$Nike(NKE)$ released an earnings report that didn't make investors too happy and had a less-than-optimistic outlook for the year ahead, which led directly to a sharp drop in the stock price.

Earnings Review

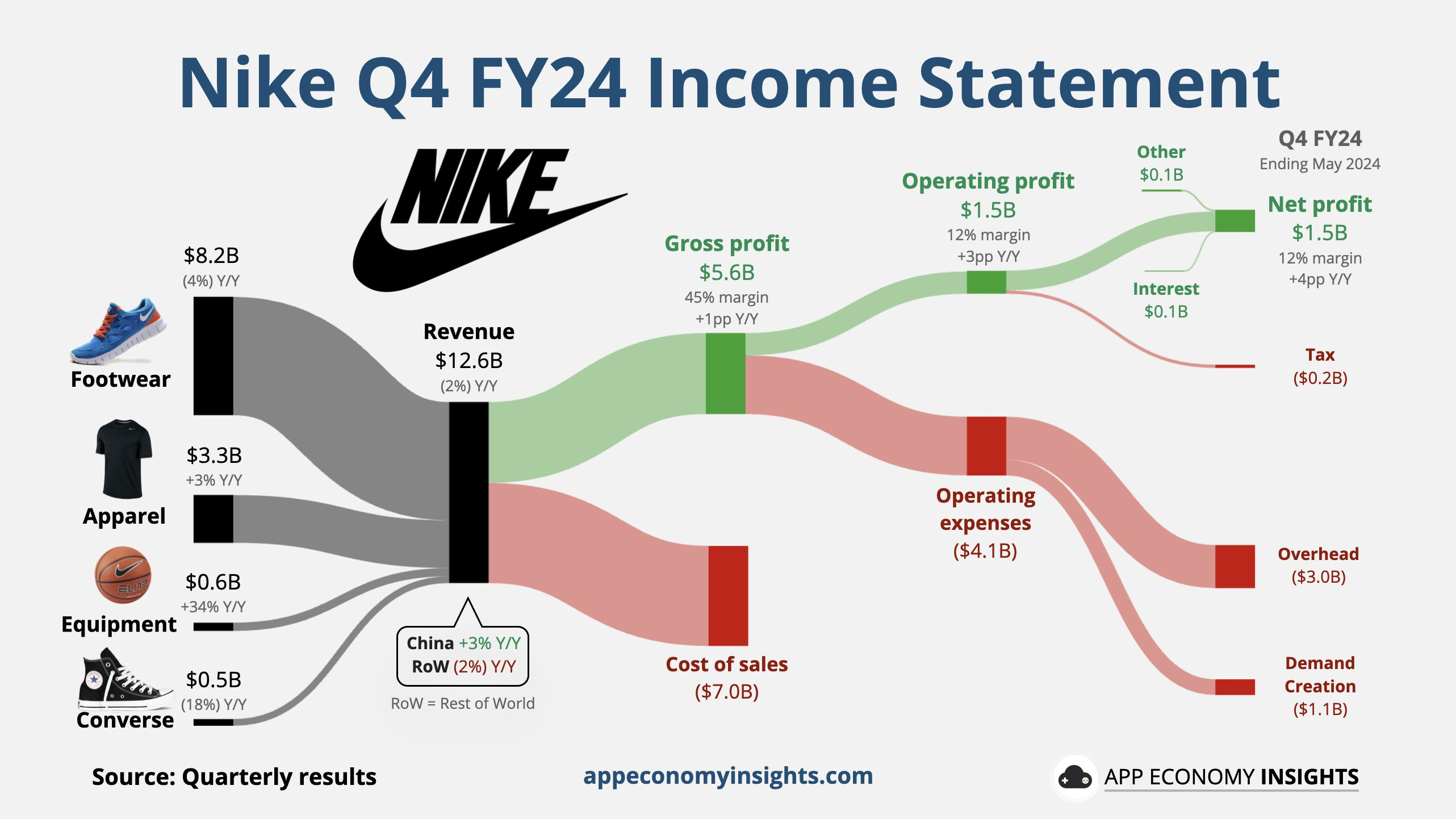

Overall revenue fell short of expectations. For the fiscal fourth quarter through the end of May, Nike's total revenue fell 2 percent to $12.6 billion, especially in its consumer sales business, where revenue fell 8 percent to just $5.1 billion.

Net profit fared moderately well, up 45% year-on-year to $1.5 billion.

For the entire fiscal year 2024, Nike's revenue of $51.36 billion is essentially the same as last year, making it the slowest year of annual revenue growth for Nike since 2010 (out of the epidemic).

Sales by channel, Nike branded sales declined 1%, Nike Direct revenue fell 8%, Converse sales fell 18% and wholesale sales fell 5%.

Regional sales, across all markets, Nike's performance was less than stellar. Revenue of $5.28 billion in North America, $3.29 billion in Europe, the Middle East and Africa, and $1.71 billion in Asia-Pacific and Latin America fell short of expectations.

By category, footwear sales in North America were down 6%, apparel was up 4%, equipment sales were up 47%, and total sales were down 1%; footwear sales in China were up 2%, apparel was up 5%, and equipment sales were up 28%, and total sales were up 3%; globally, footwear sales were down 4%, apparel was up 3%, and equipment was up 34% and Total sales declined 1 percent.

Nike had to cut its earnings guidance for fiscal 2025 due to declining sales in stores and online, as well as a downturn in the business of some of its classics, such as the Air Force 1. This directly led to the stock plummeting more than 12% in after-hours trading.

Investment Highlights

The main reasons for the slowdown in Q4 revenue growth include.

Lifestyle product line sales declined. Revenues were flat in the fourth quarter, primarily due to lower sales in the lifestyle product line, despite growth in the sports performance product line.

Increased macroeconomic uncertainty. The Company's management mentioned that it has lowered its guidance for FY2025 due to increased uncertainty in the macroeconomic environment.

Foreign Exchange Challenges. Fluctuating foreign exchange rates and an overly strong U.S. dollar negatively impacted the Company's revenues.

Direct channel sales decline. Nike Direct sales declined 7% in the fourth quarter, with Nike store sales down 2% and Nike digital channel sales down 10%.

Decrease in factory store traffic. The Company has observed a decline in factory store traffic in North America, reflecting increased pressure on price-sensitive consumers.

Outlook of FY2025, the expected decline in revenue is based on the market environment and the company's strategy, the company will take measures to control costs and improve gross and net profit margins.

Meanwhile, the market situation varies in different regions, and sports performance products will remain the focus, and the company will make adjustments to the lifestyle product line will be adjusted. In addition, new product launches will be based on market demand and trends, and innovations will help boost sales and brand image.

Management remains confident in the Company's recovery plan, focusing on the following areas.

Focus on consumer needs

Increasing the proportion of full price sales

Maintaining brand health

Optimization of market capacity

Comments