What happens to $Tesla Motors(TSLA)$ the other day, is gonna happen to $Apple(AAPL)$ .

As the Q1 financial report was officially released, the excessive pessimism previously held by the market towards TSLA has been alleviated. TSLA's stock price soared from a low of just $140 to over $190, rebounding by more than 35% in just four days.

The gross margin is not as pessimistic as the market had estimated, and Musk's cost management remains reliable;

Actions such as layoffs to reduce operating expenses have also begun, and there is hope for an improvement in profit margins;

The further advancement of FSD, with price increases in the North American region, and this is a business with a higher profit margin.

These listed movements are tantamount to declaring war on short sellers.

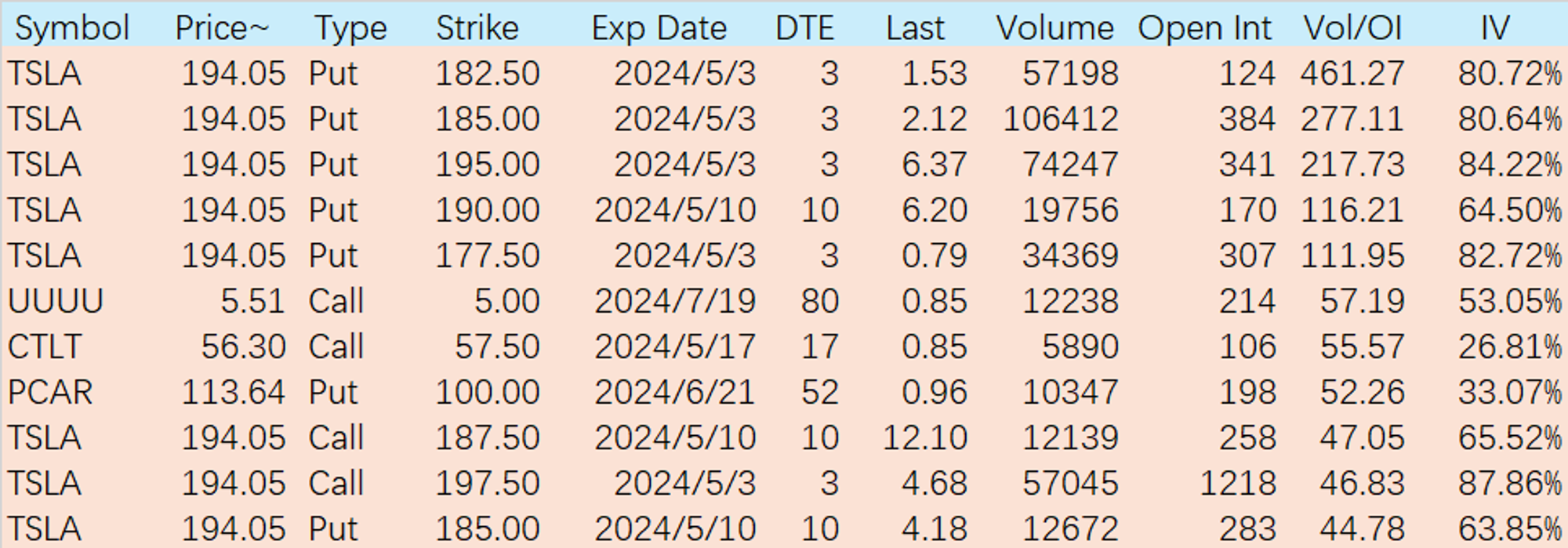

April 29th, options for TSLA above 180 started to go wild, and short sellers (long PUT side) who had previously planned to hold on and fight for time, were scrambling to close their positions.

On the other hand, AAPL, another giant previously affected by pessimistic sentiment, has also seen some changes recently. With the financial report due to be released on May 2nd, short sellers have started to pull back in advance, leading to an early rebound.

Since Apple is holding a special event on May 7th, and so far no one knows what they have up their sleeve, short sellers are also relatively conservative.

Bernstein also upgraded its rating on April 29th, and the report is expected to be released. In pre-market trading, the stock price rose by 2%.

Due to the weak iPhone 15 cycle and concerns about the structural damage to Apple's business in China, AAPL's rating has dropped significantly. Bernstein believes that the weakness in the Chinese market is more cyclical than structural, and has noticed that historically, Apple's business in China, due to its highly sensitive functional base, has been much more volatile than Apple as a whole.

This rating also coincides with Musk's surprise visit to China.

It's possible that in the near future, if Cook visits China again, it might bring some surprises?

Image

Comments