Investors awaited this week's inflation report for clues on the Fed's policy path. Treasury yields and the U.S. dollar index declined.

Options market data suggested the S&P 500 ETF could see a pullback of over 1.5% priced in by May 17 expiration. For QQQ, there was room left for a 2.2% rally this week, while a 4.2% decline was expected. The small-cap Russell 2000 had room for a 1.4% decline priced in for the week.

Details:

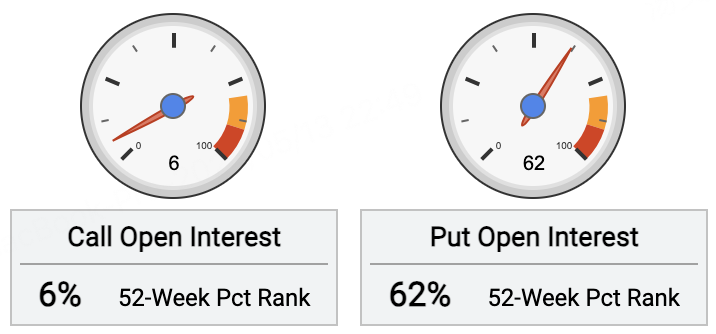

The $SPDR S&P 500 ETF Trust(SPY)$ saw open call interest decline -2.9% over the past 5 days. Open put contracts decreased -0.5% over the same period.

For call options, investors bought the most $SPY 20241220 680.0 CALL$ with a 680 strike, adding 18,000 contracts. This implies expectations for a 30% rally in SPY by December 20 expiration.

For put options, the most bought was the $SPY 20240517 512.0 PUT$ with a 512 strike, adding 38,000 contracts. This signals expectations for a decline of over 1.5% in SPY by May 17 expiration.

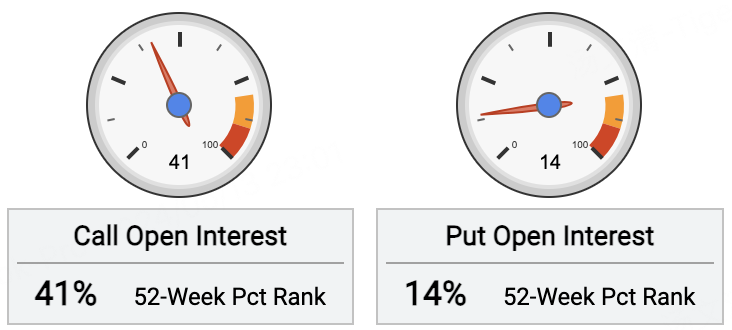

The $Invesco QQQ(QQQ)$ saw open call interest fall -2.6% over the past 5 days. Open put contracts declined -2.8% over the same period.

For call options, investors sold the most $QQQ 20240517 452.0 CALL$ with a 452 strike, adding 19,000 contracts. This implies expectations capping upside in QQQ below 2.2% by May 17 expiration.

For put options, investors sold the most $QQQ 20240517 423.0 PUT$ with a 423 strike, adding 10,000 contracts. This suggests expectations for a decline of less than 4.2% in QQQ by May 17.

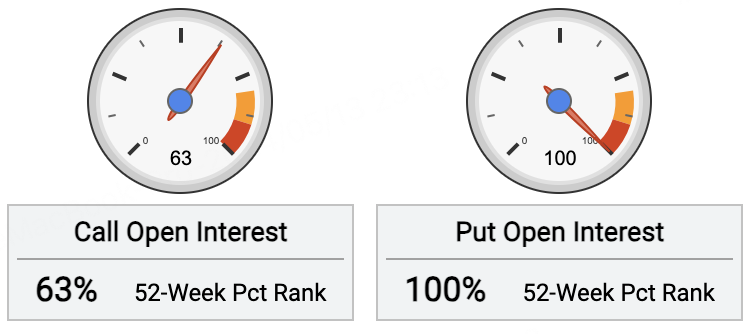

The $iShares Russell 2000 ETF(IWM)$ saw open call interest decline -0.9% over the past 5 days, while open put contracts rose 0.1% over the same period.

For call options, investors bought the most $IWM 20240621 218.0 CALL$ with a 218 strike, adding 13,000 contracts. This signals expectations for a 6.8% rally in IWM by June 21 expiration.

For put options, investors heavily bought the $IWM 20240621 194.0 PUT$ with a 194 strike, adding 88,000 contracts. This implies expectations for a 4.9% decline in IWM by June 21.

Comments