When $Nvidia (NVDA)$ is again a single day rose more than 6%, leading the whole market when in fact the market divergence has begun.

$S&P 500 (.SPX)$ The index rebounded from the The rally from the lows was essentially flat, with the $Dow Jones (.DJI)$, a proxy for the blue chips. a> The index is down 0.55% after a new high, while the $ Nasdaq (.IXIC)$ index topped 17,000 for the first time, thanks to a third consecutive day of record highs for NVIDIA shares.

From a macro-fundamental perspective

Better-than-expected consumer confidence data continued to raise consumer expectations for inflation over the next 12 months. Contradictory data reflect consumers' optimism about the stock market, but also the growing likelihood of a recession.

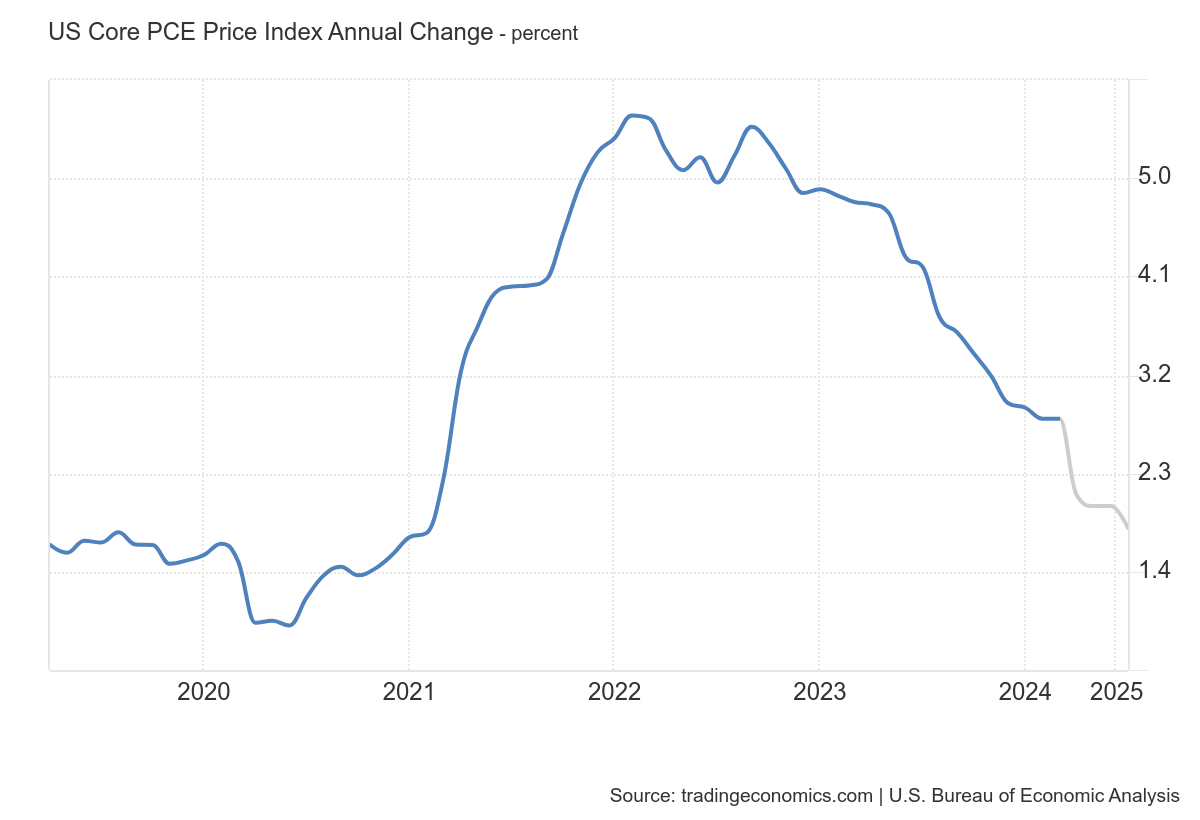

Fed officials unleash hawkish rhetoric. Minneapolis Fed President Nell Kashkari made hawkish comments, stating that a future rate hike cannot be ruled out. These comments have dampened market optimism for lower interest rates to some extent.

And more importantly, the market is beginning the "risk-off mode"

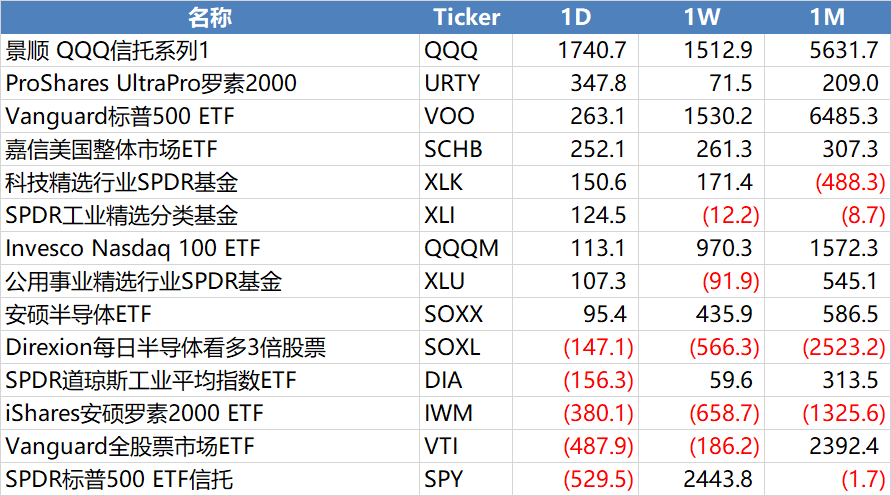

From May 28 ETF flows

The technology sector as a whole received inflows, for example, $Invesco QQQ(QQQ)$ received inflows of $ 1.7 billion in a single day, a reversal of the outflow trend since last week;

The two main ETFs for the S&P 500 are in the opposite state, with $SPDR S&P 500 ETF Trust(SPY)$ seeing $530 million in outflows while $Vanguard S&P 500 ETF(VOO)$ has $260 million in inflows, and is still an outlier overall;

The Russell 2000, a proxy for growth stocks, $iShares Russell 2000 ETF(IWM)$ $ProShares UltraPro Russell2000(URTY)$ also had inflows and outflows in exactly the same state;

The Dow ETF $SPDR Dow Jones Industrial Average ETF Trust(DIA)$ , on the other hand, saw significant outflows.

This also shows that the current market in the pursuit of high performance of Nvidia, is also equivalent to a "risk aversion" of the newspaper group, the overall position is also in the market under the new highs constantly tend to "risk aversion" state.

Comments