The biggest event of the weekend was Iran's attack on Israel. I don't know if you have noticed that many incidents this year tend to happen on weekends, as agreed.

If this attack occurs in the middle of the week, I am afraid that financial Market fluctuations are definitely not small. And if it happens on the weekend, there is enough time for countries to appease market sentiment. I believe that when the market opens on Monday, the financial market will be much more rational.

Looking back at Iran's attack on Israel, in fact, Iran is also well-known. After all, Israel first attacked the Iranian embassy in Syria, and then it attracted Iran's counterattack. We do not agree with military retaliation, but Iran's attack on Israel is generally expected.

Inside the incident, and after the attack, Iran said that the retaliation is over. As long as Israel does not "return it", basically this incident has come to an end, and the sentiment of the financial market will ease a lot. Just look at the development of the situation, there is no need to chase the incident too much.

Impact on the precious metals market

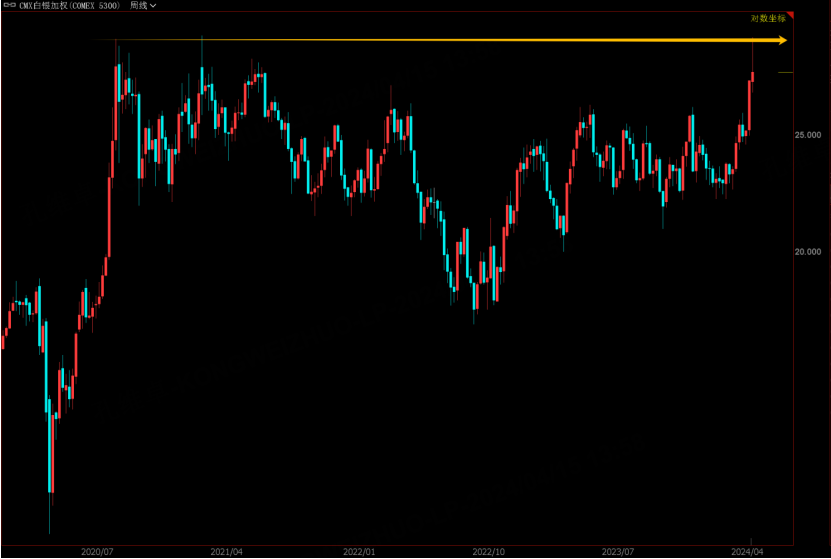

The huge shock in gold prices on Friday night was affected by the Iran attack. It first rose rapidly and then fell sharply. It was very consistent with the news over the weekend. It attacked quickly first, and then all parties stated that the attack was over. Therefore, it is estimated that the opening of the precious metals market next week will not be very violent, and then it will depend on the wording and actual actions of the Israeli side.

If it "fight" back. It is difficult for the precious metals market to fall. If there is no With any practical actions, the price of gold may usher in a short-term rapid adjustment.

I had emphasized to everyone that technically, the 5-day moving average must be used as the judgment benchmark for this kind of squeeze market. If the short squeeze market continues, the price will not fall below the 5-day line. If it falls below the 5-day line It means that the short-term rapid market is over and will usher in a relatively large adjustment.

The current gold price is already on the edge of the 5-day moving average. It depends on whether the 5-day moving average can be held on Monday. If it is held, it will continue to rise in the future, as shown in Figure 1 (Russia-Ukraine conflict in 2022). If it cannot be held, as shown in Figure 2 (Gold price stage peaked), friends who are bullish or bearish must be mentally prepared for the current large fluctuations.

For silver, the short-term direction is consistent with that of gold, and the adjustment of gold prices to silver is not much better. Moreover, silver just reached the key price of 30 US dollars per ounce and then pullback/retracement, which is very technical. If it is adjusted sharply, it will be a good opportunity to buy bottoms. Friends who are long may wish to wait a little longer. Anyway, the decline is in place before intervening, and the safety factor is also high. much.

$NQ100 Index Main 2406 (NQmain) $$Dow Jones Main 2406 (YMmain) $$SP500 Index Main 2406 (ESmain) $$Gold Main Company 2406 (GCmain) $$WTI Crude Oil Main Company 2405 (CLmain) $

Comments