$Microsoft (MSFT)$ reported FY24 Q4 Earnings after July 30th.

The overall performance is still very strong, but it falls short of being a surprise as market expectations are also more plentiful.Coupled with the cloud business Azure's growth rate can not always chicken blood, the market is worried about the growth rate decline; and on the other hand, the company maintains high capital expenditure (CapEx), but has not yet seen the same amount of real money returns, naturally, the next fiscal year's profitability has an impact.

Therefore, the after-hours performance reflects this earnings season investors both "fear(plunge to -8%)" and "greed (pulled back to -3%) characteristics.

Investment highlights

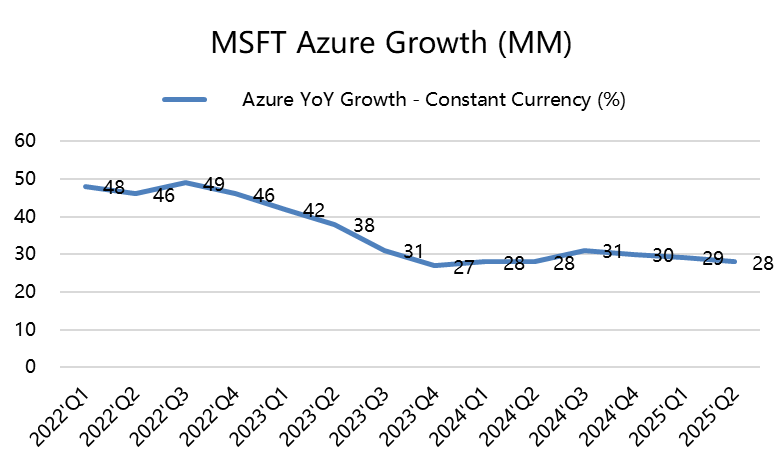

Azure growth slowed.The -8% at one point after the bell was largely related to this as well

Azure growth has slowed and is the main reason for investor disappointment and a likely belief that revenue from AI is slowing down.Q4's Azure revenue growth of 29% year-on-year (30% in constant currency) was below the consensus estimate of 30%-31%.Azure growth is expected to slow further to 28%-29% in the next quarter.

The company said on the call that the slowdown in Azure growth is mainly due to optimization spending and macroeconomic factors in some regions, while AI-related business growth is strong, and the decline in Azure growth is mainly due to late-stage weakness in some markets in Europe, which is not related to AI.However, it is currently limited by supply capacity.Azure growth is expected to re-accelerate in the second half of fiscal 2025 as AI infrastructure expands.

So now the question is whether investors will buy into the company's explanation

Capex increase further.

Capex in FY24Q4 rose further to $19bn, up 77% YoY and 36% YoY, a figure that also pulled down overall free cash flow, posting its first YoY decline in 5 quarters and falling short of expectations.

If capex is too high and exceeds expectations, there's a high probability that it will pull down margins in the upcoming fiscal year.

The market's concern is that so much capex, invested in the name of AI, doesn't end up delivering at least an equal return, or even disproves it to some extent, and that would be extremely detrimental to the company's future growth.

Overall financial performance

FY24Q4 revenue reached $64.7 billion, up 15% year-on-year (up 16% at constant exchange rates), essentially unchanged from expectations

Operating profit of $27.9 billion, up 15% (up 16% at constant exchange rates), ahead of market expectations of $27.6 billion.

Earnings per share of $2.95, up 10% year-over-year (up 11% at constant exchange rates), unchanged from expectations;

Capital expenditures were $13.87 billion, up 55% year-over-year and above market expectations of $13.27 billion.

Comparable free cash flow was $18.3 billion, down 13% year-over-year and below market expectations of $19.7 billion;

Business Segment Performance

Productivity and Business Processes segment revenue of $20.3 billion, up 11 percent

Intelligent Cloud segment revenue of $28.5 billion, up 19 percent

More Personal Computing segment revenue of $15.9 billion, up 14 percent

Key growth businesses

Microsoft Cloud quarterly revenue reaches $36.8 billion, up 21% year-over-year

Azure and other cloud services revenue up 29 percent

Office 365 Business Edition revenue up 13%

LinkedIn revenues increased 10%

Xbox content and services revenue up 61%, primarily from the Blizzard acquisition

Full Year Results.

FY2024 full year revenue of $245.1 billion, up 16% year-over-year

Full-year operating profit of $109.4 billion, up 24%.

Full-year net profit of $88.1 billion, up 22%.

Remaining focus of attention

1. AI's contribution to revenue.

AI has been a key driver of Azure growth, contributing about 3 percentage points of growth.

Adoption of Copilot for Microsoft 365 is accelerating, with customer growth of over 60%.

GitHub Copilot has become a major source of revenue growth for GitHub, accounting for over 40% of its growth.

2. Cost Management and Profitability

The company is aggressively investing in AI infrastructure, but is also optimizing its cost structure.

It expects to realize economies of scale and improve margins in the long term.

There may be some volatility in the short term, but the company is confident of long-term margin improvement.

3. Copilot Pricing Strategy

Copilot adopts a tiered pricing strategy to meet the needs of different customers.

It currently focuses on large enterprise customers and will expand into the SME market in the future.

Pricing will be based on the value customers receive, not just the cost.

4. Gaming Outlook

The integration of Activision Blizzard is progressing well and is expected to deliver significant synergies.

Game Pass subscription growth is strong and the content library is expanding.

The company is optimistic about the long-term growth potential of its gaming business, especially in cloud gaming and cross-platform.

Overall, analysts focused on Azure growth, AI business development, cost management, and the newly acquired gaming business. microsoft emphasized the positive impact of AI across all lines of business, and said it is balancing short-term investments with long-term growth.The company remains optimistic about its future prospects, especially in the areas of AI and cloud computing.

Comments