$Broadcom(AVGO)$ recently released its financial results for Q3 of fiscal year 2024 and provided an outlook for the fourth quarter.Overall, despite the strong Q3 results, the forecast for Q4 was below market expectations, causing the stock to slide in after-hours trading.

Q3 Results Overview

Total revenue of $1.307 billion, up 47% year-over-year, slightly ahead of expectations of $1.302 billion, although excluding the impact of the VMware acquisition, revenue growth was only 4% year-over-year.

Adjusted EBITDA of approximately $820 million, or 63% of total revenue, slightly higher than the expected $7.94 billion; adjusted EPS of $1.24, up 17% year-over-year.

Gross margin of 63.9%, lower than expected 76.5

Free cash flow of $4.8 billion, below expectations of $6.28 billion.

Analysis by Business Unit

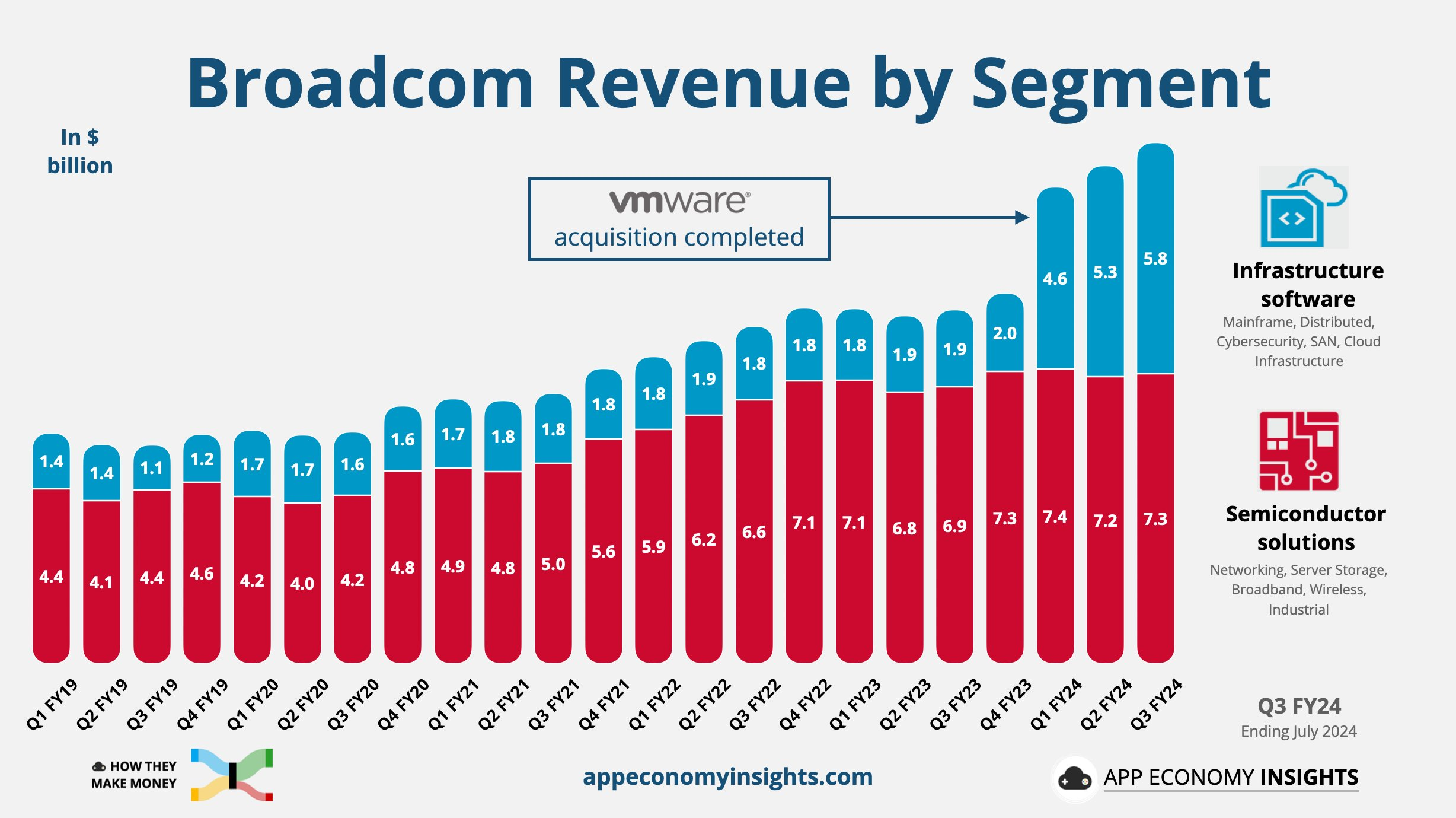

Broadcom's business is organized into two main segments: semiconductor solutions and infrastructure software.

Semiconductor Solutions

Q3 Revenue: $727M, 56% of total revenue, up 5% YoY

Key drivers:

Networking: revenues reached $400M, up 43% YoY, primarily benefiting from strong demand for AI networks and custom AI gas pedals.

No AI Networks: down 41% YoY, but up 17% sequentially, showing signs of recovery.

AI-related products: AI revenue is expected to reach $3.5bn in Q4, up 10% from Q3

Expectations: Semiconductor revenue is expected to reach ~$800M in Q4, up 9% year-over-year[1][2].

Infrastructure Software

Q3 Revenue: $580 million, up 200% year-over-year, driven by VMware

VMware performance:

VMware Cloud Foundation (VCF) achieved significant market acceptance, with an annualized booked value of $2.5 billion in Q3, up 32% year-over-year.

VMware's transformation is well underway and is expected to continue to drive future growth.

Q4 Infrastructure Software revenue is expected to reach approximately $600 million with overall revenue growth of 51%[2].

Q4 Outlook

Broadcom's forecast for Q4 FY2024 shows expected revenue of $1.4 billion, below market expectations of $1.413 billion

Adjusted EBITDA is expected to be 64% of total revenue.Of this, AI-related revenue is expected to reach $1.2 billion, driven primarily by Ethernet networking and custom gas pedals.

Market Challenges: Broadcom's Q4 forecast fell short of market expectations, primarily due to uncertainty in overall market demand, particularly with respect to the pause in telecom and service provider spending.

Future Outlook: Despite the challenges, Broadcom remains optimistic about the future growth of its AI and software business, which is expected to continue its strong growth momentum through fiscal 2025.

Investment highlights

1. on AI revenue share

The company said that AI revenues in Q3 were approximately $3.1 billion, with compute-related revenues accounting for approximately two-thirds of the total and network-related revenues accounting for one-third of the total.It expects the Q4 composition to maintain a similar trend and is optimistic about AI revenue growth in fiscal 2025.

2 Changes in the enterprise market

There has been a recent revenue shift from cloud service providers to the enterprise market, Broadcom's AI offerings are focused on hyperscale customers and cloud platforms and therefore have not been impacted by changes in the enterprise market.He emphasized that Broadcom is not focused on the enterprise AI market.

3. Performance and future growth of the VMware business

Customers are performing well in terms of moving to a subscription model, and the Company expects this trend to continue in the fourth quarter and potentially into 2025.

4 Recovery in the non-AI semiconductor market

The non-AI networking business continues to underperform and is going through its typical down cycle, and the Company believes it has passed the bottom, with non-AI semiconductor orders up 20% in the third quarter.He expects this market to continue to recover in the fourth quarter.

Comments