$Cisco (CSCO)$ reported its Q4 FY24 results after the U.S. stock market closed on Aug. 14, with the company posting a strong Q4 performance, boosted by AI demand and additional gains from the Splunk acquisition.At the same time, the company also raised its guidance for FY2025 due to optimistic expectations for order growth.

CSCO was up over 6% at one point after hours.

Earnings Overview.

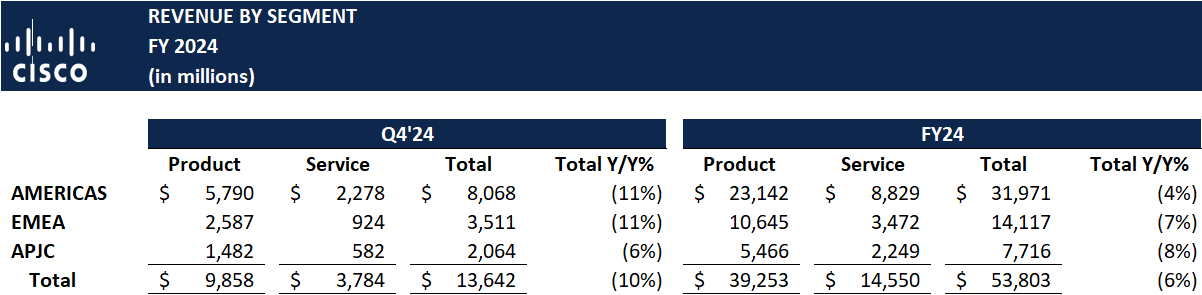

Revenues for Q4 of FY24, which ended July 27, totaled $13.64 billion, down 10% year-over-year but still ahead of market expectations of $13.54 billion, with the acquisition of Splunk contributing $960 million to the quarter.

Total product orders grew 14%, or 6% excluding Splunk.

Annual Recurring Revenue (ARR) reached $29.6 billion, up 22%.

Subscription revenue accounted for 56% of total revenue, demonstrating a continued growth trend.

Earnings per share were $0.87, ahead of the market consensus estimate of $0.85.

Full-year FY2024 revenue was $53.8 billion, down 6% year-over-year, and GAAP adjusted earnings per share (EPS) was $3.73, down 4% year-over-year.

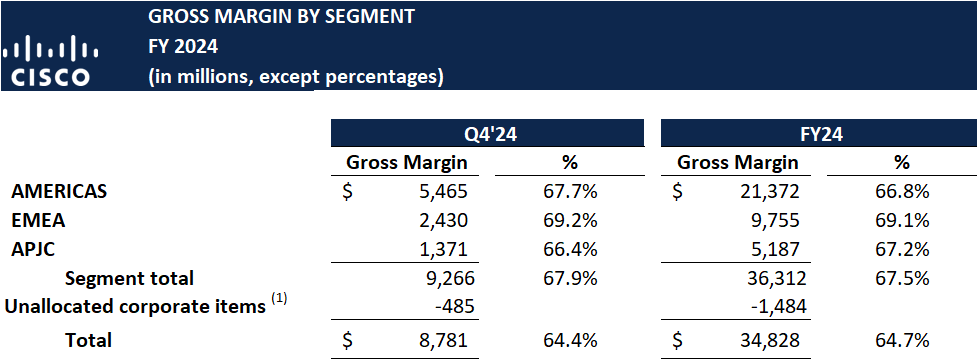

In terms of guidance, the company expects FY25 revenue of $55 billion to $56.2 billion, higher than the market consensus estimate of $55.67 billion, and gross margin of 67.5%, higher than the expected 67.1%.The midpoint of the Q1 estimate is $13.75 billion, above the consensus of $13.71 billion.

Investment highlights

AI Investment.

The CEO said Q4 saw steady customer demand and business order growth as customers rely on Cisco to connect and protect all aspects of their organizations in the age of AI.Customer demand showed balanced growth across regions, particularly in the Americas and Europe.Customers are actively investing in AI and network modernization despite going through a period of inventory digestion, demonstrating trust in Cisco technology

AI orders with large-scale customers have exceeded $1 billion, with an additional $1 billion in orders for AI products expected to be added in fiscal year 2025.At the same time, Cisco will continue to invest in AI, cloud and cybersecurity, emphasizing the market opportunity for AI infrastructure and Cisco's competitive advantage

Layoffs and Reorganization Plan

The company continues to expand layoffs, a restructuring plan aimed at investing in key growth opportunities and improving business efficiencies that will affect about 7% of Cisco's global workforce, or more than 6,300 people who will be laid off.This is the second round of major layoffs announced six months after the announcement in February that it would cut about 5 percent of its workforce, affecting more than 4,000 jobs.The company says the move will result in about $1 billion in short-term layoff costs.

Integration with Splunk

The acquisition of Splunk enables Cisco's security products to achieve more comprehensive observability, with Splunk's AI platform unifying data from security, IT, and engineering teams on a single platform to provide a comprehensive view across environments.At the same time, integrating Splunk's security incident investigation and efficient detection mechanisms, Cisco's security products can respond more quickly to potential threats.And Cisco plans to utilize Splunk's AI capabilities to improve the efficiency of security analysis.

Changing market demand

The company said that order growth for security products was strong, particularly in the areas of network security and SASE (Secure Access Service Edge), demonstrating customer demand for enhanced digital resilience.

Comments