Data showing a cooling jobs market revived hopes for Fed rate cuts later this year, boosting U.S. stocks. Home Depot and Caterpillar led the rally as the Dow notched its longest winning streak since December 2022 with 9 straight gains.

Options market data suggested the S&P 500 ETF may have topped out around 521, with expectations for a decline of over 1.9% priced in by June 21 expiration. For QQQ, near-term upside was adjusted higher while longer-dated put buying continued. The small-cap Russell 2000 saw room for more upside into late May, with expectations capping gains in IWM below 6.8% by May 24.

Details:

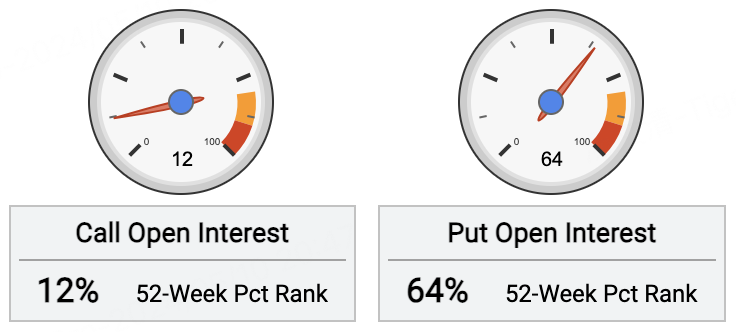

The $SPDR S&P 500 ETF Trust(SPY)$ saw open call interest rise 2.3% over the past 5 days. Open put contracts increased 3.9% over the same period.

For call options, investors sold the most $SPY 20240531 521.0 CALL$ with a 521 strike, adding 21,000 contracts. This implies expectations for SPY to trade below 521 by May 31 expiration.

For put options, the most actively traded was the $SPY 20240628 395.0 PUT$ with a 395 strike, adding 150,000 contracts as part of a butterfly spread involving the $SPY 20240628 445.0 PUT$ and $SPY 20240628 345.0 PUT$ strikes.

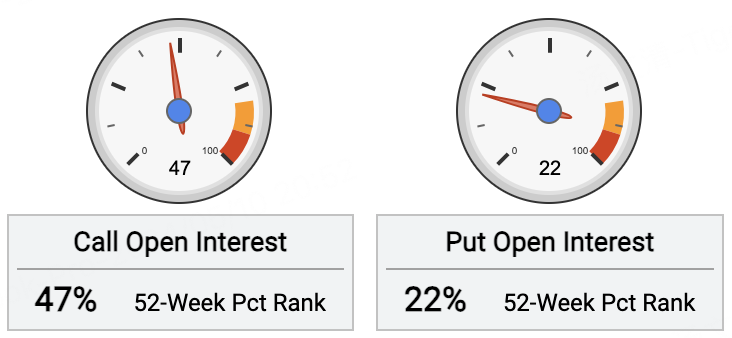

The $Invesco QQQ(QQQ)$ saw open call interest rise 2.6% over the past 5 days. Open put contracts increased 1.3% over the same period.

For call options, investors bought the most $QQQ 20240517 443.0 CALL$ with a 443 strike, adding 14,000 contracts. This suggests expectations for QQQ to rally above 443 by May 17 expiration.

For put options, investors bought the most $QQQ 20240524 415.0 PUT$ with a 415 strike, adding 50,000 contracts. This implies expectations for a 5.8% decline in QQQ by May 24 expiration.

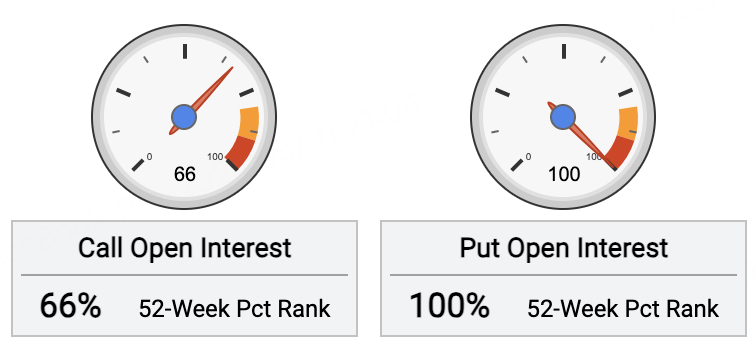

The $iShares Russell 2000 ETF(IWM)$ saw open call interest rise 1.3% over the past 5 days, while open put contracts increased 1.9% over the same period.

For call options, the most actively traded was the $IWM 20240524 230.0 CALL$ with a 230 strike, adding 13,000 contracts as part of a call spread with the $IWM 20240524 220.0 CALL$ . This signals expectations capping upside in IWM below 6.8% by May 24.

For put options, investors heavily bought the $IWM 20240621 196.0 PUT$ with a 196 strike, adding 77,000 contracts. This implies expectations for a 4.7% decline in IWM by June 21 expiration.

Comments

Great article, would you like to share it?

Great article, would you like to share it?