Investors turned more cautious on rate cut expectations, leaving indexes roughly flat as bets on Fed easing unwound, driving a pullback in risk assets. Meanwhile, the meme stock frenzy saw another twist, with GameStop and AMC Entertainment giving back some of their recent gains.

Friday, May 17th marked the monthly options expiration. SPY and QQQ saw heavy volume focused on settling this week's expiring contracts. For small-caps, bullish flows continued in the Russell 2000, with expectations capping upside below 12.9% by year-end.

Details:

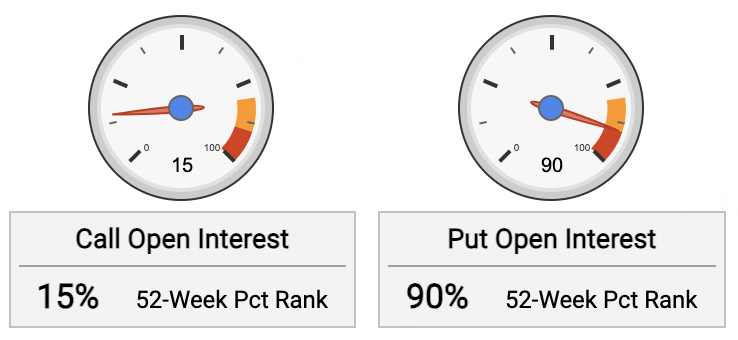

The S&P 500 ETF (SPY) saw open call interest rise 0.8% over the past 5 days. Open put contracts increased 0.4% over the same period.

For call options, the most actively traded was the $SPY 20240517 534.0 CALL$ with a 534 strike, adding 8,336 contracts.

For put options, the most actively traded was the $SPY 20240517 530.0 PUT$ with a 530 strike, adding 13,000 contracts.

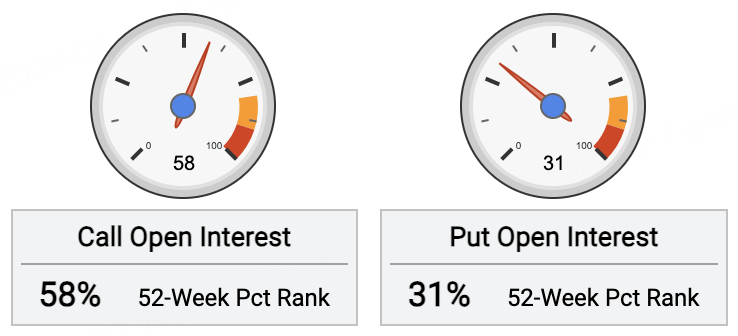

The Nasdaq 100 ETF (QQQ) saw open call interest decline -1.0% over the past 5 days. Open put contracts increased 2.3% over the same period.

For call options, the most actively traded was the $QQQ 20240621 455.0 CALL$ with a 455 strike, adding 6,495 contracts.

For put options, the most actively traded was the $QQQ 20240517 450.0 PUT$ with a 450 strike, adding 10,000 contracts.

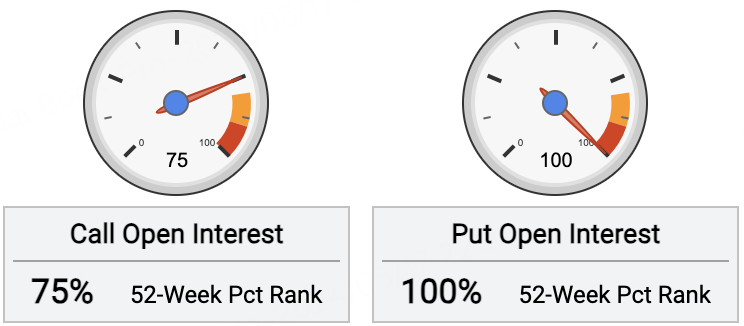

The Russell 2000 ETF (IWM) saw open call interest rise 0.3% over the past 5 days, while open put contracts increased 0.9% over the same period.

For call options, investors sold the most $IWM 20241220 235.0 CALL$ with a 235 strike, adding 11,000 contracts. This implies expectations capping upside in IWM below 12.9% by December 20 expiration.

For put options, investors heavily sold the $IWM 20240719 207.0 PUT$ with a 207 strike, adding 10,000 contracts. This signals expectations for IWM to hold above 207 by July 19 expiration.

Comments

Great article, would you like to share it?