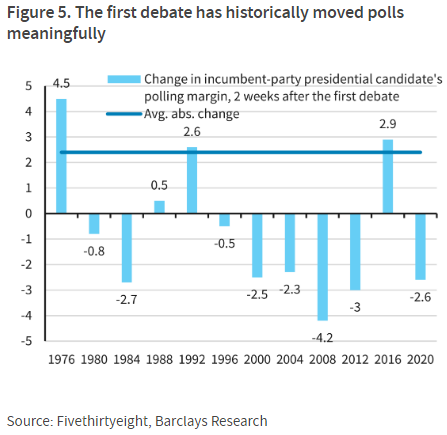

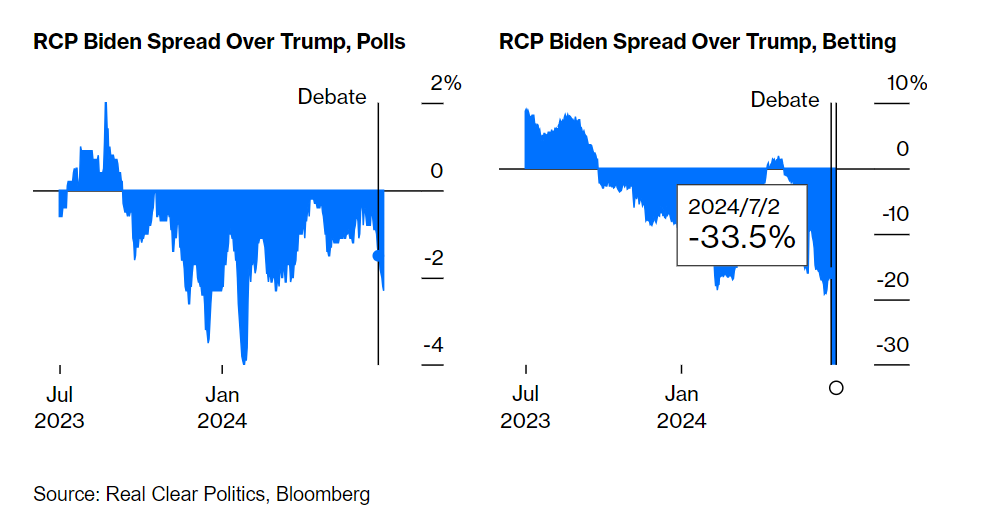

U.S. political scene has been in turmoil, with rumors that incumbent President Joe Biden may not run in the next presidential election after slipping in the polls following the last debate.

According to internal White House sources, Biden's health and intra-party pressure have become major considerations.However, Biden joined an online meeting with his campaign team that day and said during the meeting, "I'm running for office and no one can get me out. I'm not going to quit, but I'm going to campaign to the end and win."

The analysis pointed out that whether Biden withdraws from the election, the short-term impact on the market may be mainly reflected in the following aspects:

First, the change in policy expectations The Biden government's economic policies, including infrastructure development, large-scale fiscal stimulus and green energy investment, has been the focus of market attention.If Biden withdraws from the election, the continuity and implementation of these policies will become unknown.The market is concerned that the new president may adjust or slow down these policies, thus affecting the prospects of related industries.

Second, the uncertainty of international trade After Biden came to power, he readjusted the U.S. international trade policy, especially in the trade relationship with China.If Biden withdraws from the election, the market will reassess the future direction of U.S.-China trade policy, which will have a significant impact on the global trade environment, which in turn affects the performance of related companies.

Third, the variables of the corporate tax reform plan The Biden government's corporate tax reform program, including raising the corporate tax rate and strengthening tax administration, is an important part of its economic policy.Biden's withdrawal could cause these tax reform programs to run aground or be revisited, which in turn could have a significant impact on corporate profitability and stock market valuations.

Meanwhile, a strong Trump return could bring about a number of policy changes.

Trade policy: Trump plans to impose benchmark tariffs of 10% on global goods, especially on Chinese goods up to 60%, to protect U.S. industries.

Tax policy: proposes to further reduce the corporate income tax rate from 21% to 15%, continuing his line of tax cuts.

Investment policy: support infrastructure investment and U.S. manufacturing, and promote the development of high-tech fields.

Immigration policy: favors skilled immigration while severely restricting illegal immigration.

Energy policy: supports traditional energy industries and may reopen oil and gas exploration.

Trump's policies could lead to slower economic growth and increase pressure on the job market while pushing up inflation.Of course, tax cuts may boost corporate earnings, but they may also exacerbate fiscal deficits.

From Investment perspective

Optimism and pessimism are mixed Different market participants have divergent expectations about Biden's exit.Some optimists believe that Biden's exit could lead to new economic policy opportunities, particularly in the areas of promoting economic growth and innovation.Pessimists, on the other hand, worry that increased political uncertainty will lead to increased market volatility and dampen investor confidence.

Whether Biden ultimately withdraws from the race will depend on a number of factors, including his health, party support and public opinion.During this period, the market will remain highly sensitive and any relevant news may trigger new volatility.Investors need to monitor developments closely and take appropriate risk management measures.

$USD/JPY(USDJPY.FOREX)$ $US10Y(US10Y.BOND)$ $US20Y(US20Y.BOND)$ $iShares 20+ Year Treasury Bond ETF(TLT)$ $S&P 500(.SPX)$ $SPDR S&P 500 ETF Trust(SPY)$ $Invesco QQQ(QQQ)$ $ProShares UltraPro QQQ(TQQQ)$

Comments