The US Federal Reserve kicked off its two-day policy meeting, with markets awaiting the rate decision outcome amid generally cautious sentiment.

Options flows showed expectations for SPY to see limited downside below 4.8% by June 21 expiry. For QQQ, there was defensive put buying to hedge against potential outsized drawdowns. The Russell 2000 was expected to trade in a 191-209 range.

Details:

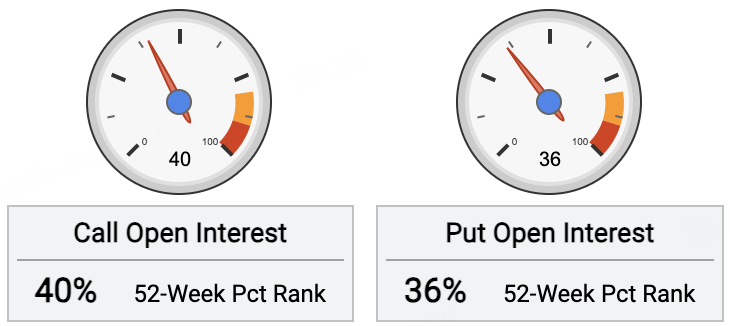

The S&P 500 ETF (SPY) saw open call interest decline 0.4% over the past 5 days. Open put contracts increased 1.1% over the same period.

For call options, investors bought the most SPY 20240628 542.0 CALLs with a 542 strike, adding 6,799 contracts. This priced in around 1.5% further upside for SPY by June 28 expiration.

For put options, the most sold were SPY 20240719 465.0 PUTs with a 465 strike, adding 15,000 contracts. This suggested expectations for limited downside beyond 12.9% for SPY by July 19 expiration.

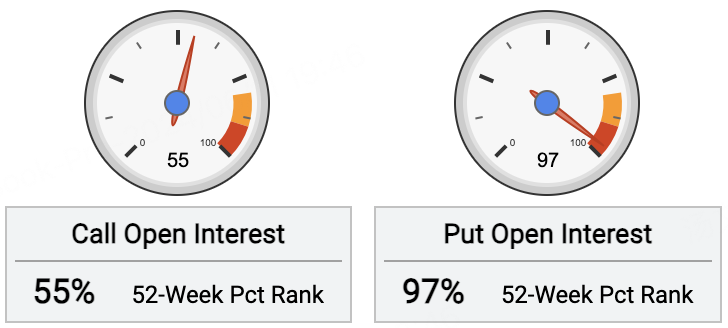

The Nasdaq 100 ETF (QQQ) saw open call interest rise 1.2% over the past 5 days. Open put contracts increased 1.5% over the same period.

For call options, investors sold the most QQQ 20240719 475.0 CALLs with a 475 strike, adding 4,826 contracts. This capped expectations for further QQQ upside beyond 2.4% by July 19 expiration.

For put options, investors bought the most QQQ 20240614 422.0 PUTs with a 422 strike, adding 19,000 contracts. This implied hedges building for a potential 9% drawdown in QQQ by June 14 expiration.

The Russell 2000 ETF (IWM) saw open call interest decline 1.2% over the past 5 days, while open put contracts increased 1.2% over the same period.

For call options, investors sold the most IWM 20240614 209.0 CALLs with a 209 strike, adding 25,000 contracts. This capped upside expectations for IWM below 4.5% by June 14 expiration.

For put options, there was heavy selling of IWM 20240816 191.0 PUTs with a 191 strike, adding 35,000 contracts. This suggested expectations for IWM downside to be limited below 4.5% through August 16 expiration.

Comments