Since Mars broke the news in April that it was in advanced acquisition talks with $Kellogg's (K)$, Hershey has also expressed interest in Kellanova.The potential deal could be a major consolidation in the food industry this year.

Kellanova, the snacks business unit spun off from Kellogg, has several well-known brands such as Cheez-It, Pringles and Pop-Tarts.

$Hershey(HSY)$ is known for its chocolate and candy products, including brands such as Reese's, Kit Kat and Twizzlers.

Mars has equally well-known brands including Dove, M&M and Snickers.

While Mars appears to be in the lead in acquisition talks, Hershey also said.This suggests that Kellanova's value in the snack food market is recognized by several large food companies.Additionally, companies including Mondelez International (MDLZ) and PepsiCo (PEP), among others, are interested in joining the buyout fray.

The WSJ said the potential acquisition could be valued at $30 billion, while Kellanova's parent company, K, had a market capitalization of just $25 billion after the close of trading on Aug. 5, leaving room for upside.

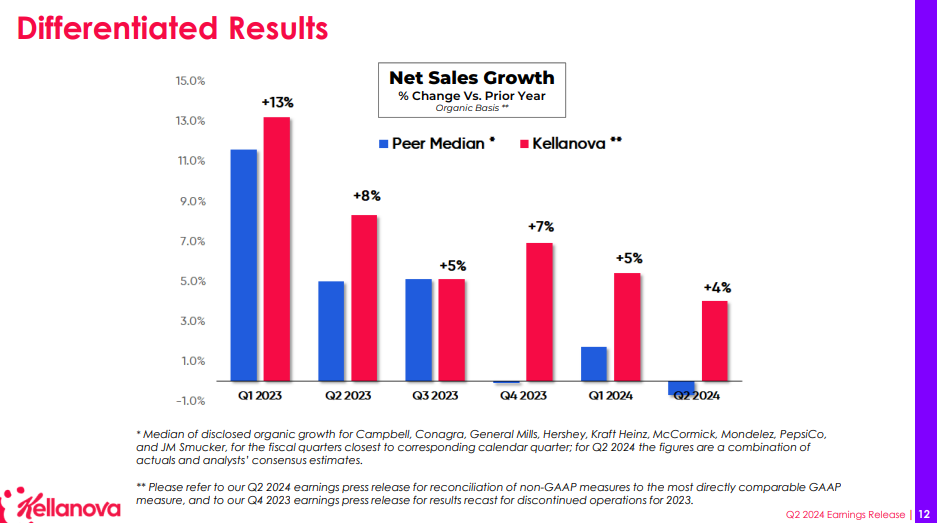

It just so happens that K reported its 24Q1 results a few days ago, and it's still doing well at a time when the consumer goods industry as a whole is trending downward.

Overview of Q2 2024 results

ORGANIC SALES GROWTH: Overall Q2 revenue of $3.19 billion was down 4.8% year-on-year, primarily due to foreign exchange gains and losses and the impact of the divestiture of the Russian business.However, organic sales grew 4% and North American sales also grew slightly, in line with the company's long-term target range.

ADJUSTED OPERATING PROFIT: Operating profit increased 21% year-over-year and 16% year-over-year on a constant currency basis, driven primarily by organic sales growth and continued margin improvement.Adjusted to exclude one-time charges, operating profit increased 13%, up 16% year-over-year at constant exchange rates.

Earnings per share: up 14% year-on-year at constant exchange rates.

Free cash flow: continued to increase year-over-year.

Gross margin: Q2 gross margin up ~340 bps y/y.

Guidance: full year organic sales guidance was raised to 3.5%+ and EPS of $3.65 to $3.75, above the market consensus estimate of $3.62.The company is steadily moving toward operating margin guidance of over 14% by 2024 and 15% by 2026.

Investment Highlights

The company returned to its normal schedule of innovation launches with a number of innovative products such as Pringles Mingles in North America and Cheez-It in Europe, and expects the contribution of innovation to sales to return to normal levels this year.

Gross margin continued to improve beyond expectations, benefiting from productivity gains and easing raw material cost inflation

Profit growth and margin improvement despite double-digit brand investment increases

Improved free cash flow expectations to just over $1 billion and continued reduction in net debt, maintaining good financial flexibility

Comments