Several outlier options on May 20 followed several market-focused events.

$Li Auto(LI)$ reported Q1 earnings. It turned out to be a big miss on the profit side of the equation, panicking investors in a thunderous way, with the stock dropping will the $21 position, hence the massive unwinding of the $23 (current week to expiration) CALL options.

$Hims & Hers Health Inc.( HIMS)$ also shot up nearly 30% on the launch of a weight-loss pill that's 80% cheaper than Eli Lilly's, while the IV of Call, which expires at 19 this week, spiked to 193% as more speculative money joined in.

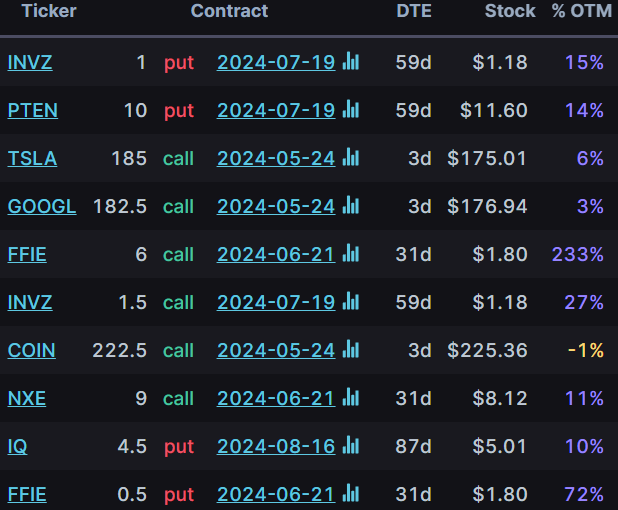

Also, the meme ticker continues, $Faraday Future (FFIE)$ After topping out at more than 50 times, its single-day volatility can still reach triple digits. At the current price of $1.80, the week-to-date put is actually $0.20, the $6 Call is actually $0.60, and the $7 Call is $0.45, and the excessively high IV has attracted a lot of investors who are shorting volatility.

Instead, $Nvidia (NVDA)$ is facing Investors have begun to bet bullishly with a bias toward earnings, with shares reaching a high of $950 before the report, but market expectations for the volatility of the report aren't as high as they were before, with an overall IV Rank of just 61.66%, much lower than what has been seen in previous earnings reports.Several outlier options on May 20 followed several market-focused events.

Comments