Investors turned defensive as worries over the Fed's rate path timing and magnitude pushed Treasury yields higher, pressuring large-cap stocks.

Options flows showed SPY at an inflection point, with either a 9.4% rally priced in by July expiry or a 5.6% drop expected by August. QQQ had at least 0.7% further upside priced in by June 14. For small-caps, upside appeared capped with expectations for IWM's rally staying below 5.1% by mid-June.

Details:

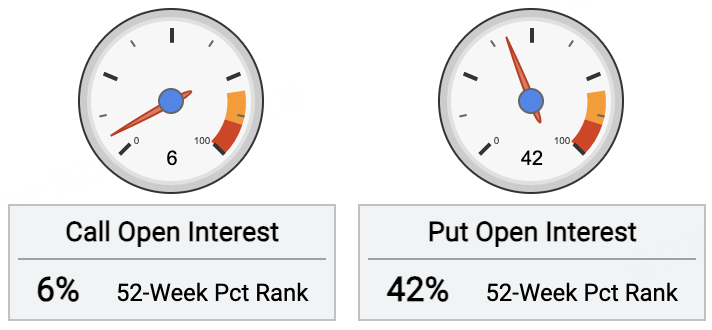

The S&P 500 ETF (SPY) saw open call interest rise 1.4% over the past 5 days. Open put contracts increased 1.2% over the same period.

For call options, investors bought the most $SPY 20240719 580.0 CALL$ with a 580 strike, adding 46,000 contracts. This implies around 9.4% further upside priced in for SPY by July 19 expiration.

For put options, the most actively traded was the $SPY 20240719 515.0 PUT$ with a 515 strike, adding 13,000 contracts.

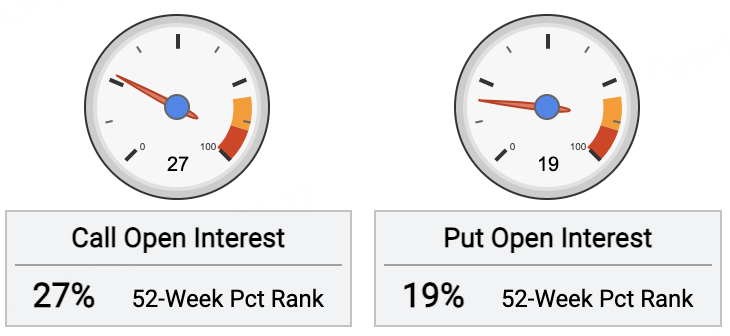

The Nasdaq 100 ETF (QQQ) saw open call interest rise 1.7% over the past 5 days. Open put contracts increased 1.6% over the same period.

For call options, investors sold the most $QQQ 20240614 475.0 CALL$ with a 475 strike, adding 21,000 contracts as part of a call spread vs the $QQQ 20240614 463.0 CALL$ . This priced in at least 0.7% further upside for QQQ by June 14 expiration.

For put options, the most actively traded was the $QQQ 20240531 421.0 PUT$ with a 421 strike, adding 13,000 contracts.

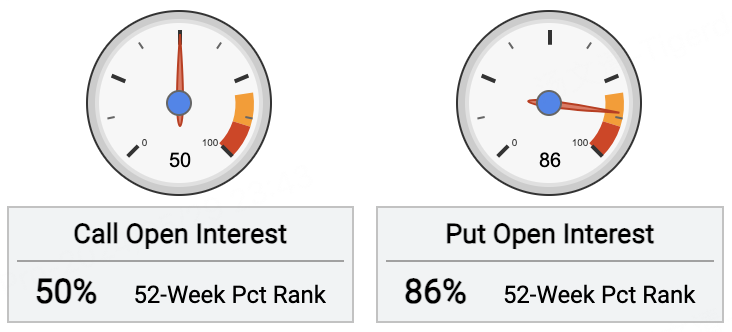

The Russell 2000 ETF (IWM) saw open call interest rise 1.0% over the past 5 days, while open put contracts increased 0.6% over the same period.

For call options, investors sold the most $IWM 20240614 216.0 CALL$ with a 216 strike, adding 13,000 contracts as part of a call spread vs the $IWM 20240614 223.0 CALL$ . This capped expectations for further IWM upside below 5.1% by June 14 expiration.

For put options, there was heavy buying in the $IWM 20250117 190.0 PUT$ with a 190 strike, adding 6,650 contracts. This priced in a 7.5% decline for IWM by January 17, 2025 expiration.

Comments

Great article, would you like to share it?

Great article, would you like to share it?

Great article, would you like to share it?