Traders are looking for more clues on whether the Fed could start cutting rates. After a pullback in April, stocks have rebounded recently on renewed hopes for Fed rate cuts this year, with corporate earnings for the first quarter also providing some optimism so far.

Options market data suggested the S&P 500 ETF may have topped out around 520, with any pullback limited to less than 4.8%. For QQQ, downside expectations continued to be tempered, with a decline of less than 2.2% priced in by June 21 expiration. Small-cap Russell 2000 looked to have topped as well, with expectations for the index to trade below 208 by mid-May.

Details:

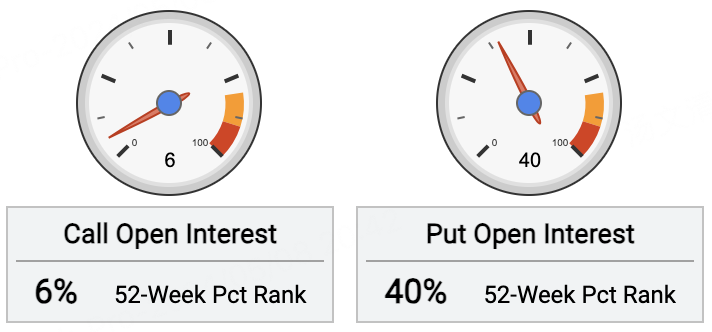

The $SPDR S&P 500 ETF Trust(SPY)$ options overall reflected a bearish trading sentiment, with sellers of put options dominating. Open call interest declined -0.8% over the past 5 days. Open put contracts increased 11.9% over the same period.

For call options, investors sold the most $SPY 20240517 520.0 CALL$ with a 520 strike, adding 16,000 contracts. This implies expectations for the S&P 500 ETF to trade below 520 by May 17 expiration.

The most sold put option was the $SPY 20240719 492.0 PUT$ with a 492 strike, adding 13,000 contracts. This suggests expectations for a decline of less than 4.8% in the S&P 500 ETF by July 19 expiration.

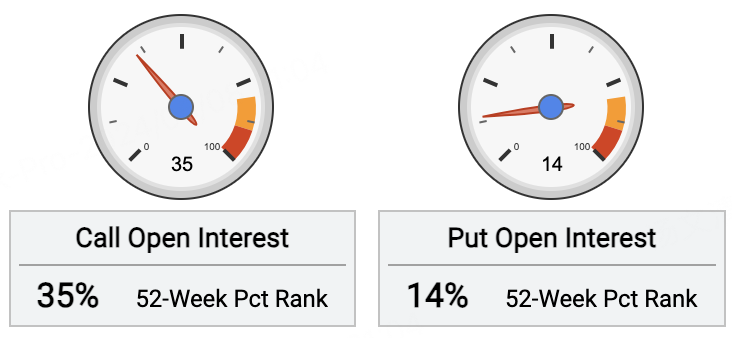

The $Invesco QQQ(QQQ)$ options overall showed a bullish trading sentiment, with sellers of put options dominating. Open call interest increased 1.7% over the past 5 days. Open put contracts grew 3.9% over the same period.

For call options, the most actively traded was the $QQQ 20240621 420.0 CALL$ with a 420 strike, adding 7,070 contracts.

For put options, investors sold the most new $QQQ 20240621 430.0 PUT$ with a 430 strike, adding 12,000 contracts. This implies expectations for a decline of less than 2.2% in QQQ by June 21 expiration.

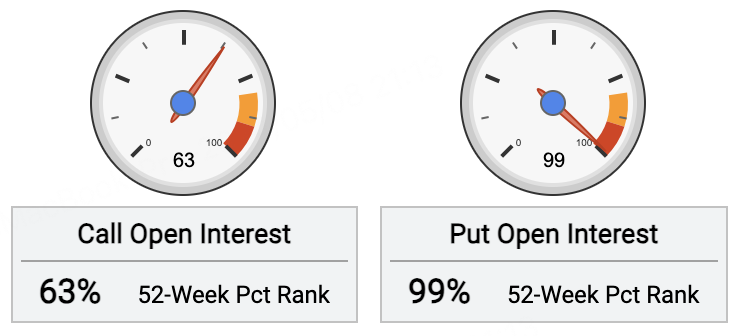

The $iShares Russell 2000 ETF(IWM)$ options overall reflected a bearish trading sentiment, with sellers of put options dominating. Open call interest grew 3.7% over the past 5 days, while open put contracts increased 4.9% over the same period.

For call options, investors sold the most $IWM 20240517 208.0 CALL$ with a 208 strike, adding 14,000 contracts. This signals expectations for IWM to trade below 208 by May 17 expiration.

For put options, investors heavily bought the $IWM 20240621 196.0 PUT$ with a 196 strike, adding 28,000 contracts. This implies expectations for a 3.9% decline in IWM by June 21.

Comments