In summary: Tesla's stock price is likely to settle around $160 this week, but there is a small probability of a gamma squeeze on call options, pushing the price up to $170.

After its earnings report, $Tesla Motors(TSLA)$ rebounded 11%, essentially just recouping last week's losses. Apart from "killing" the shorts, there seems to be no other substantial impact - it was just noise.

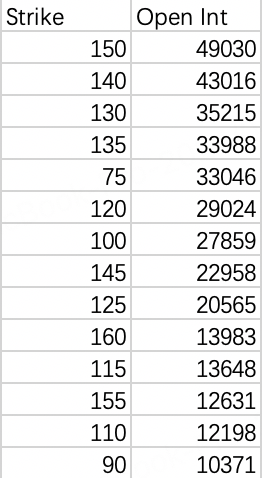

The short-sellers were hit hard, with the effect being significant. The top 9 out-of-the-money put options expiring this week were essentially all buried, expiring worthless. Listed from low to high strike prices, the put options with open interest above 10,000 contracts had strikes at: 150, 140, 130, 135, 75, 120, 100, 145, 125, 160, 115, 155, 110, and 90.

The distribution of strike prices is discontinuous. Even if the stock price breaks below $160, there is no need to worry about a reverse gamma squeeze. The price would likely just oscillate around $160, so there is no need to consider shorting.

Since a large amount of option trading was focused on the earnings week, next week's open interest data will be an order of magnitude lower than this week's. It will likely follow this week's inertial trend. So, future strategies can be a continuation of this week's: hold bullish positions or sell puts.

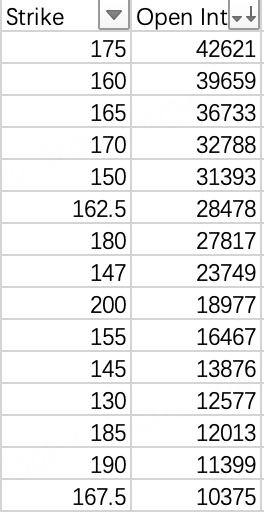

The call option side is relatively more interesting. The highest out-of-the-money call strike this week is $175, followed by 160, 165, 170, 150...

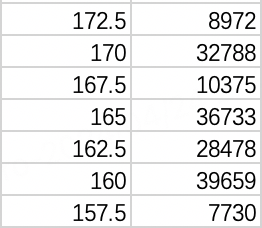

According to market maker theory, if the stock settles at $160 this week, it can kill off most call and put option positions. However, it's noteworthy that the open interest data between $160 and $170 still shows potential upside momentum, with open interest above 20,000 contracts for essentially every strike price.

Specifically, if the stock price approaches $162.5 before 2 PM on Friday, a further push to $170 is possible, presenting an opportunity for option gamma. But if the stock price remains hovering around $160 on Friday, with obvious upside resistance, you can just go to sleep.

In summary, while Tesla's stock price is likely to end the week around $160, there is a small probability of a forced gamma squeeze, with option volatility between $160 and $170 potentially becoming extreme.

Comments

Gamma squeeze? Admin probably lost alot of money betting on GME/AMC last time

Great article, would you like to share it?