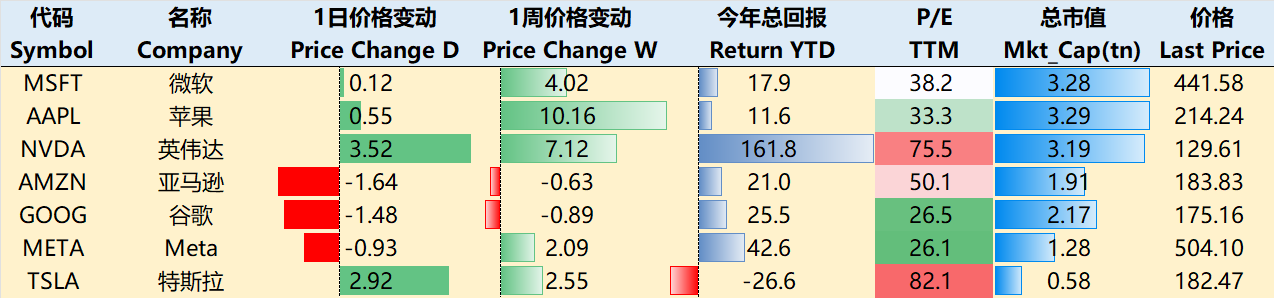

Big-Tech’s Performance

With tech stocks on the offensive and CPI cooling, the market ignored the bearishness and was certain of a bullish year, even with the Fed's reluctant hawkish stance.

Following this week's stock split, NVIDIA led AI-related tech companies to new record highs, and Apple broke through $210 in one fell swoop as it announced its partnership with OpenAI at WWDC, once again entering the $3 trillion club.

By the close of trading on June 14, the best performers over the past week were $Apple(AAPL)$ +10.16%, followed by $NVIDIA Corp(NVDA)$ +7.12%, $Microsoft(MSFT)$ +4.02%, $Tesla Motors(TSLA)$ +2.55%, $Meta Platforms, Inc.(META)$ +2.09%, $Amazon.com(AMZN)$ -0.63% and $Alphabet(GOOG)$ -0.89%.

Big-Tech’s Key Strategy

Who's next after the "3 Trillion Trio"?

Nvidia, Apple, Microsoft have stabilized three trillion market capitalization, but also wrapped up the two weeks of the big technology trading hot spots. So when should the "wind and water turn"? With the current strength of the seven giants, are likely to usher in a wave of fever at some point in the future.

The closest thing to a $3 trillion market cap at the moment is Google, which has been running almost sideways for two months after its late April earnings surge, and it's clear that the market is far less enthusiastic about Gemini than it is about ChatGPT.But more importantly

Even without using the Gemini Big Model, the Google Cloud Platform is still an important realization tool;

The main advertising business will still improve its realization efficiency with AI;

The new CFO has a strong focus on financial efficiency, and layoffs in the advertising department and cloud business are important manifestations of this.

Not coincidentally, META, on the other hand, has slowly risen back up after its earnings plunge at the end of April, mainly due to the fact that

The core business is super profitable and has over $30 billion in free cash flow to support the valuation;

Its Llama 3 major models are not the strongest, but the good thing is that they are open source, which lowers the threshold for developers to use them;

AI plus the ability to realize the advertising business, and the social media platform this hand is an important display of AI applications;

NVIDIA, which sells shovels, may have a head start, but hardware is cyclical, and software companies may have an easier time getting real estate over the long term.

The market focus is still on the hardware layer, with Google and Meta being the easiest and fastest aspects to commercialize;

If Google and Meta at the app level don't work, then the hardware cycle will be altered;

In terms of current valuations, only Google and META have dynamic price-to-earnings (TTM) ratios of under 30x among the Big Seven (26.5 and 26.1, respectively), and given NVIDIA's track record, it's about the same level in 2026. But if we consider the growth rate at the application level, perhaps these two companies are also essential to the asset portfolio.

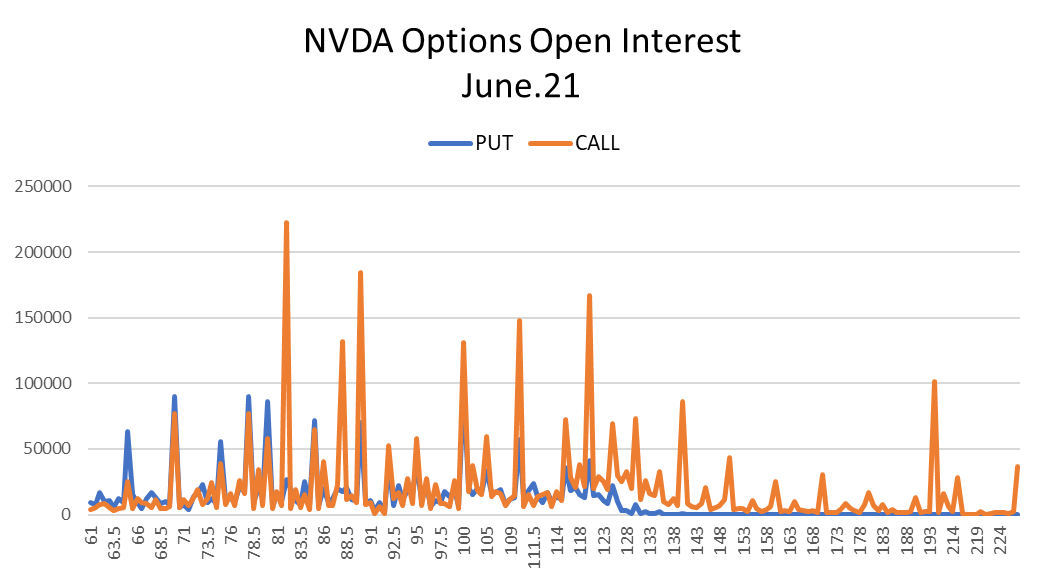

Big-Tech Weekly Options Watcher

Will NVDA pull back before the Quadruple witching day?

A number of investors may be comparing the TSLA post-split trend in 2021, which has pulled back roughly as much as 30% since the split. But the two are currently in different situations. For one thing, the fundamentals are far apart, AI is still in an accelerated uptrend period and is still in a state of oversupply, and also the macro is different.

June 21 monthly options, is another four witching day, as the overall market are at new highs, the game may also be more concentrated in Call, the overall single volume is much larger than Put, concentrated in the 120-130 position is also the most, but also indirectly indicates that the market sentiment is optimistic.

Big-Tech Portfolio

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly. The backtesting results are far outperforming the S&P 500 since 2015, with a total return of 1,960% and SPY returning 211% over the same period, a new record for excess returns.

The broader market hit a new high this week and the portfolio's year-to-date return hit a new high of 30.2%, outpacing the $SPDR S&P 500 ETF Trust(SPY)$ 's 14.5%.

The portfolio's Sharpe ratio for the past year was 2.7, while the SPY was 2.2 and the portfolio's information ratio was 1.9

Comments