$ulta beauty(ULTA)$ reported its first earnings report after becoming Warren Buffett's newest position, and as overall results and guidance fell short of market expectations, it plunged 8% after hours, with investors exclaiming, "Did Warren Buffett look away?

Performance summary

Revenue and profit missed expectations

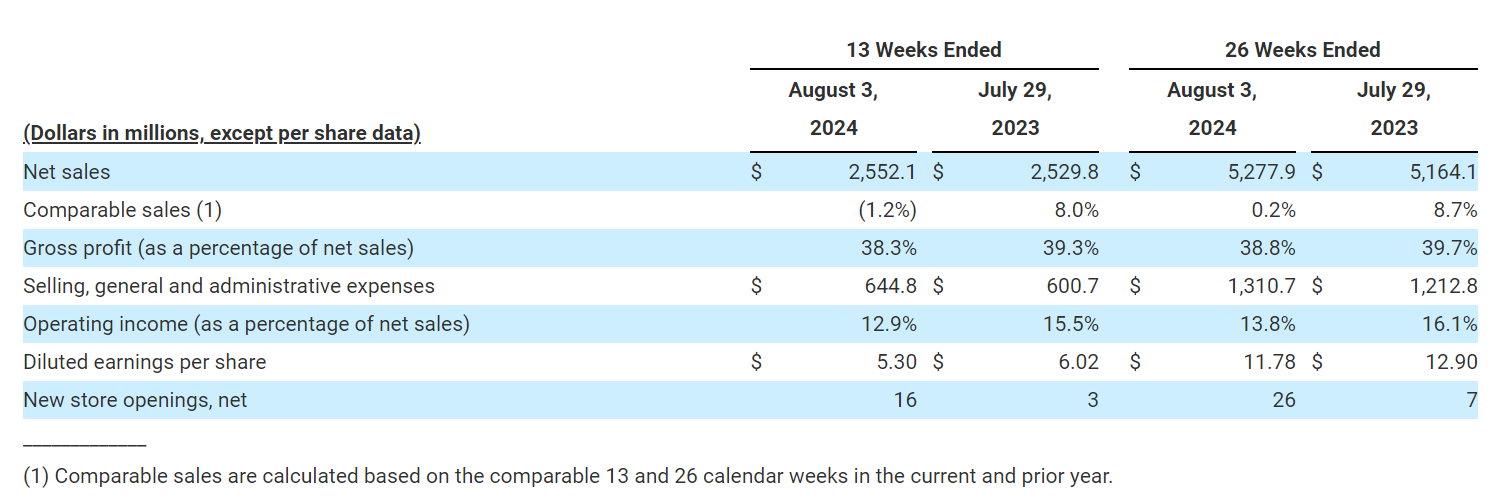

Total revenue came in at $2.55 billion, up 4% year-over-year, but still below market expectations of $2.6 billion.

Net income was $252.6 million, down from $300.1 million a year ago.

Earnings per share were $5.30, below analysts' expectations of $5.50.

Store business dragged

Same-store comparable sales declined 1.2%, below market expectations for 1.3% growth.

This included a 1.8% decline in transaction volume and a 0.6% increase in customer unit price.

Full-year guidance lowered

The company lowered its full-year sales guidance for fiscal 2024 to $11.0 billion-$11.2 billion, down from its previous forecast of $11.5 billion-$11.6 billion.

Earnings per share guidance was also lowered to $22.60-$23.50 from $25.20-$26.00 previously.

Comparable sales guidance was lowered to -2% to 0% from previous 2%-3% growth.

Investment highlights

What caused Q2 results to Miss?

Comparable sales declined and were mainly due to lower transaction volumes.The Company believes that macroeconomic conditions (e.g., inflation and lower consumer spending) may have resulted in lower consumer spending on beauty products, which in turn impacted store sales.

Overall gross margin decreased to 38.3% as a result of lower merchandise gross margins and increased apportionment of fixed costs in stores.

Selling, general and administrative expenses as a percentage of sales increased to 25.3%, primarily due to an increase in the apportionment of store salaries and benefits, corporate expenses, and a rise in marketing expenses as a result of intense competition from other beauty retailers, such as Sephora, which put pressure on store profitability.

How did ULTA Beauty attract investors?

Neither Warren Buffett nor his investment managers add a position lightly, and BRK isn't known for having a wide range of positions.ULTA has its own unique appeal to become a Buffett position.Its strengths also fit right into Buffett's stock-picking logic.

Stable head market share and industry position, as the largest specialty beauty retailer in the U.S. Ulta has a 9% share of the $112 billion U.S. beauty market, and the company excels in capital efficiency and asset turnover;

Stable customer base and loyalty program (membership).The company's 43 million Ultamate members provide 95% of the company's sales and provide the company with a stable cash flow, with a membership base of 34 million prior to the outbreak, which is growing very rapidly;

The current valuation, which is low and already reflects expectations of little to no free cash flow growth over the next decade, also serves as a foundation for the company.

In addition, while all companies in the consumer sector inevitably face macro headwinds, the beauty category has indeed been the strongest performer in the segment.As the economic environment improves and consumer confidence returns, Ulta has the opportunity to regain its growth momentum.

Warren Buffett's Position

ULTA to represents 0.1% of Warren Buffett's position, a very tiny portion;

It's not as if Buffett hasn't lost money historically, and it's not uncommon for him to cut his way out of a position, such as airline stocks;

Munger has even had a history of holding positions for a quarter and then selling them, and they old boys can be very flexible too

Comments