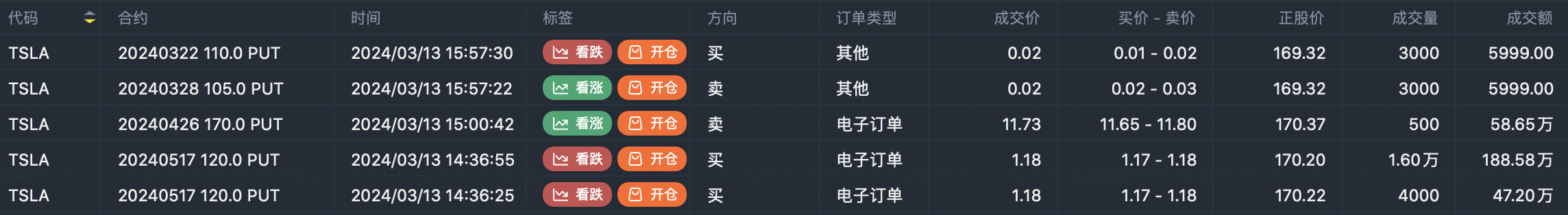

$Tesla Motors(TSLA)$ was downgraded to "underweight" by Wells Fargo Bank, dragging Tesla shares down 4.5% so far this year, Tesla shares have fallen 31.8%. Wells Fargo analyst Colin Langan said Tesla's growth in its core markets has slowed, calling Tesla a "growth company without growth," noting that sales in the second half of 2023 were up just 3 percent from the first half, while prices fell 5 percent. Tesla's sales are expected to be flat this year and decline in 2025, which downgraded the stock to "underweight" and slashed its price target to $120 from $200. Option transactions show that PUT options with a strike price of 120 were heavily bought with a total turnover of more than 20,000 lots of $TSLA 20240517 120.0 PUT$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Meta Platforms, Inc.(META)$ buy put options $META 20240322 487.5 PUT$

$Tesla Motors(TSLA)$ buy put options $TSLA 20240517 120.0 PUT$

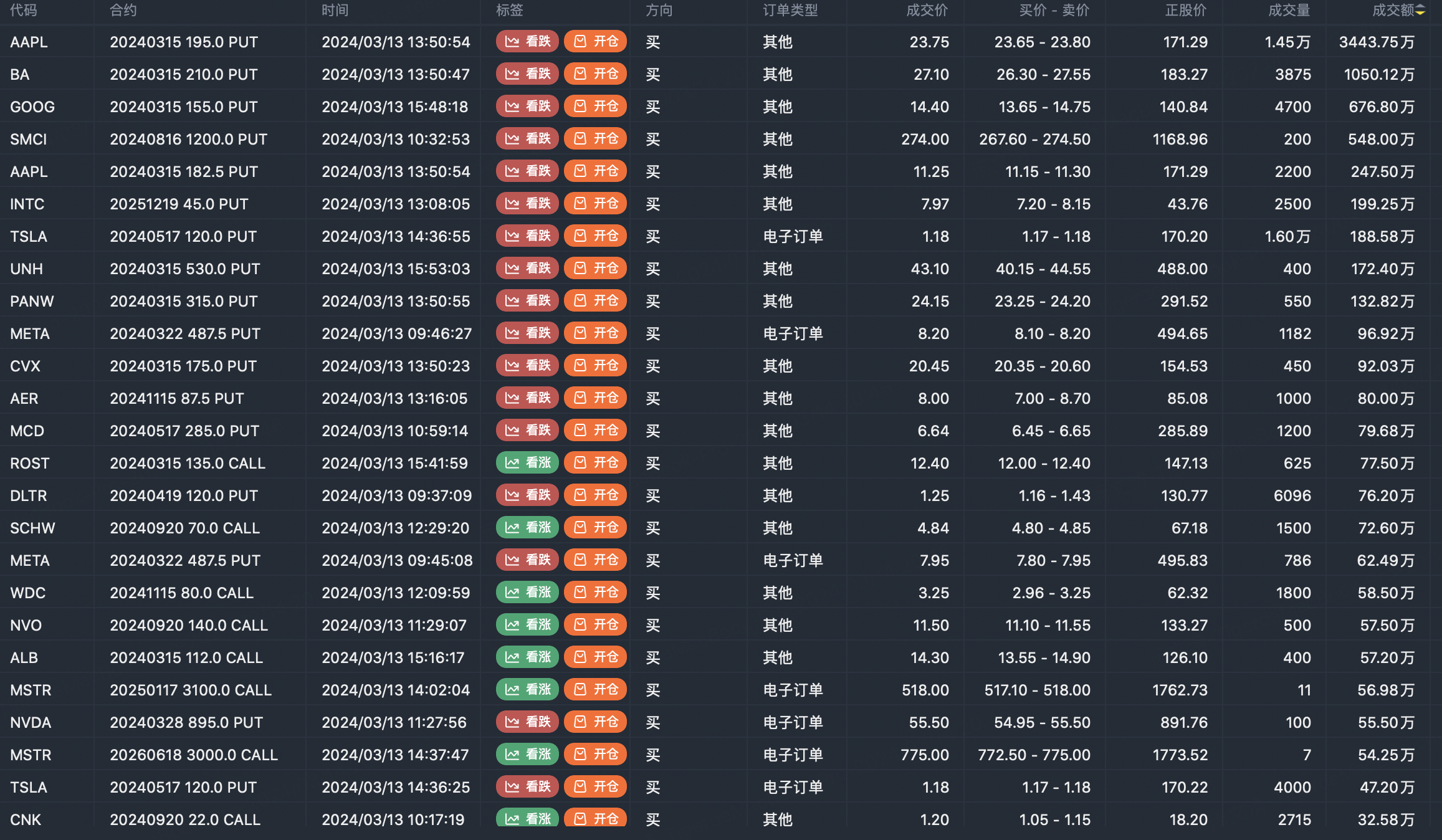

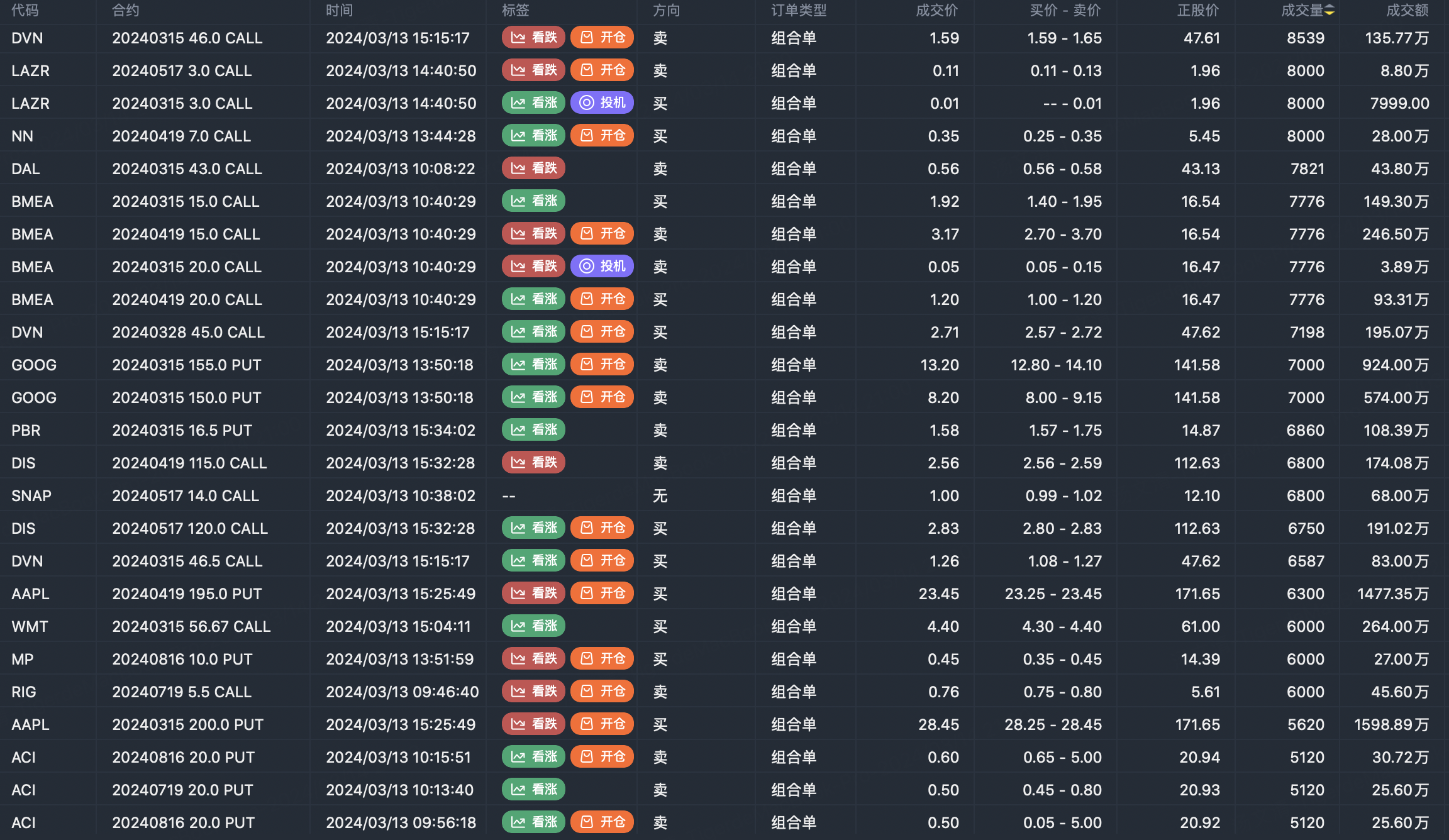

Option buyer open position (Single leg)

Buy TOP T/O:

$AAPL 20240315 195.0 PUT$ $BA 20240315 210.0 PUT$

Buy TOP Vol:

$TSLA 20240517 120.0 PUT$ $AAPL 20240315 195.0 PUT$

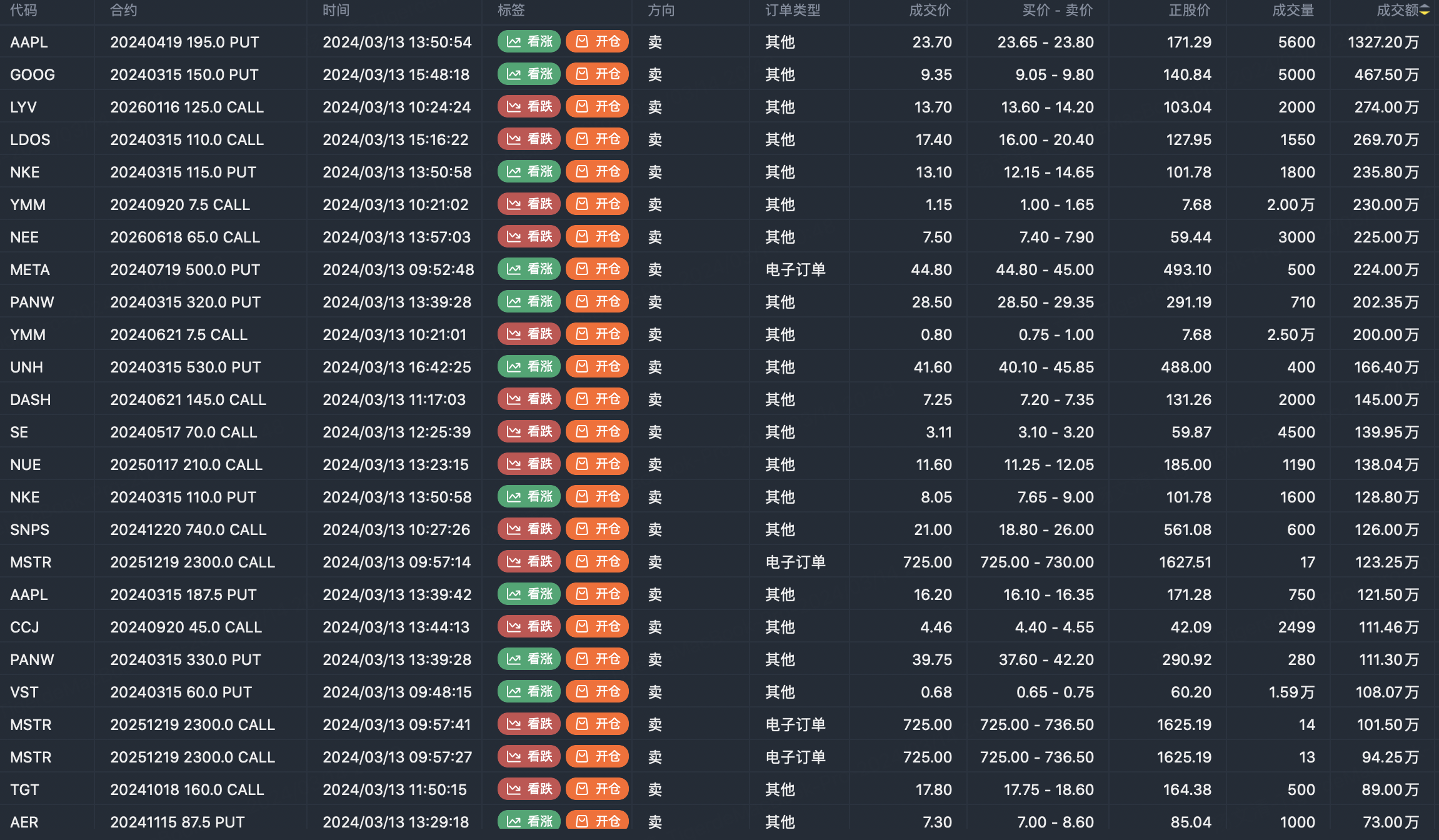

Option seller open position (Single leg)

Sell TOP T/O:

$AAPL 20240419 195.0 PUT$ $GOOG 20240315 150.0 PUT$

Sell TOP Vol:

$YMM 20240621 7.5 CALL$ $VST 20240315 60.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

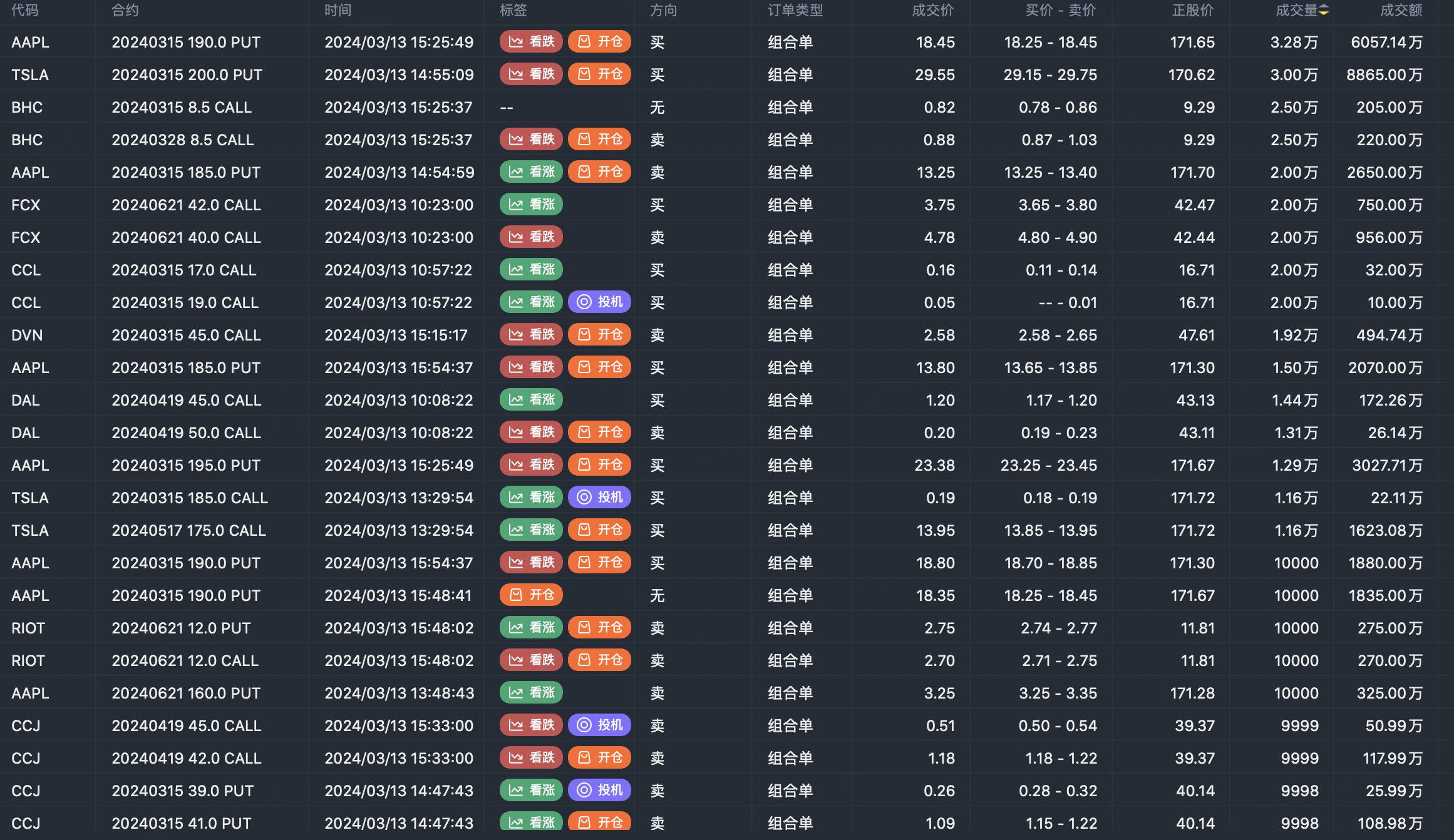

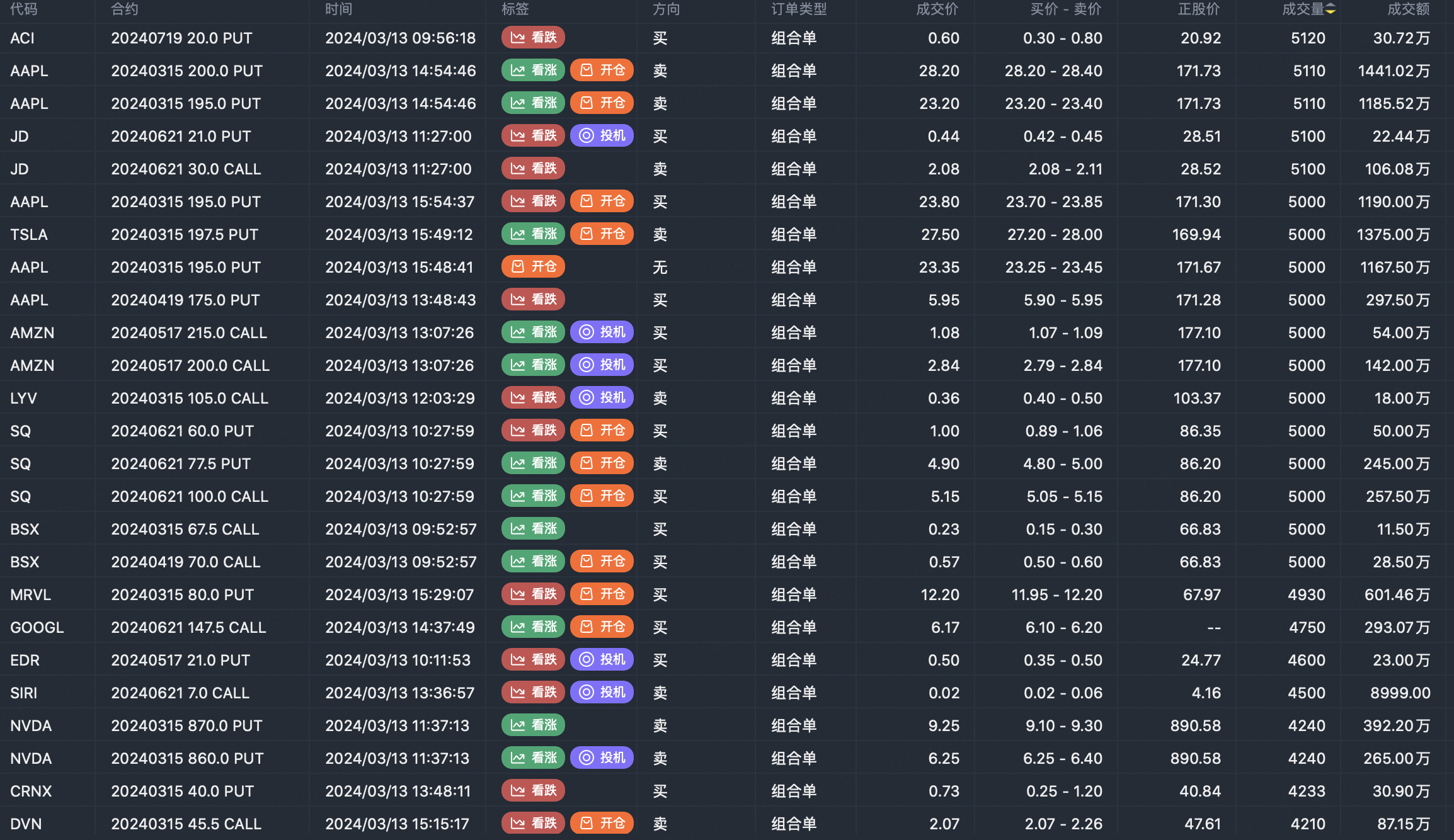

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Comments