At 20:30 Beijing time on Thursday, March 14th, the US Department of Labor released the PPI data for February, which exceeded expectations in terms of year-on-year, month-on-month and core PPI year-on-year data. Relaying the previous CPI data, it further continued to imply the stubbornness of inflation.

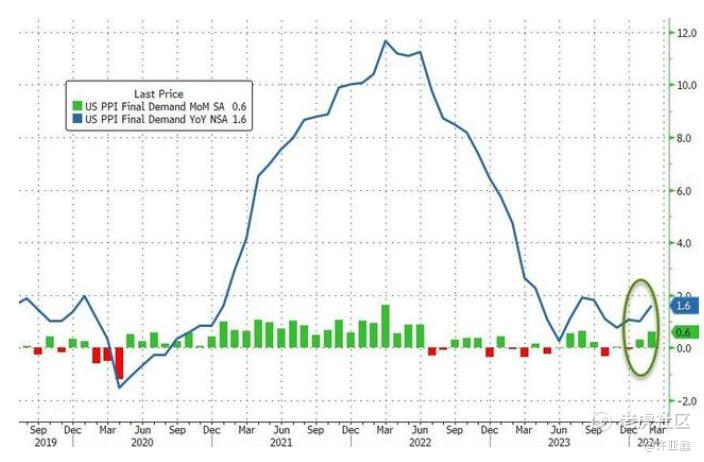

Data show that the PPI of the United States warmed up beyond expectations in February, rising by 1.6% year-on-year, and the previous value was 1.2%.Far exceeding the expected 0.9%; PPI accelerated by 0.6% month-on-month,It is twice the expected value,The previous value is 0.3%.

The core PPI excluding food and energy prices increased by 2% year-on-year, which was the same as the previous value.Exceeding expectations by 1.9%;The core PPI rose by 0.3% month-on-month, which was less than the expected 0.5%, but accelerated from 0.2% last month.

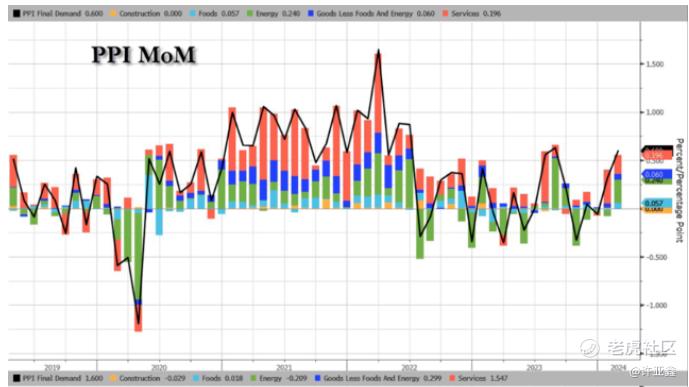

As shown in the above figure, as far as the sub-item price index is concerned, High energy prices are the main reason for the unexpected rebound of PPI in February,Its price index rose by 4.4% month-on-month, contributing about 70% increase in commodity PPI in February.

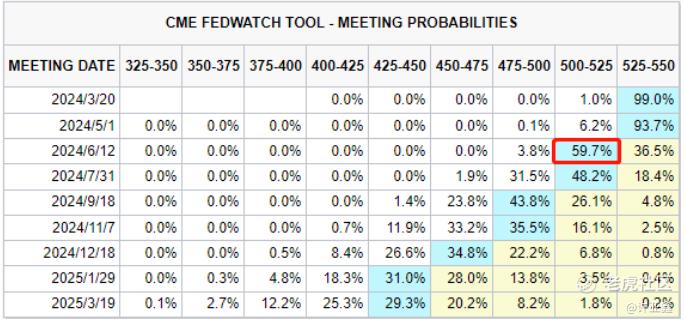

As the Federal Reserve will announce its interest rate resolution in March next week, tonight's PPI data is also the last set of inflation data before the interest rate meeting. Federal Reserve Chairman Powell said earlier that although the Federal Reserve may cut interest rates this year, it will not do so until there is more evidence that inflation does fall back to its target level of 2%.

Obviously, from Tuesday's CPI to Thursday's PPI, there is no support for the Fed to take action at the March interest rate meeting, which means that,At the meeting on interest rates in March, there is a high probability that it will stay put.

According to CME group FedWatch tool, traders in the federal funds futures market predicted that the probability of FOMC cutting interest rates in June was 59.7%, compared with 58.2% before PPI data was released.

After the PPI data of the United States was released, the US Dollar Index once again rushed to 103 after the opening of North America with the help of the data, which was exactly the same as the expected trend given above, and the price of gold also hit a time low of $2,157/oz.

Operationally, I reminded everyone to pay attention to the auction results of 30-year US debt at 1 am.

Although the final auction result of US debt is different from what we thought in advance, it is correct to run in operation, because the overnight high point happens to appear on the daily K-line at 1 am, that is, $2,179.80/oz.

If the price of gold can't refresh the support area of 2150-55 USD/oz tonight, it means that the hourly level will form a new sub-low, then the price of gold will enter the rebound rhythm again, and the possibility of refreshing high cannot be ruled out.

Tomorrow will be "the, and big fluctuations will hit. Are you ready? !

$NQ100 Index Main Connection 2312 (NQmain) $$SP500 Index Main Connection 2312 (ESmain) $$Dow Jones Main Connection 2312 (YMmain) $$Gold Main Connection 2312 (GCmain) $$A50 Index Main Connection 2403 (CNmain) $

Comments