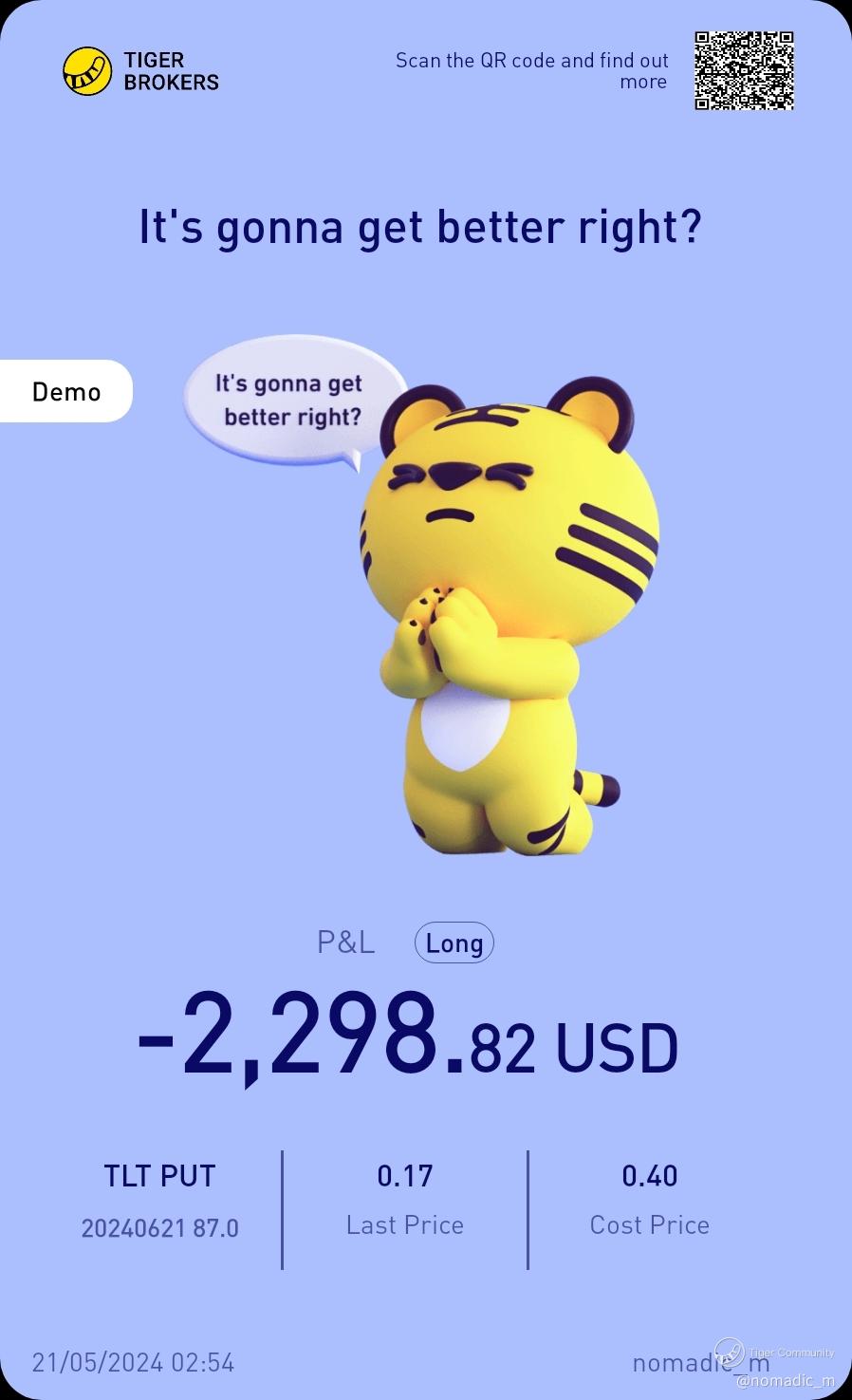

so I demo-ed $TLT 20240621 87.0 PUT$, short put of $iShares 20+ Year Treasury Bond ETF(TLT)$ at $87, expiring at 21st June as per @OptionsTutor

thank god this is demo. otherwise my weak heart can't handle it 💔 😭

Have You Ever Tried Demo Account?

Join me in trading this earnings season! Let’s learn options with demo account, and grow investment knowledge through practice!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments

Sis, you did it in the wrong direction… You should short/sell a put option at $87, instead of buying puts @nomadic_m

感谢您关注我的交易。💖

我分享的订单是空头看跌期权。你需要卖出模拟账户中的“看跌”合约。对于空头看跌,当当前价格下跌时,你获利。💰

但你的订单是“多头看跌”,当当前价格下跌时,你就亏损了。

作为期权的买方,合约的时间价值会随着时间的推移而衰减。⏳

空头看跌期权的胜率更高,因为它受益于时间衰减和价格稳定或上涨。

你可以在模拟账户中再次尝试这种“空头看跌期权”,看看它在6月份会如何收盘。📆

Could you check back on your order and tell me the date at which you sold this put? I'm quite certain you sold the put when TLT was in the greens, such that when TLT falls, your put ends up being very red.

You may ask, what's the purpose in me asking that. Simple. The trick is, SELL A PUT when ITS DAMN RED (of course at a strike price that you're willing to buy the shares if it goes south OR you're very certain that it will rebound such that your put expire worthless). SELL A CALL when it's DAMN GREEN (naked if you're daring and expect that it will drop eventually before your expiry, or covered if you own the stock and don't mind it being called away).

I trade options on Crypto related stocks at the moment (CLSK, MARA, COIN, CONL, MSTR, IREN, RIOT) and closed some puts (sold ON VERY RED DAYS) earlier on when these stocks skyrocketed.

I've got to try and recall what I typed for you earlier 🤦♀️🤦♀️

The trick to options trading is time. It's a time dependent kinda thing. Which means that if you were to sell a put at the wrong time, then you'd end up being in the reds prettily easily.

Could you kindly look up the date where you sold this particular put? There is quite a good chance you sold the put on a GREEN day, such that when TLT falls, your put ends up in the reds.

You may ask, eh. Why are you asking such a strange question? Trick here is. You SELL PUTS only on VERY RED DAYS (of course it must be a stock you're willing to be assigned if things go south OR you're certain it will rebound prior to expiry such that it expires worthless). And you SELL CALLS only on very GREEN DAYS (naked if you're daring enough and expect the stock to fall prior to expiry OR covered if you don't mind your stocks being called away).

That's the most important rule that governs majority of my option trades.