Summarizing option flows across the semi space yields mixed signals - two bullish, one bearish. But looking at broader index flows, the bias seems tilted towards strength. Let's assume NVDA's earnings are unlikely to disappoint.

With expected earnings move around 7.5% and ATM implied vol around 4.4%, calls look richly priced, so put selling is preferred. Any strike below 850 seems a safe zone.

AMD: Large buy in the $AMD 20240524 175 CALL, clear bullish tilt

SOXX: Large buy in the $SOXX 20240621 220 PUTS$, clear bearish view

SOXL: Large buy in the $SOXL 20240524 44.5 CALL$ , an aggressive bullish bet. Notably, this large buyer swept up calls right at Friday's intraday lows around 2:30pm.

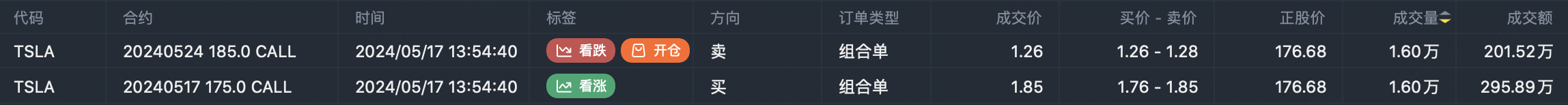

Reference the $TSLA 20240524 185 CALL$ for put selling.

Admittedly, I have mixed feelings on this trade. On one hand, couldn't Tesla's inability to rally meaningfully be because dealers keep pinning it to this 185 strike? But on the other, we should thank them for graciously putting their homework on display for us to copy.

My TSLA game plan remains the same - sell calls on pops like the 190 strike, sell puts on dips around 170. If it sells off Monday morning, you know what to do.

Apple seems to have resumed its uptrend, so deep out-of-the-money put sales could be explored. For a nearer-dated play, the $AAPL 20240524 205 PUT$ . Or for a longer expiry, the $AAPL 20240621 215 PUT$ .

The benefit of these deep OTM puts is they capture premium decay while avoiding the risk of shares gapping through your short strike on a rally.

Just be mindful you may need to take profit before expiry if the stock hasn't rallied to your short strike, to avoid ending up with a high-strike long put position.

Still a potential play, but this cycle's rip got cut short. Pre-spike, the highest strikes were only around 34. Post-spike, open interest extended out to 120 - laying the groundwork for a more expansive move next time.

The main obstacle currently is still very elevated implied vols making options expensive. It may take a month for volatility to really settle down. Who wants to buy when IVs are this rich? Even dealers likely view premiums as too hefty to reposition aggressively.

Let's keep an eye on the $GME 20241018 13 CALL$ - once they pull back towards $6 or so, they could make for an interesting lottery ticket spec for whenever the next meme rip cycle emerges. But also have to stay open-minded that dealers may shift their focus elsewhere after this GME reboot stalled.

$Faraday Future Intelligent Electric Inc.(FFIE)$

Not much new to discuss on FFIE. No weekly options, and current volumes are too thin to meaningfully impact the underlying's trajectory. An opening 20k lot on any single strike could be enough to drastically skew prices.

For now, it just seems to be a case of the pistons pumping in unison, taking turns lifting and passing the baton. I've seen enough frenzies come and go. That said, with so many retail traders already clustering around this name, it does set the stage for another meme ramp when the rotations eventually return.

Comments

Great article, would you like to share it?