Summary

- Patterson-UTI Energy has been struggling due to low commodity prices, but improvements in the natural gas market could reverse the trend.

- The company offers a range of services in the drilling and fracking sectors, and its cash conversion rates are among the top in the industry.

- The potential decline in shale production and increasing demand for gas in electricity generation and industrial usage could benefit PTEN.

- We rate PTEN as a buy at current levels.

A pretty sight!

grandriver

Introduction

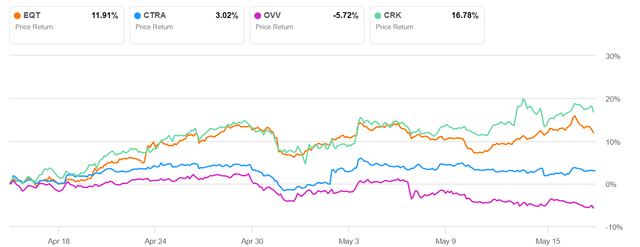

Patterson-UTI Energy (NASDAQ:PTEN) has been treading water for most of this year as rig counts have suffered and frac spreads have gone to the house. The problem, of course, has been the slow withering of commodity prices, particularly on the natural gas side. Things are changing that will reverse the trend, and some of this equipment - not all, mind you - will go back to work as we move into the third quarter. Why? As the title of this article suggests, the worm has turned for gas, which is an oilfield expression meaning generally that things are getting better. The fundamentals for gas are improving. We have seen a more than ~50% rally in gas prices over the last month, and that has sent a price signal to buy the gas focused E&P companies. EQT Corp, (EQT), and Comstock Resources, (CRK) have seen strong rallies over the past month in comparison to more oil focused E&P's.

Price return for Gas Drillers (Seeking Alpha)

The service sector always lags the operators, and as activity picks up, investors should become more focused on PTEN stock. Patterson is widely covered by the analysts and currently is collectively rated as an Overweight. Price targets range from $14 on the low side to $19 on the high side. The median is $15.00, suggesting most feel there is only potential for modest growth over the short term.

I tend to agree- for the short term. PTEN beat expectations on EPS in Q-1, but missed on revenue by $5 mm. If they were to beat lowered expectations in Q-2, it could spark a nice momentum shift rally in the stock and one I think would continue into 2025. Based on what we now expect from the market next year-new sources of demand from utility generating requirements for base load, AI data centers, which could comprise 8% of electricity requirements by 2030, and another 4-5 BCF/D from LNG, better days are ahead.

We last covered PTEN with a buy rating in November of last year at $12.00. It's down ~8% from that level, so we are underwater, but momentum and fundamentals to go higher seem to be building. Accordingly, we are maintaining our buy rating on expectations that the gas market has bottomed and oil will hold in the upper $70's to low $80's going forward.

Investors looking for growth, a modest dividend, and share count reduction should carefully consider taking a position in PTEN at current levels.

The thesis for PTEN

The company is one of the top U.S. land drillers, with about 20% of the market. With the acquisition of NexTier last year, they are also one of the top frac providers behind Halliburton, (HAL), Liberty Energy, (LBRT), and a tossup for the third spot with ProFrac Holdings, (ACDC). PTEN offers Super Spec rigs that can "walk" to a new well slot on a pad-saving risk and time, as well as a high proportion-80%, of Tier IV DGB frac spreads and a growing population of Emerald Efrac units.

They also provide cementing, wireline, and drilling tool support. Operators often see an advantage of working with service providers that can handle multiple tasks due to the tight timing of sequential operations-

- reaching TD with drilling BHA

- running and cementing casing

- perforating and fracking stages

- drill out of plugs between stages

It has been well documented that both the drilling and fracking markets are down significantly from a year and half ago, but an interesting thing has happened. Though off from last year, neither rig or frac crew revenue has cratered as happened in the oil oilfield. In oilfield 2.0 companies appear to have learned the folly of down-bidding to maintain share in a declining market, as this comment from Andy Hendricks, CEO, indicates:

Average rig revenue per day was $35,680, with average rig operating cost per day of $19,510. The average adjusted rig gross profit per day was $16,170, a decrease of less than $200 from the prior quarter. Since the start of 2022, we have returned more than 80% of our free cash flow to shareholders, while at the same time improving our free cash flow conversion. We continue to expect to convert at least 40% of our adjusted EBITDA to free cash flow in 2024.

(Source: Company filings)

This is a pretty good sign for the next 18 months to 2-3 years as the chickens come home to roost from deferred drilling and completions. Cash conversion rates for Patterson are in the top tier of the industry now, and could go still higher. That bodes well for shareholder returns.

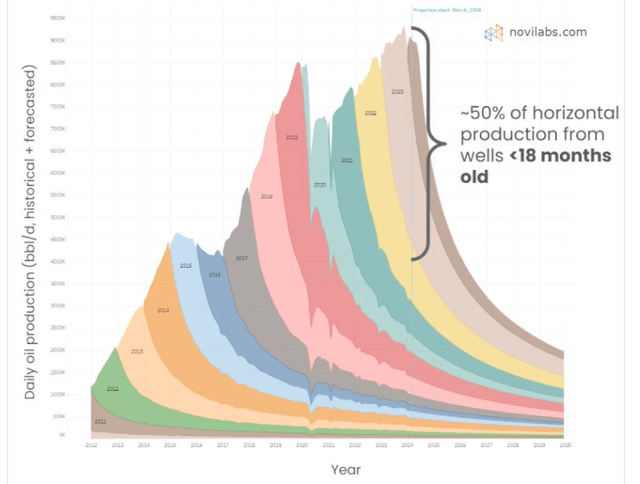

Final point on the coming longevity of the drilling and frac market resurgence. Ted Cross, VP of energy analyst firm Novi Labs, has published information that highlights the extent of the current disconnect and seeming levitation of shale output from rig activity.

Shale Production Aging graph (Novi Labs-Used with permission)

The takeaway from the graph above is that 50% of U.S. shale production is potentially in decline. Leading to the question, can longer laterals, technology, and increased frac intensity, offset increasingly drilled up Tier I acreage and a 600 active rig market forever? We don't think so, and that should lead to better market conditions for PTEN.

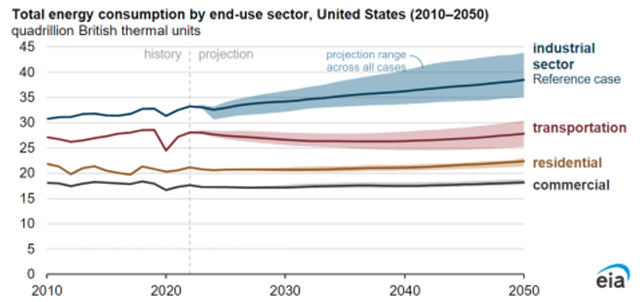

On a macro scale, the IEA reports in a data set that carries through Feb. 24 that gas for electricity generation rose 5.9% YoY. This is extended and verified in the EIA graphic below that shows the industrial usage, which includes gas for data center operations increases in all cases through 2050, and represents a lot of new demand that could account for 8% of total U.S. demand by 2030.

EIA energy demand graphic (EIA)

Risks

Obviously, I think the risk of further share price reduction is unlikely in the scenario I see developing and have described. It should be noted that the company felt that Q-2 might be a little softer, with a decline of 5-7 rigs from Q-1.

Recent trading activity suggests to me that investors are looking past Q-2 potential Q-2 softness, and entering the stock for the rally to come.

Q-1, 2024 and Outlook

Q-1 Drilling Services revenue was $458 million. Drilling Services adjusted gross profit totaled $186 million during the quarter. Average rig revenue per day was $35,680, with an average rig operating cost per day of $19,510. The average adjusted rig gross profit per day was $16,170, a decrease of less than $200 from the prior quarter. Also called "Rig Margin," this is a solid return that is likely to improve as we head into Q-3.

The Completion Services segment totaled $945 million, with an adjusted gross profit of $199 million. Most of the sequential change in revenue was a function of lower activity and the mix shift away from higher revenue jobs in the Haynesville.

PTEN is generating positive cash flow and funding capex and shareholder returns from it. In the most recent quarter, PTEN returned $130 mm to shareholders in the form of an $0.08 dividend and $98 mm in share buybacks. On an annualized basis, the company is on track to reduce its share count by 10% in 2024.

Outlook for 2024

PTEN expects to average 114 active rigs in Q-2 compared to 121 active rigs in the first quarter, with adjusted gross profit per day expected to be down roughly $300 from the first quarter. Completion services revenue is forecast to be approximately $860 million, with an adjusted gross profit of around $170 million. PTEN expects total CapEx of roughly $180 million, with most of the sequential reduction coming from a decline in CapEx in the Completion Services segment. Company-wide annual CapEx spend will be $740 million or less. (Source: Company filings)

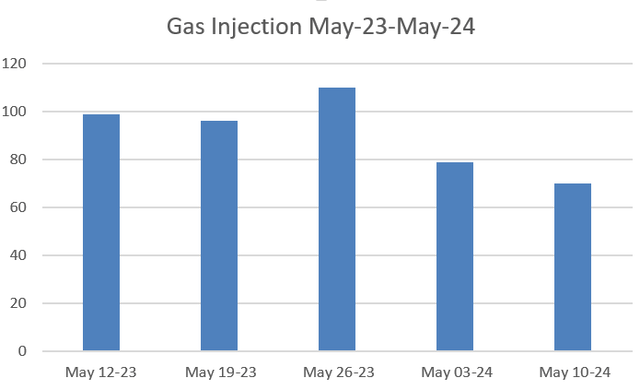

The coming catalyst for PTEN

If we start seeing demand ramp for any of the applications we have discussed-electric generation for cooling, AI demand, and the baked in 5-6 BCF/D coming from LNG exports, I think a price signal will be sent to the market for gas. We may be seeing it already. Last week's injection of 70 BCF was 20 BCF below this time last year. That's quite a drop YoY and may have other explanations, but the trend is our friend. If this keeps up, I think the rally in gas will continue.

Gas storage 2023, 2024 (EIA gas storage report-chart by author)

Your takeaway

At the present, PTEN is trading at 4.5X EV/EBITDA. I think as we head into the third quarter, revenues will pick up from rig additions. I am not expecting a land rush thanks to the large quantity of gas in storage, but as noted above, the fundamentals could shift pretty quickly if this injection disparity continues. Even the perception that will start chipping away at the gas overhang due to current demand should reset the market's thinking.

The midpoint of analyst projections represents respectable price appreciation, with further gains potential as we head into the second half of the year. I think PTEN should be bought at current levels for future price appreciation and modest but rising income from dividends and share count reduction.

Comments