$Destiny Tech100 Inc(DXYZ)$ is a closed-end fund, with an initial listing price of $8.25, soaring to over $100 in just 9 days, closing at $99.75. And post-trade on April 10, it surged another 16%.

There's a reason for all the frenzy, this closed-end fund is composed of 100 top private tech companies, including $Tesla Motors(TSLA)$ Elon Musk's SpaceX, $Apple(AAPL)$ competitor EpicGame, and the current hottest ChatGPT's parent company OpenAI $Microsoft(MSFT)$ .

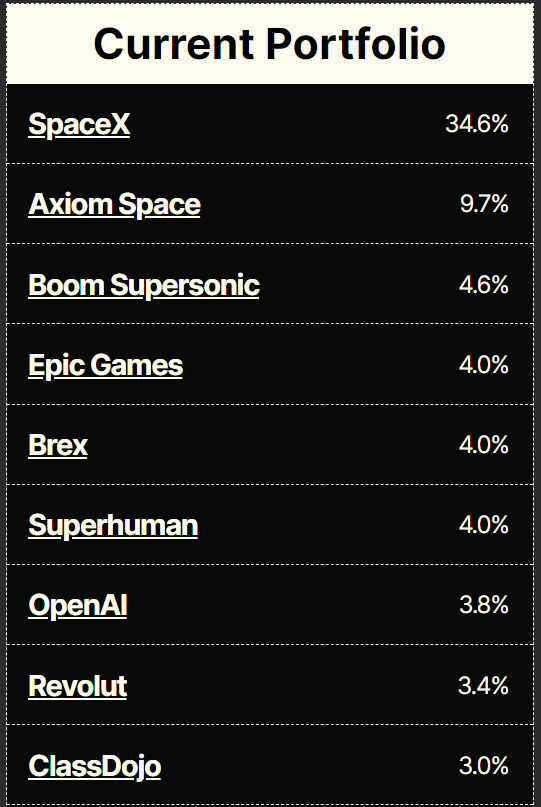

The main holdings are as follows, with SpaceX accounting for over a third of the portfolio at 34.6%. So buying this CEF is equivalent to buying a high percentage of SpaceX.

It is even more weighted than $ARK Space Exploration & Innovation ETF(ARKX)$ by Cathie Wood.

Why such dramatic surge?

Generally, closed-end funds typically do not have large fluctuations, not because of good liquidity, but precisely because of poor liquidity, investors are unwilling to buy.

Therefore, as long as there's a hot topic, instantly attracting more investors, there's a possibility of speculation leading to increased trading volume and price volatility.

Also, the fund's shares are fixed and limited, unlike regular companies that can simply issue more shares, so there are limitations on the supply.

In addition, these private companies, the underlying assets of DXYZ, are difficult to determine in price because they do not trade publicly on the secondary market like stocks that are valued 'at market price' daily.

Their value is essentially determined by the price at which the buying and selling sides in the market are willing to pay for the closed-end fund stock.

Is the current price reasonable?

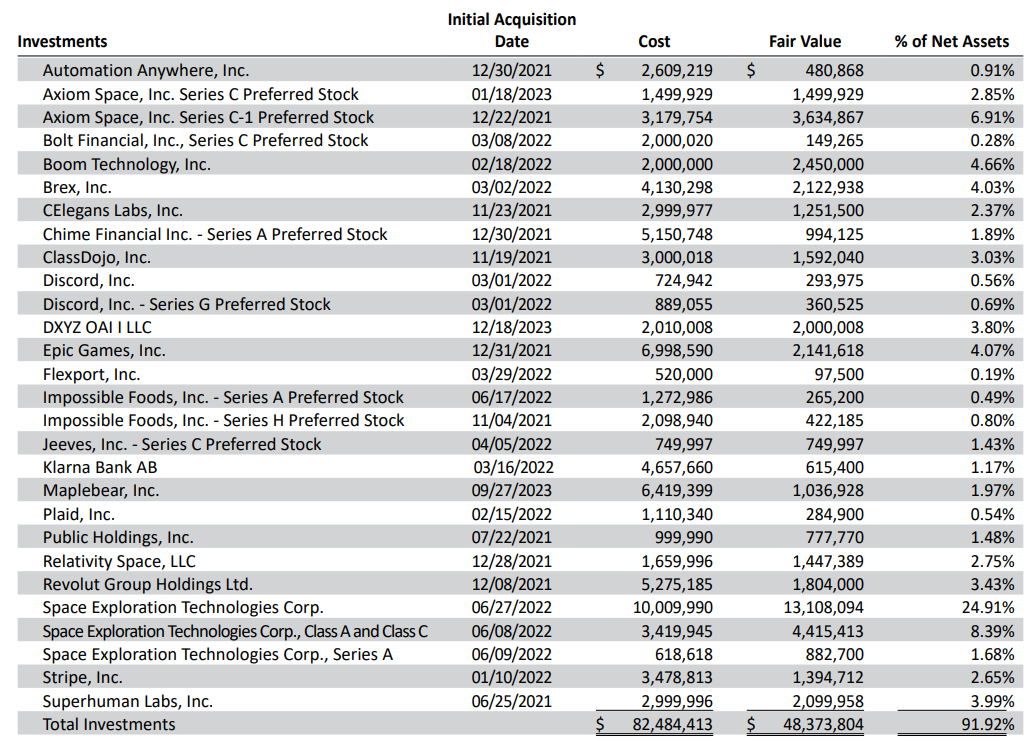

According to the fund's annual report, as of December 31, 2023, total assets are $53,461,960, which is $53 million. The fair value of these investments in unlisted companies is $48.37 million.

And based on the closing price of April 8, it is $1.0857 billion, which is a 21 times premium.

Even if star companies like SpaceX and OpenAI triple their valuations this year, they can't justify this premium.

At the same time, the company has a high management fee of 2.5%, if the fair value does not increase more than this annually, fund investors will also suffer losses.

The trading of this stock is a bit like the days of $GameStop(GME)$ not necessarily matching its value, but investors' enthusiasm is unceasing, they keep coming. Since closed-end funds do not have options or other derivatives backing them, short-term fluctuations may still be significant.

Comments