Big-Tech’s Performance

On July 11th, the Nasdaq gave back a week's worth of gains after hitting two straight new highs.In the past week, the technology giants took turns to hit new highs, but in the unexpected cold CPI index came out, the market pricing rate cuts are expected to be more, but the funds flow back to small-cap stocks, but also to a certain extent balanced the head of the individual equity weighting "over-concentration" of the problem.

Will this be the second half of the overall trend? Or is it a blip? The key is still to see how the rate cut is expected and lands.

The best performers over the past week through the July 11 close were $Apple(AAPL)$ +2.72%, $Meta Platforms, Inc.(META)$ +0.54%, $NVIDIA Corp(NVDA)$ -0.69%, $Alphabet(GOOG)$ $Alphabet(GOOGL)$ -0.13%, $Amazon.com(AMZN)$ -1.29%, $Microsoft(MSFT)$ -1.32%, and $Tesla Motors(TSLA)$ -2.18%,.

Big-Tech’s Key Strategy

How do you deal with the increased volatility of too much concentration?

Concentration in the US stock market has been rising over the past decade, with the top 10 companies in the market accounting for nearly 27% of market capitalization by the end of 2023, and by the end of June 2024 it had reached 29.7%, while the last time it reached such a high level was 1963, when it was the giants of telecoms, oil stocks, IBM, and so on.

Globally, the U.S. market does not have the highest level of concentration, but rather economies with incomplete industry chains, especially those dependent on a few large companies, have much higher levels of concentration.

Whether high concentration is justified depends on whether the market capitalization of these large companies at the head reflects the prospects for value creation.For example.

Economic Profit. The top 10 U.S. companies in 2023 account for 69% of the index's total economic profit compared to 27% of its market capitalization.

Future Expectations.Magnificent Seven is also spending far more on capital expenditures (mainly on AI) than any other company.

But the risks of high concentration are also clear.

Increased volatility. on July 11, leading declines in Tesla, Nvidia and other large tech stocks caused Magnificent Seven to evaporate $623 billion in market capitalization, the largest one-day market cap on record.

Difficulty with active management has resulted in a passive increase in tech equity weightings. A small number of stocks have played a dominant role in overall market performance, making it difficult for actively managed investors to outperform indices benchmarked against these stocks.Cathie Wood is one of them, and the Ark fund, which invests in innovative companies, has significantly underperformed the broader market this year, with more outflows.And those outflows are chasing headline stocks, further increasing concentration.

How do you deal with the risks associated with high concentration?

Diversification.Focus on sectors outside of headline tech companies, but also on stocks in sectors with strong fundamentals and relatively strong stock prices as well.

Reduce the cost of capital in headline concentrated stocks.Allocation using derivatives, ETFs, etc. to reduce cost of capital and increase utilization.

Volatility hedging with derivatives.In addition to hedging directly, for example, buying PUTs when market concentration is highest is often also when implied volatility is relatively highest, and this is the time to trade derivatives through the seller to gain volatility and thus offset some of the pressure from volatility.

Big-Tech Weekly Options Watcher

Tesla's options are very responsive to market sentiment.

Tesla had a big pullback this week after three days of Squeeze, but options are still Calling more volume, and the July 19th expiration month option position is also around 270.As the stock becomes more volatile, Covered Calls become more cost-effective, with open interest currently increasing in positions above 250.

Big-Tech Portfolio

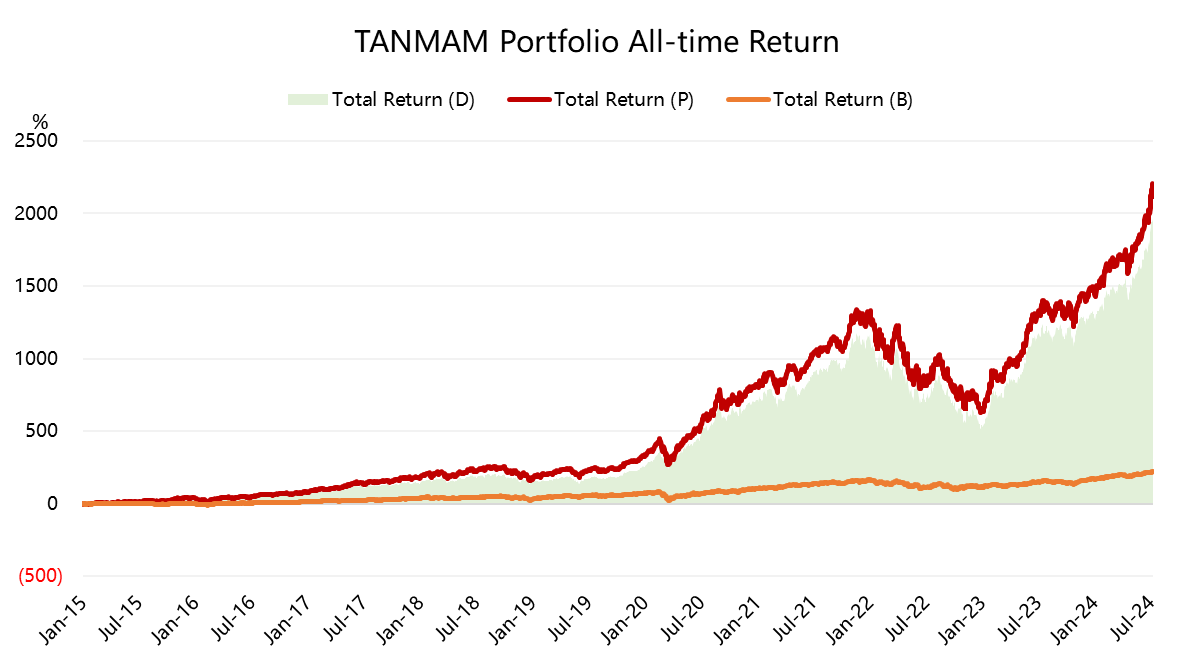

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are a far outperformer of the S&P 500 since 2015, with a total return of 2115%, while the $SPDR S&P 500 ETF Trust(SPY)$ returned 220% over the same period, before pulling back after hitting record highs.

This week the broader market hit a new high and the portfolio's year-to-date return hit a new high of 40.03%, outperforming the SPY's 17.82%.

The portfolio's Sharpe Ratio for the past year is 2.5 compared to SPY's 1.9 and the portfolio's Information Ratio is 1.9

Comments