A growing number of Wall Street economists are warning that,The Federal Reserve has waited too long to reverse course after raising interest rates to their highest point in two decades.

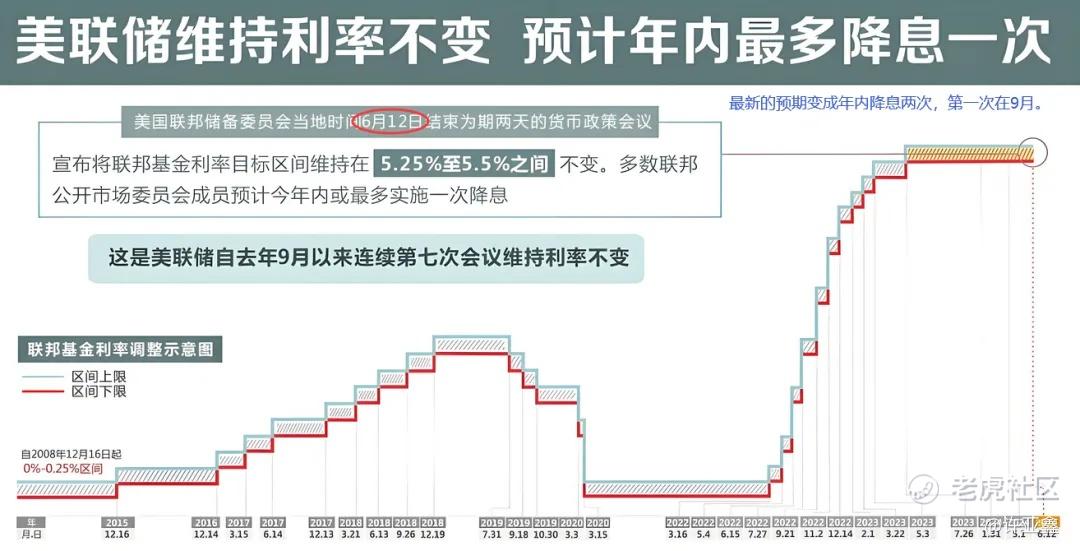

At present, the market generally expects that the FOMC will keep the benchmark interest rate stable for the eighth consecutive time at its July meeting, which marks one year since the FOMC has maintained the current interest rate target range of 5.25% to 5.5%.However, for September, the market has unanimously expected that this is the most likely time node for the Federal Reserve to cut interest rates.

I once mentioned that Federal Reserve Chairman Powell's dovish stance actually means that the Federal Reserve has given up its 2% inflation target, and interest rate cuts are already the next event with a high probability. The recent plunge in the US dollar and the rise in gold and silver, In fact, they are all pricing for this matter.

Of course, apart from the expectation of interest rate cut, the fluctuation in the financial market was the result of the gunshot in Pennsylvania, which made the market funds begin to bet on Trump's return to the top of the White House.

When Trump was interviewed by the media before, he summed up his own economic policy as "low interest rate + low taxes + high tariffs". Such a policy agenda is generally unfavorable to the US dollar and beneficial to gold.

New York Fed President Williams, the "three in command" of the Federal Reserve, hinted that if inflation continues to slow in the near future, there may be reasons to cut interest rates in the coming months, but not at the Fed meeting in two weeks.

The new york Fed president also said that there are signs that the U.S. labor market is gradually cooling down. His remarks indicate that there are signs that the situation in the U.S. labor market is gradually cooling down,The Federal Reserve may consider cutting interest rates when it meets in mid-September, provided there are no major surprises in the economic situation.

Trump's Treasury Secretary candidate and JPMorgan Chase CEO Dimon said the Federal Reserve should be patient when it adjusts interest rates next time to take into account the possibility of inflation rising again in a volatile world.

Federal Reserve Governor Waller just said that the most likely direction of monetary policy is to cut interest rates. As a hawkish representative within the Federal Reserve, Waller's recent remarks suggest an open stance on the Federal Reserve's interest rate cut in September to maximize the chances of a soft landing for the economy.

"While I don't think we have reached the end goal, I do believe that we are getting closer to the point where a policy rate cut is justified."

His latest speech represents a significant change from two months ago,At the time he hinted that the Fed didn't need to cut interest rates until December, and now he's clearly open to a September rate cut.

To sum up, the Federal Reserve's first interest rate cut in September has become imminent and has to be launched.

-END-

$NQ100 Index Main 2409 (NQmain) $$Dow Jones Index Main 2409 (YMmain) $$SP500 Index Main 2409 (ESmain) $$Gold Main 2408 (GCmain) $$WTI Crude Oil Main 2408 (CLmain) $

Comments

It is currently expected that Trump will win the election. If you were Powell, what would you do?