$NVIDIA Corp(NVDA)$ arnings can be a star-studded affair, and as the world's leading GPU maker, a good or bad Q1 report as well as changes in next guidance could affect the overall broader market. $GraniteShares 2x Short NVDA Daily ETF(NVD)$ $GraniteShares 2x Long NVDA Daily ETF(NVDL)$ $NVIDIA Bear 1.25X ETF-AXS(NVDS)$

First quarter results

Consensus market revenue of $24.69 billion, up 243.3% year-over-year; EBITDA up 439% year-over-year to $16.46 billion and EPS up 418% year-over-year to $5.65

The all-important Data Center segment showed significant growth momentum. With shorter H100 GPU lead times and the introduction of the H200 product, data center revenue is expected to grow significantly, potentially reaching $23 to $24 billion, well ahead of market expectations of $21.1 billion.

In addition, the company's continued progress in AI inference performance, particularly in the Hopper H200 product cycle, is expected to continue to solidify its leadership in AI, reflecting NVIDIA's strong competitive advantage in emerging areas such as gaming graphics processors, data centers, high-performance computing (HPC), and AI and autonomous driving, as well as its CUDA software platform's uniqueness and deepening system software capabilities.

It has beaten earnings estimates 88% of the time over the past four years. In the last quarter, it beat estimates by 11% and raised guidance by 10%. Over the past three years, NVIDIA has raised guidance by an average of 7% per quarter. If this trend continues, NVIDIA could beat estimates again and raise them by 10%, bringing the potential year-end gain to 43%.

direction

On the financials front, the market is expecting higher earnings from NVIDIA. Analysts expect NVIDIA's EPS for the first quarter of fiscal year 2024 to reach $5.44, while the full-year estimate was raised to $25.18 from the previous $24.14. This expectation reflects the market's confidence in NVIDIA's business growth and profitability.

In terms of company valuation

The consensus market price target, at $963.36 in 2024 and $1,247.95 in 2025, is almost 30 times the expected P/E for 2026 at current earnings estimates.

marketplace

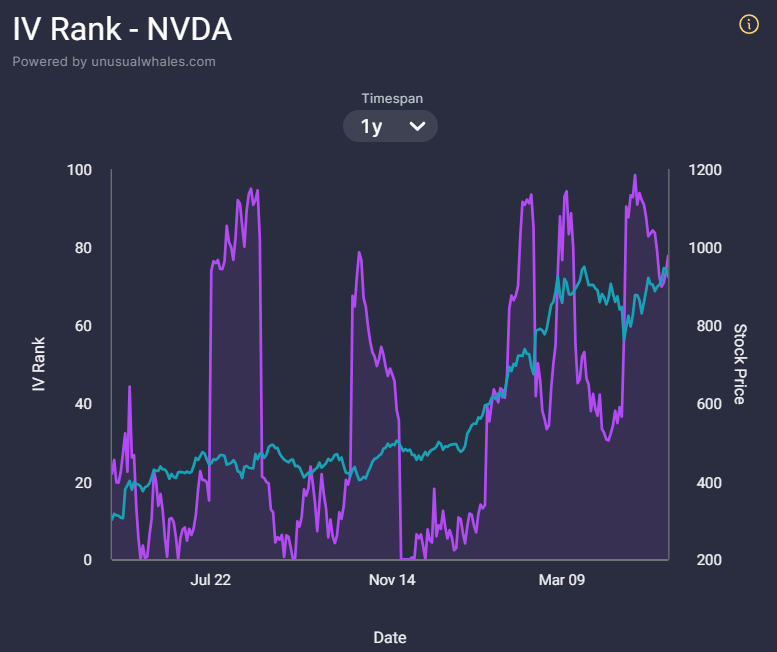

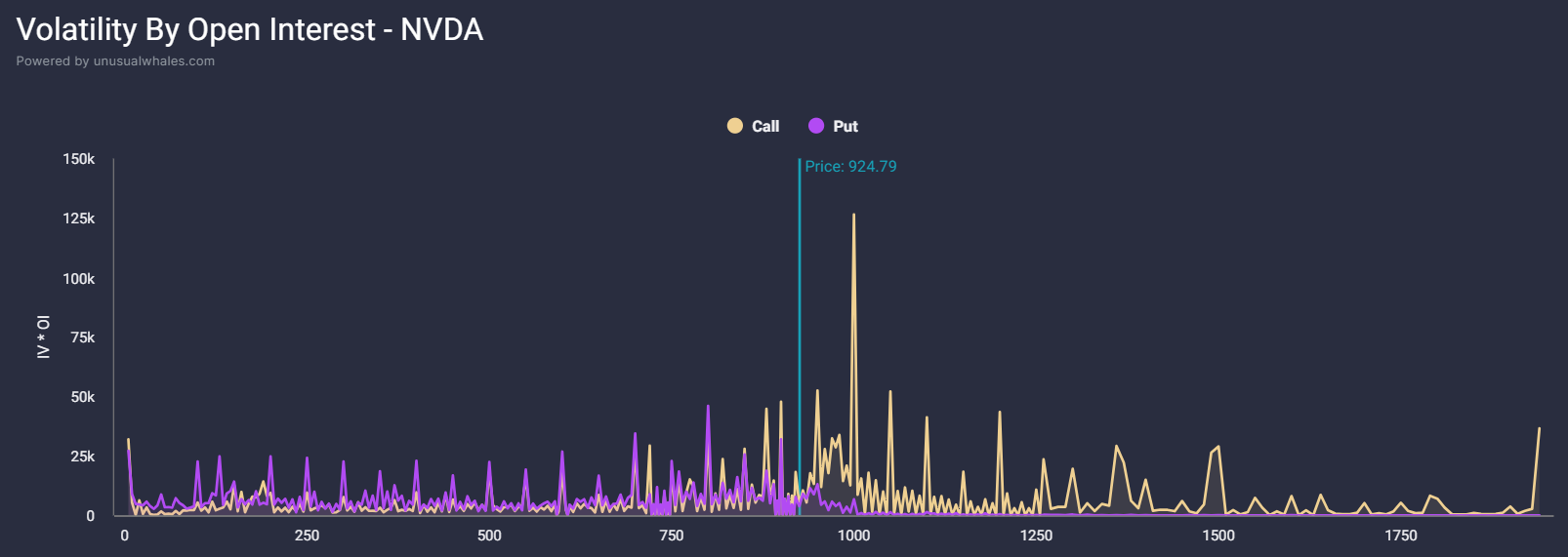

As it stands, NVDA's IV rank is at 60-70% of the past year's level, with far less volatility expected than previous times; $1,000 could become a significant threshold in terms of open orders, with a very high number of open Calls.

Comments