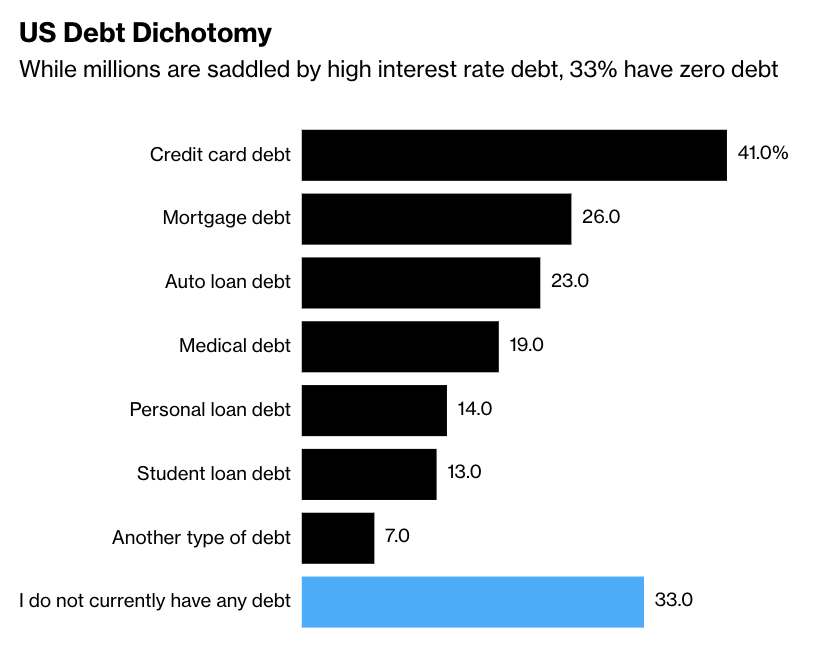

Recently, U.S. economic data has been more volatile, and the market has swung back and forth on the Fed's rate cut expectations as a result. Especially after the release of the latest employment data and inflation data, the market divergence is more obvious. Previously, the May nonfarm payrolls data significantly exceeded expectations, CPI 3.3 is also lower than the expected 3.4%, while the core CPI fell even faster.

Fed meeting highlights

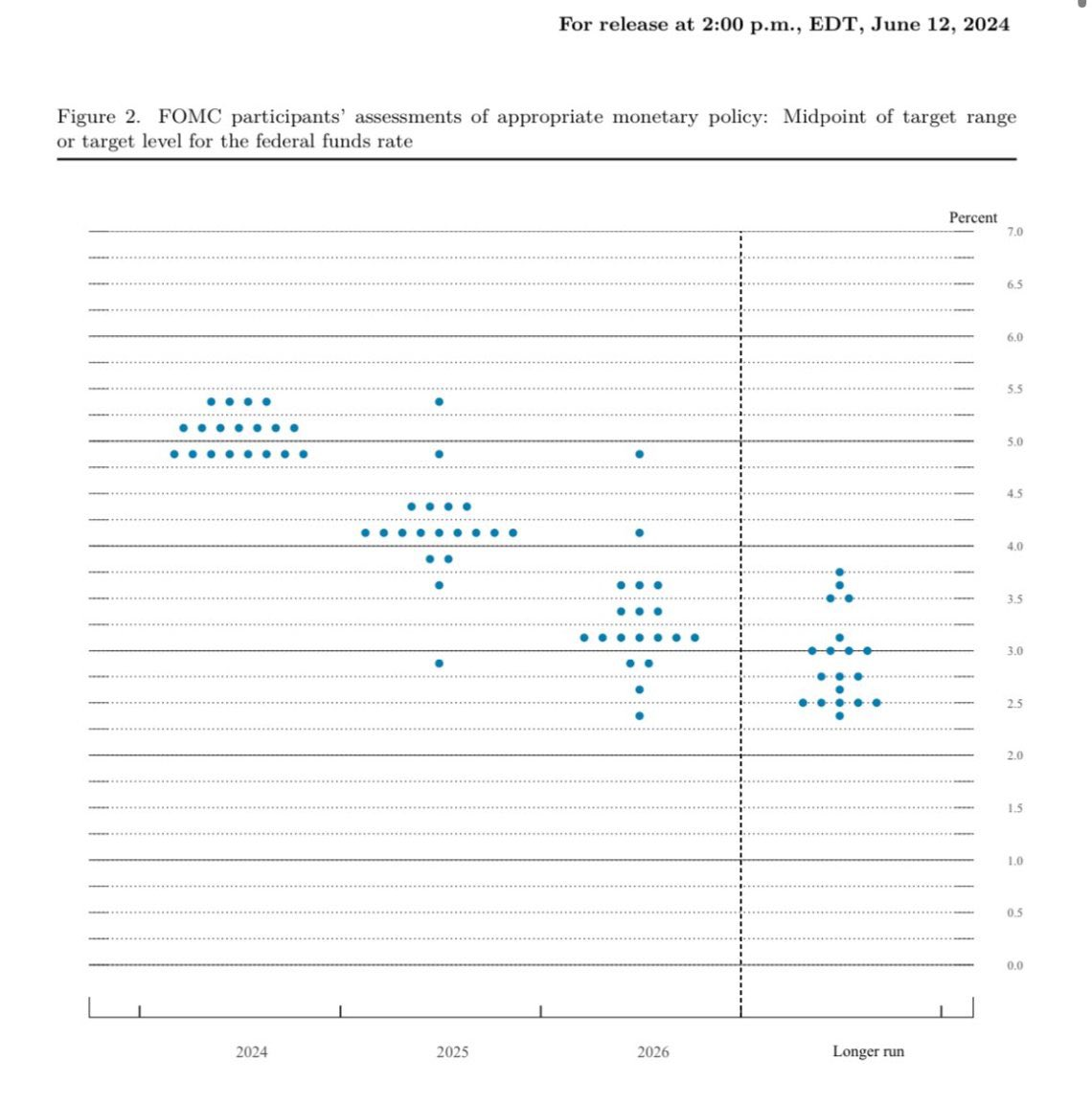

Bitmap Adjustment

The Fed adjusted its dot plot, reducing the number of rate cuts for the year to one from three in March, while the number of rate cuts for 2025 was revised upward to four from three. Overall, the number of rate cuts was reduced from six to five. Although the market is expected in September and December each have a rate cut, but the Fed chose "time for space" strategy, to avoid the market premature game rate cut expectations.

pace of contraction

The Fed guided at its May meeting that tapering would begin to decelerate in June, with Treasuries shrinking by $25 billion per month and MBS by $35 billion per month. This move was in response to the risk of a potential non-linear pullback in liquidity and to ease financial liquidity pressures

Powell's statement

Analysis of the path of interest rate cuts

Data dependency

In his post-meeting remarks, Powell emphasized that future rate cuts are dependent on data, particularly a pullback in inflation data. He said that despite stronger employment data, more evidence of falling inflation must be seen to confirm the rationale for a rate cut.

Economic expectations

The Fed has shown some caution in its expectations for the future economy, suggesting that they will continue to monitor changes in inflation and the job market and avoid premature or excessive policy adjustments.

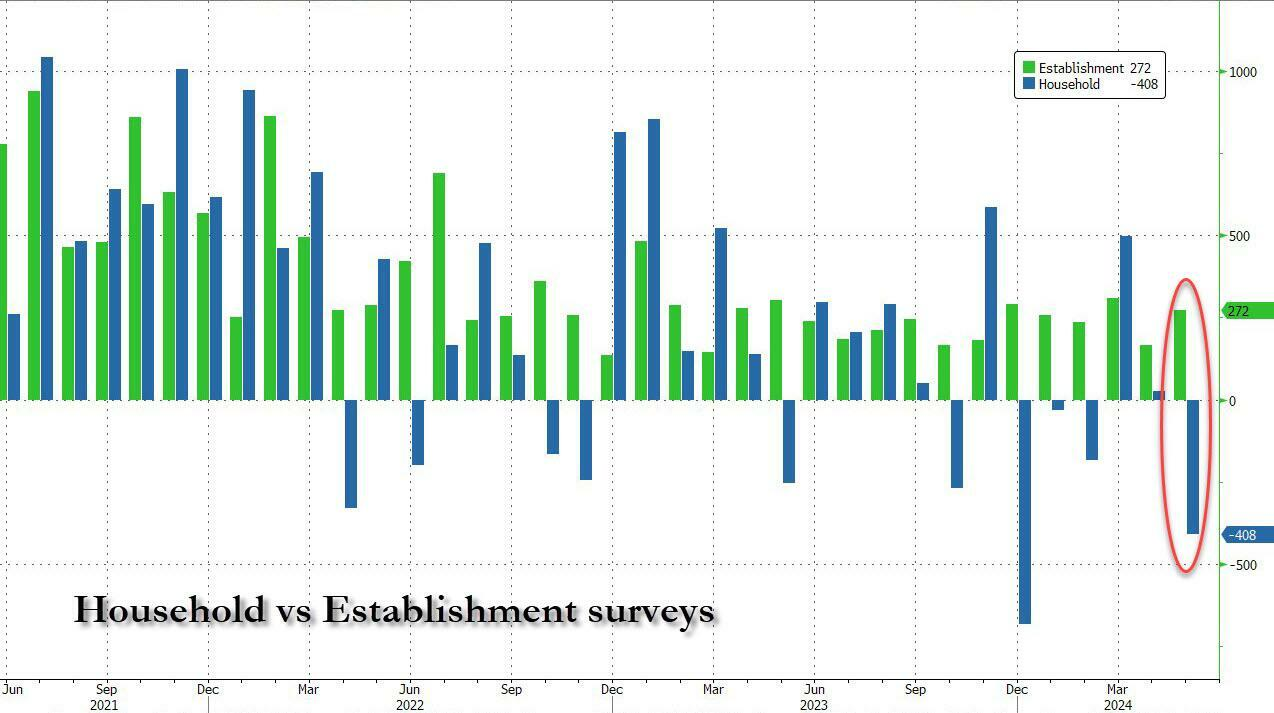

The durability of inflation and the resilience of the labor market will be key factors in determining the path of interest rate cuts. Powell also mentioned that the current labor market, while seemingly strong, there is a possibility that some of the data is overestimated.

market reaction

The market had a mixed reaction to this. On the one hand, some investors believe that the Fed's cautious attitude can prevent the market from overreacting, and on the other hand, some investors believe that it shows the Fed's concern about the economic outlook. Overall, the market's expectation of two rate cuts within the year may need to be adjusted.

Summary

This Fed meeting sent a message of restraint and was more hawkish than the market expected, but this hawkishness may have been intentional in order to prevent the market from gaming expectations of rate cuts in advance (but may have had little effect)

The third quarter is expected to be the key window, the annual rate cut in the range of 100 to 125 basis points. We renewing, the Fed's current hawkish stance is precisely to leave space for future dovish policy maneuvers.

Trends in asset classes

U.S. Bonds: There is a stage opportunity before the rate cut, but need to pay attention to the rhythm of trading. U.S. bond rates around 4% may be a reasonable level, short-term or in the range of 4.2% to 4.7% fluctuations. $iShares 20+ Year Treasury Bond ETF(TLT)$ $Direxion Daily 20 Year Plus Treasury Bull 3x Shares(TMF)$

Gold: Opportunities remain ahead of rate cuts with a pivot to $2,500/oz. Gold rises higher in the rate cut anticipation phase $SPDR Gold Shares(GLD)$

U.S. Stocks: Short-term may be shaky, but there is still upside for the whole year, with an expected upside of 5% to 7% at around 5500. Technology stocks have a relative advantage in the short term and will lead the broader market winds. $S&P 500(.SPX)$ $SPDR S&P 500 ETF Trust(SPY)$ $Invesco QQQ(QQQ)$ $NASDAQ(.IXIC)$ $NVIDIA Corp(NVDA)$ $Apple(AAPL)$

Dollar: Expect a range of 102~106, with the dollar likely to remain strong due to an earlier rate cut by the ECB and weaker economic fundamentals. $USD Index(USDindex.FOREX)$

Comments