Big-Tech’s Performance

NVIDIA earnings is the biggest focus across the market. Excellent earnings once again exceeded already high expectations, while guidance was boosted and inventories stayed low to show that AI demand remains strong.

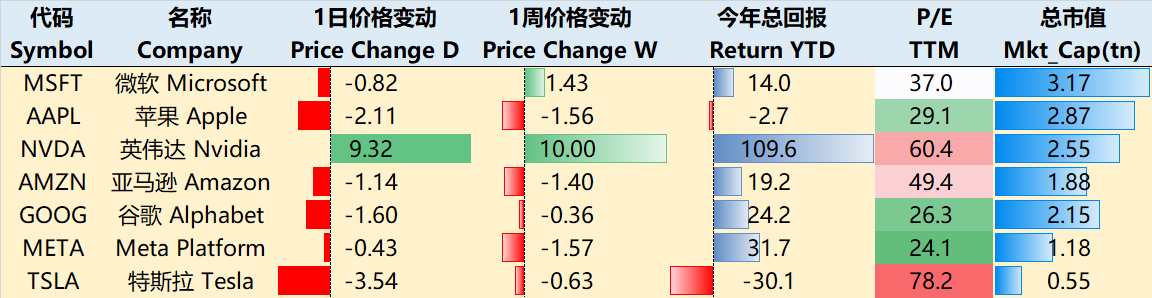

By the close of trading on May 23, the best performer over the past week was $NVIDIA Corp(NVDA)$ +10%, followed by $Microsoft(MSFT)$ +1.43%, while all others closed lower, $Alphabet(GOOGL)$ $Alphabet(GOOG)$ -0.36%, $Tesla Motors(TSLA)$ -0.63%, $Amazon.com(AMZN)$ -1.4%, $Apple(AAPL)$ +1.56%, and $Meta Platforms, Inc.(META)$ -1.57%.

Big-Tech’s Key Strategy

Will the stock split be a "new high" performance?

In addition to the performance of the explosion, NVIDIA gave a "potential big gift", is the stock 1:10 split, before holding 100 shares of shareholders, on June 7 will become 1,000 shares.

It goes without saying that the benefits of a split are most directly related to increasing stock liquidity and attracting more investors, which amounts to a positive signal from the company - that it believes that its stock price still has a decent amount of upside potential.

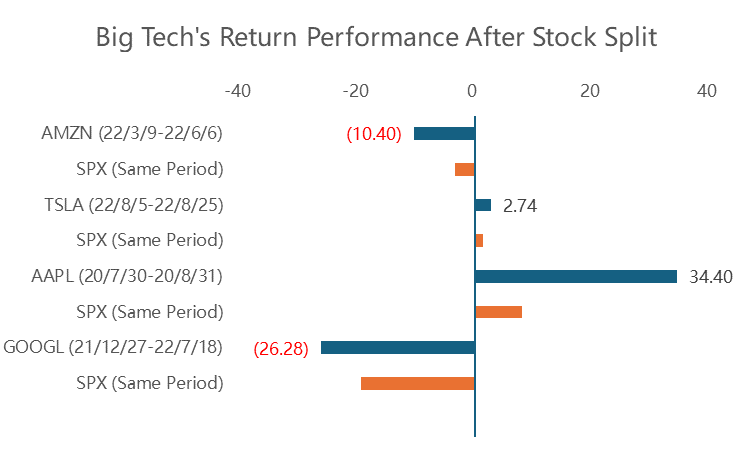

Historically, the Big Seven have a history of splitting, and four - TSLA, AAPL, GOOGL and AMZN - still have a history of splitting after 2020.

The period between the announcement of the split and its formal entry into force:

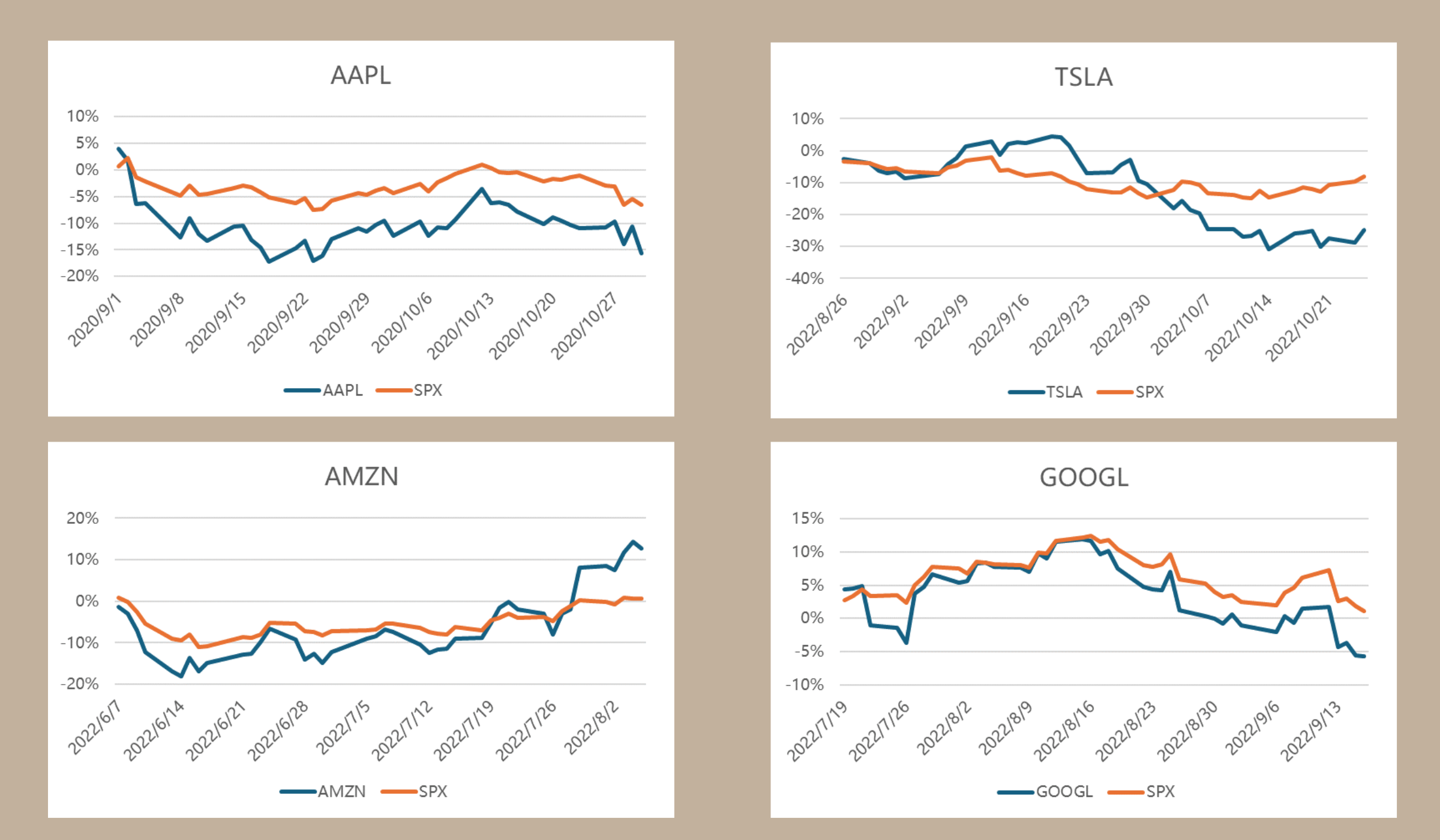

Both AMZN and GOOGL did not outperform the broader market, but that has to do with the fact that 2022 is in a pullback period as most of the big tech companies have a Beta greater than 1;

Apple, which is in the midst of a massive entry phase by long-term investors such as Warren Buffett, has done particularly well, thus outperforming the broader market by more than 25%, while Tesla has just come off a Gamma Squeeze and the heat is on;

And performance varied in the 2 months after the split became official:

Strong performers within the first month were TSLA and GOOGL, but the only strong performer within the second month was AMZN;

AAPL, due to the huge increase in the period between the announcement and the official entry into force, has the meaning of "Buy the news, sell the fact", while TSLA, after a strong performance in the first month, began to see a huge retracement, also has the meaning of "Sell the fact". TSLA, on the other hand, after a strong performance in the first month, began a huge pullback, also suggesting "Sell the fact.

Taken together, splits do offer investors more trading opportunities, especially now that options trading is becoming more plentiful. When a high-priced stock splits, it is possible for investors to "Cover" their positions with more granular options, thereby increasing their influence on the stock price.

The current momentum of NVDA is quite similar to what it was during the heyday of the TSLA deal, so after this wave of good news, one should also beware of the wave of profit-taking that follows.

Also announcing 1:10 stock splits are $Lam Research(LRCX)$ , while other AI-concept high-priced stocks, such as $Broadcom(AVGO)$ , may also announce stock splits.

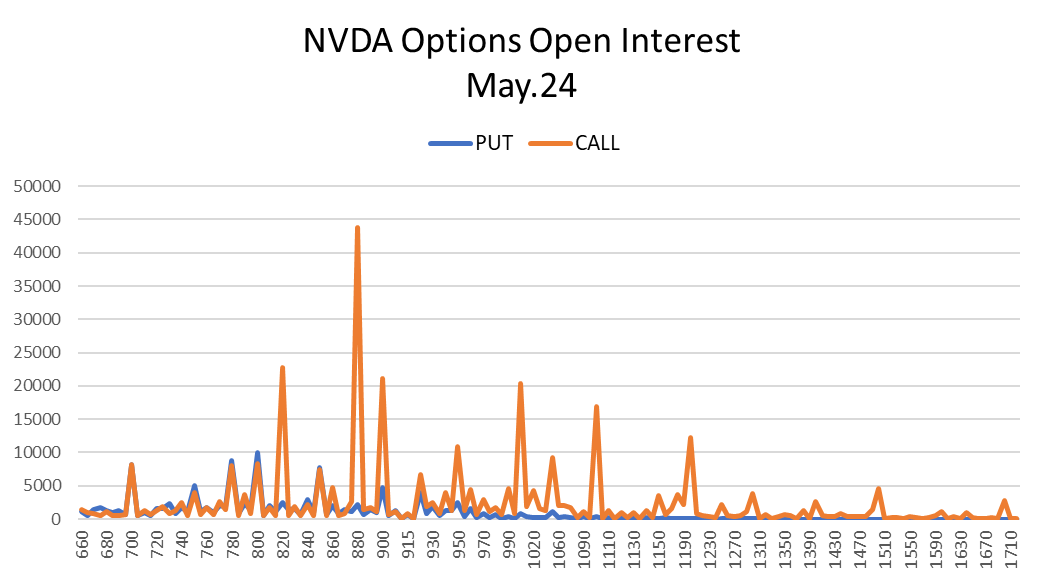

Big-Tech Weekly Options Watcher

The $1,000 price level has been breached following the NVDA earnings announcement, so a large number of previously open Call positions may need to have further action, potentially with the option to Roll to a higher priced live position, so the Call OI is much larger than the Put in terms of June expiration options.

Big-Tech Portfolio

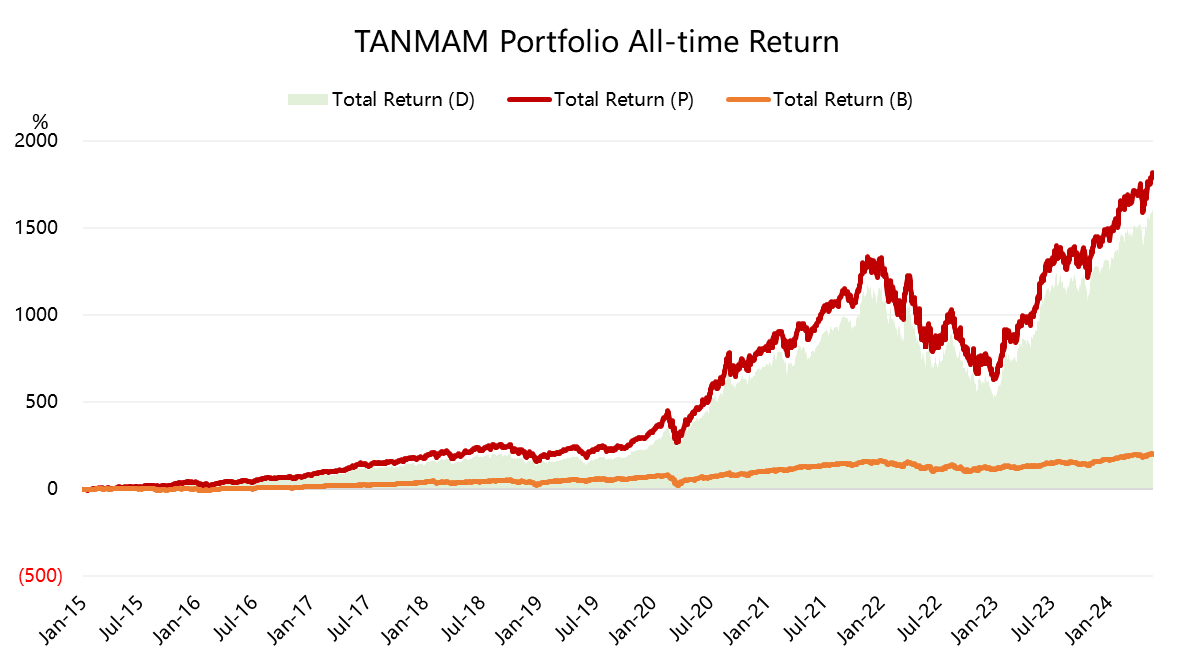

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly. The backtesting results are far outperforming the S&P 500 since 2015, with a total return of 1,802% and the $SPDR S&P 500 ETF Trust(SPY)$ returning 202% over the same period, a new record for excess returns!

The broader market hit a new high this week and the portfolio's year-to-date return hit a new high of 20.24%, outpacing the SPY's 11%.

The portfolio's Sharpe ratio for the past year was 2.7, while the SPY was 2.3 and the portfolio's information ratio was 1.8

Comments