Big-Tech’s Performance

The curtain falls on Q1 2024, with strong tech stocks leading the S&P 500 and Nasdaq 100 to new highs. Two concepts are leading the way: AI and digital currency, both with certain performance supports and benefiting from a decline in risk premiums.

Big tech companies are also showing a bifurcation, with NVDA performing the strongest in Q1, surging 82.6%, and TSLA being the worst performer, pulling back 29.3%.

As of the close on March 28th, over the past week, the best performers among big tech companies were $Alphabet(GOOGL)$ $Alphabet(GOOG)$ +2.26%, $Amazon.com(AMZN)$ +1.25%, $Tesla Motors(TSLA)$ +1.72%, $Apple(AAPL)$ +0.06%, $NVIDIA Corp(NVDA)$ -1.18%, $Microsoft(MSFT)$ -2.01%, $Meta Platforms, Inc.(META)$ -4.37%.

Big-Tech’s Key Strategy

Undercurrents in Tesla trading

Although it has been the worst performer among big tech companies since the beginning of the year and has fallen out of the "Big Seven", Tesla still has:

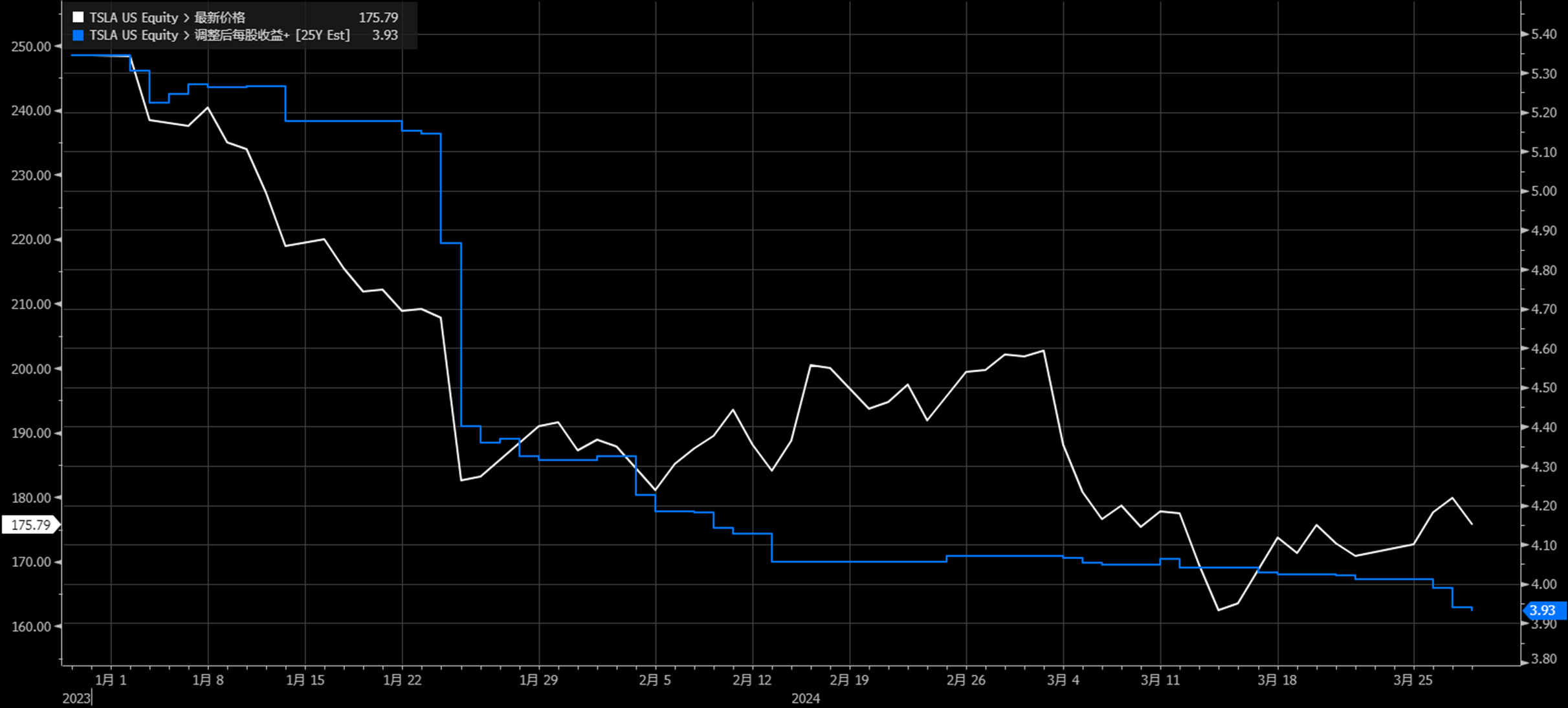

A weak Chinese market, with a Q1 delivery volume of 457,000, lower than the previously expected 494,000 units. Wall Street's consensus forecast has been continuously lowered since the beginning of the year, especially with intensive reductions in March, and the reduction in the second half of March was substantial.

The market has also started to lower its performance expectations for 2025, making the forward P/E ratio appear increasingly high, and investors may feel overvalued.

However, Tesla's bulls never give up, such as Cathie Wood's Ark Fund, which bought 270,000 shares of Tesla this week.

In the absence of hotspots in other tech companies, the undercurrents of investor speculation in Tesla are surging again.

The IV of options on April 19th has been rising over the past week, and the current IV percentage has reached 85% (exceeding 85% of the time over the past year);

The Realized Volatility of 3 months is continuously rising, and the Implied Volatility is at a relatively higher position compared to RV.

One of the reasons is that April will officially announce deliveries, and a financial report will be coming up. More importantly, Tesla's stock price is currently at a position where it could go up or down, so investors expect there may be a "staircase" change in the next month.

Big-Tech Weekly Options Watch

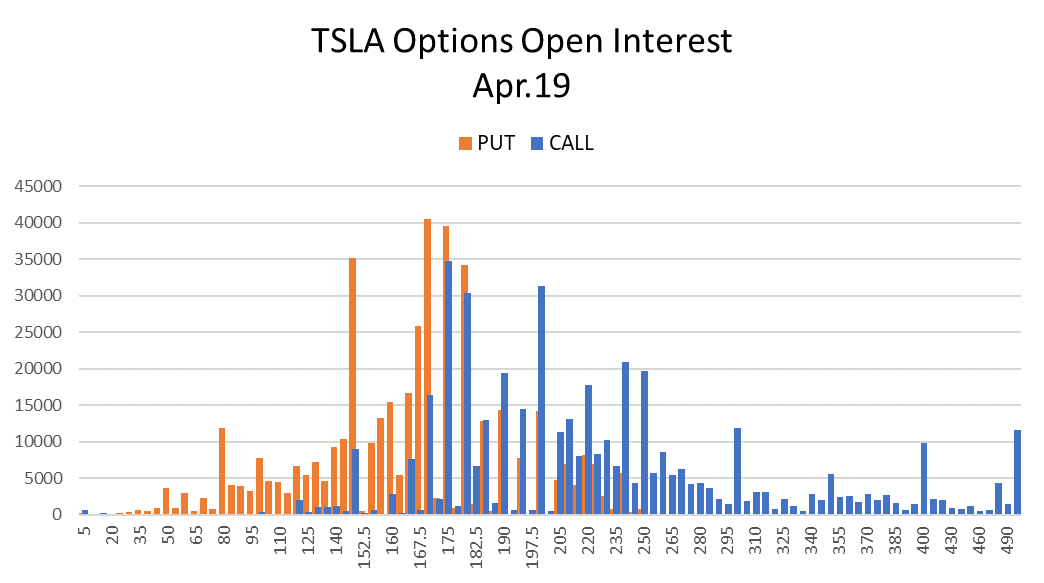

This week, due to one less trading day and the end of the quarter, there will not be much volatility. The performance of Tesla's options is beginning to reveal more and more risk sentiments.

The IV for the week of the April 19th earnings report is rising, and the number of unexpired options being bet on is also rising. The skewness is also at -0.58, with PUT trades still more popular. 140 is an important position for PUT, but it also means that there are not a few people willing to take the plate at this point. CALL, on the other hand, is more scattered, with plenty of speculative orders still at 200-250.

Big-Tech Portfolio

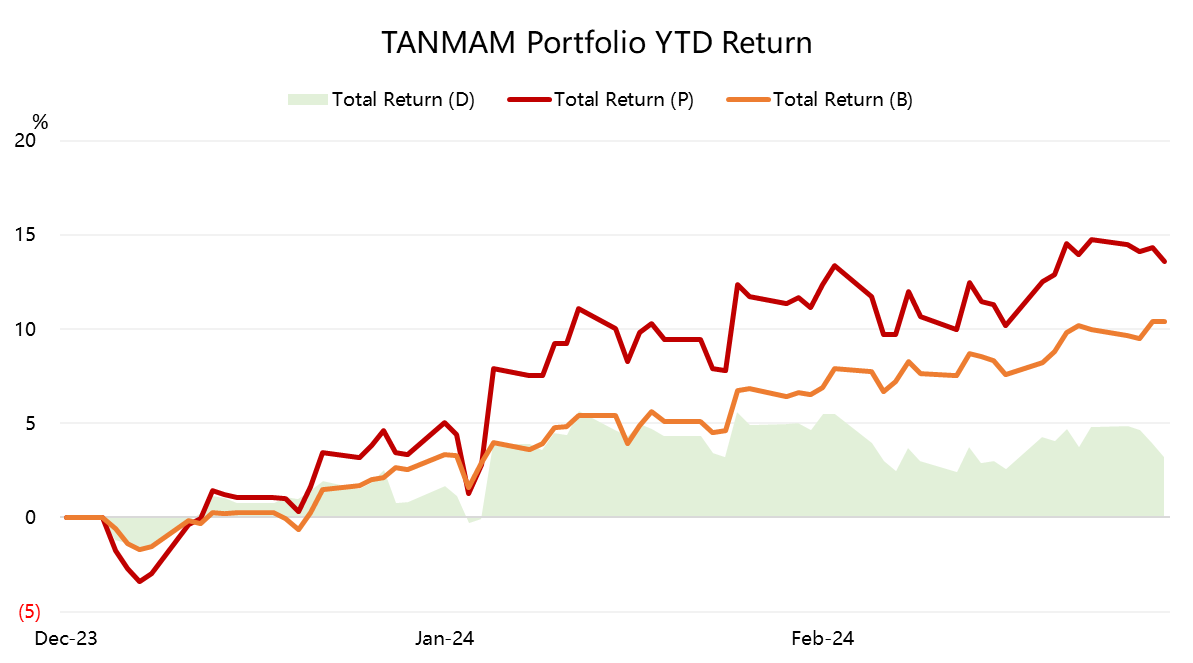

The Magnificent Seven form an investment portfolio (the "TANMAMG" combination), with equal weights and weights readjusted every quarter. Backtesting results since 2015 have far outperformed the S&P 500, with a total return of 1697.4%, compared to SPY's return of 200.27%, continuing to hit new highs.

The return since the beginning of the year has been 13.63%, exceeding SPY's 10.39%. The performance at the end of this week's quarter was stable.

The Sharpe ratio of the portfolio over the past year was 3.13, while SPY's was 2.57, and the portfolio's information ratio was 2.05.

Comments