$PDD Holdings Inc(PDD)$ plunged the second day, on the one hand, the analysts of large banks have felt that the current plunge is a little over the top, the camel is bigger than a horse, on the other hand, the institutions also take the lead in the wildly throw, after 30 points may as well fall 10 points, hard to the management on the lesson.

$Morgan Stanley(MS)$ : Who said long-term profitability is down?

$Citigroup(C)$ : management's self-defeating expectation management, and it's only going up when the bearishness is out of the way

$Goldman Sachs(GS)$ the target price has not yet taken into account the valuation of Temu ......

The most honest of all is the options investor, because options are not just about being "long" or "short", but also about the target price.Two days after the crash, options position feedback how to change?

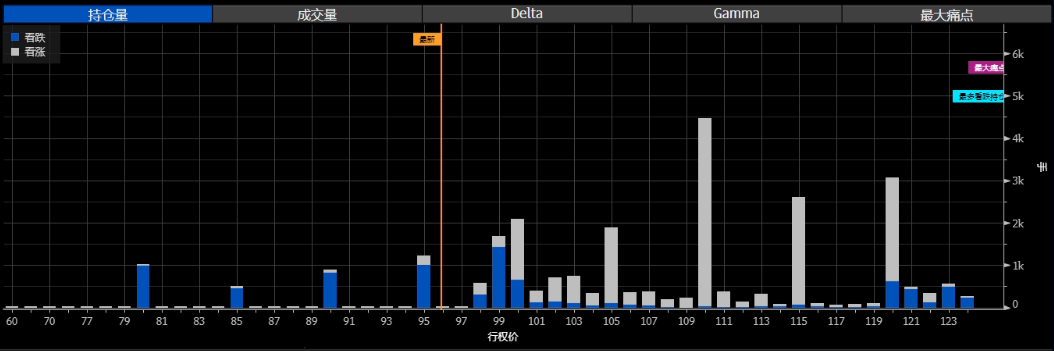

August 30th.

Doomsday options due the week of the earnings report, there are basically no Calls under 100 at this point, 110 has the most Covered Calls, and the rally is not looking good to get past this position.And 90 and 95 have the most PUTs, a position that is still mostly long for bottoming after the earnings plunge (Sell PUT).

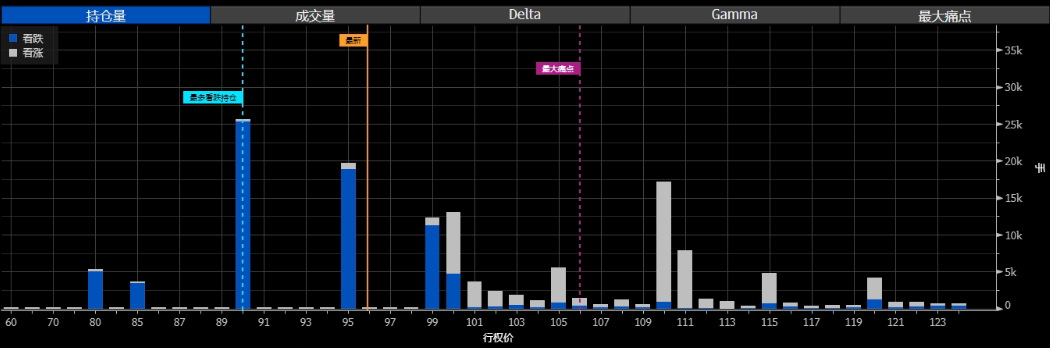

September 6th.

The week after earnings, Covered Calls were highest at 110 and 115, also reflecting the mindset of some investors with positive positions, while PUTs were relatively even, instead there were still some longs trying to gamble on PUTs at 100.

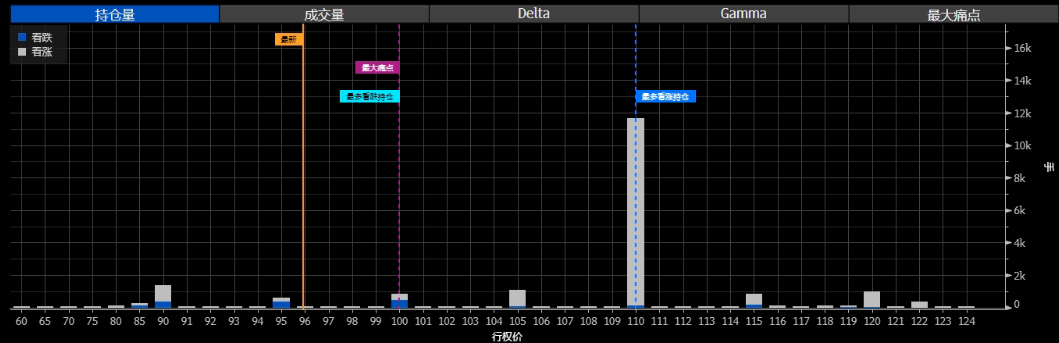

September 13th

Basically no trades, except for more Covered CALL at position 110.

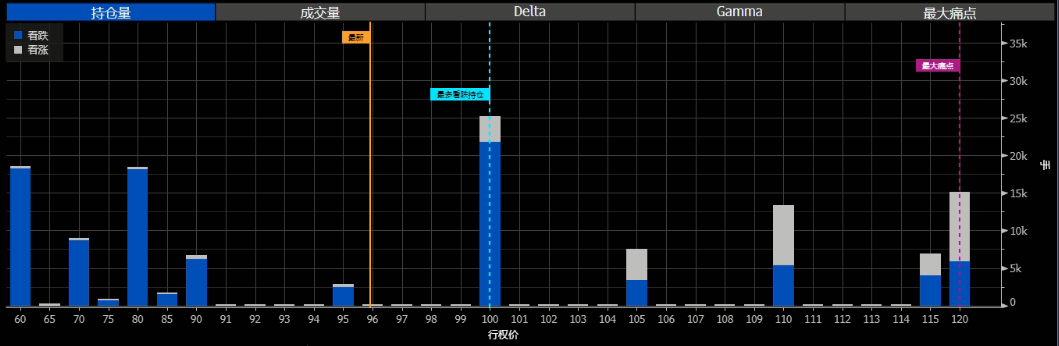

September 20

This is the September monthly options, Covered CALL distribution in the 110-120, but there are large orders in the 60 and 80 position placed a lot of PUT, but the most is still 100 PUT, new large orders also have, and the previous order is also more, after all, it is a monthly option, many investors are actually very early to "100 plunge PDD"The.

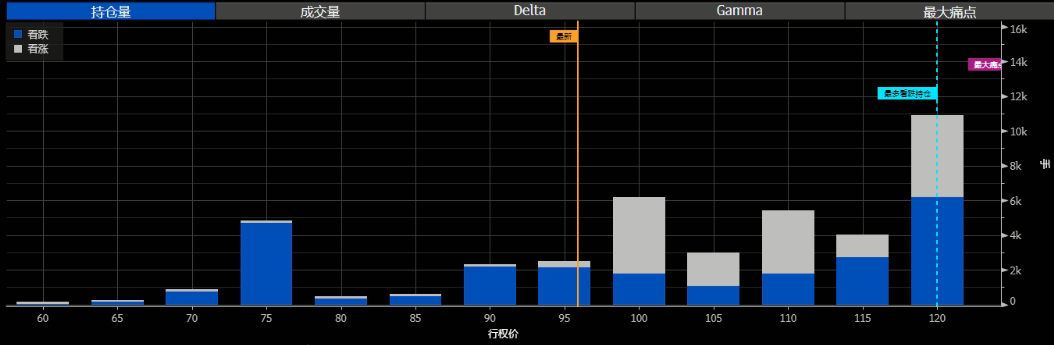

October 18th.

For October monthly options, there were quite a few additions of Covered CALL at the 100, 110 and 120 positions, which appears to be a large investor who thinks this position has a long way to grind.

But at the same time, there are quite a few new PUTs in the 90 and 95 positions, although the biggest addition is still in the 75 PUT, which is relatively more robust.

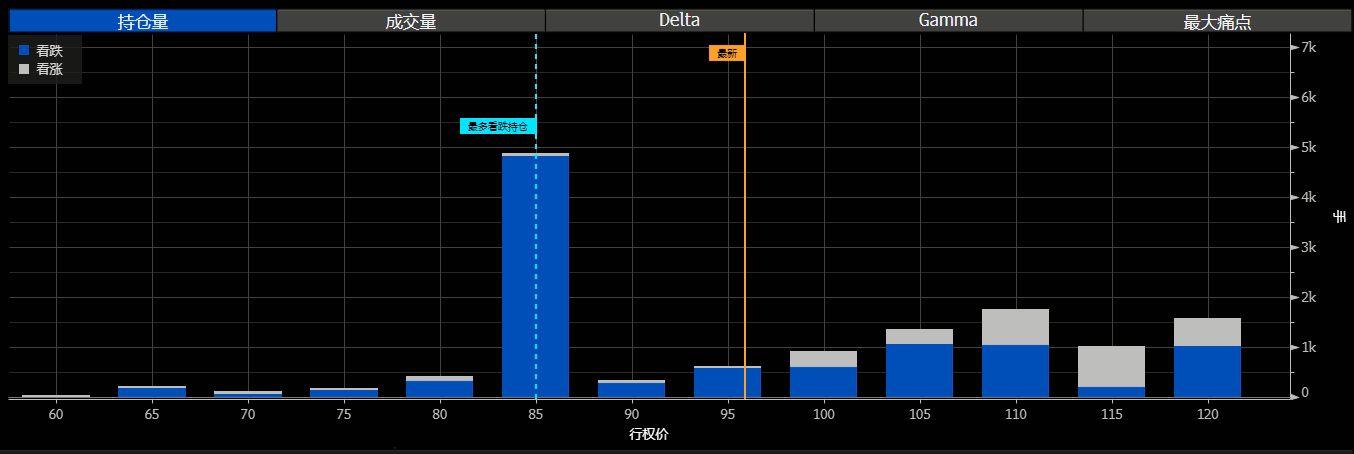

December 20th.

For the end of the year four witching days of options, the largest new order was for the PUT in the 85 position, which doubled in volume.

Taken together, options investor sentiment reacted to the fact that the PDD could last for some time in the 90-110 position.

Comments