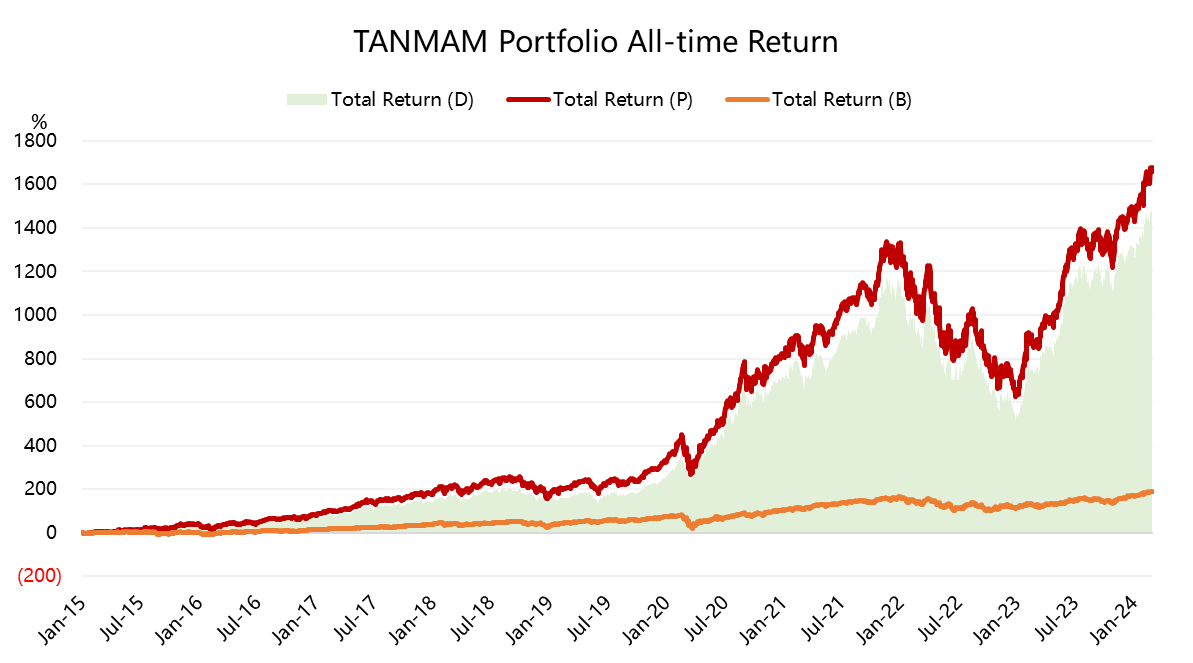

The "Magnificent Seven" form an investment portfolio ("TANMAMG" portfolio) with equal weights and quarterly rebalancing. The backtested results since 2015 have far outperformed the S&P 500, with a total return of 1677.92%, compared to $SPDR S&P 500 ETF Trust(SPY)$ 190.76%, both reaching new highs.

The year-to-date return is 12.39%, surpassing SPY's 6.89%.

The portfolio's Sharpe ratio for this year is 4.2, compared to SPY's 3.9, and the portfolio's information ratio is 2.5

Comments

$Apple(AAPL)$ My target $187 The bullish divergences in MACD/RSI and the thoughts I posted earlier about Apple and AI make me think this breaks to the upside of this triangle pattern.