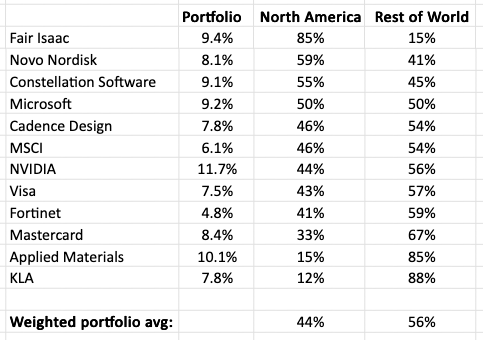

10 of the 12 companies I invest in are listed in the US.

But only 44% of their revenue is derived from North America.

$Fair Isaac(FICO)$ has the most US exposure, while $KLA-Tencor(KLAC)$ has the least (27% China, 24% Taiwan, 18% Korea).

You can be globally diversified just by owning US stocks.

$Fair Isaac(FICO)$ $Novo-Nordisk A/S(NVO)$ $Constellation Software, Inc.(CONSF)$ $Microsoft(MSFT)$ $Cadence Design(CDNS)$ $MSCI Inc(MSCI)$ $NVIDIA Corp(NVDA)$ $Visa(V)$ $Fortinet(FTNT)$ $MasterCard(MA)$ $Applied Materials(AMAT)$ $KLA-Tencor(KLAC)$

Image

Image

https://x.com/long_equity/status/1807141570854138108

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Image

Comments

Repost